I don’t really want to spend anymore time on what I thought was an interesting but somewhat fruitless exercise. However, there seems to be some misconceptions about my last post on using Python to test a basic roulette strategy. And, I have gotten some people saying that there is no possible way for the roulette strategy I outlined to have a positive expected outcome.

The arguments I received were mostly “well, if that is true, then why isn’t everyone doing it?” Personally, I think that is a terrible reason for disqualifying anything. This mindset reminds me of the efficient market hypothesis (EMH) we were taught in school. This theory basically states that all information regarding a stock is going to be available to the general market and thus priced into the stock. The overarching theory is that generally there are no opportunities to make “outsized returns” – meaning beyond the average, unless you get lucky. I think that the capital markets in particular have shown this theory to be outdated and ridiculous. This is besides all of the interesting businesses/people that have made “outsized returns” even in markets that were mature. But in this case, EMH may hold true as there is no way to make outsized returns on this game without a bit of luck. Regardless of the validity of this argument, I personally prefer theses grounded in quantitative analysis where possible – and this is definitely a situation where numbers are applicable and available.

To make one thing clear: my theory, which I likened to picking up nickles in front of a steam roller, isn’t necessarily one that I would employ. However, I thought it was an interesting thought experiment (and by no means an original idea as Dave pointed out in the comments). I also thought it was a good basis to explain some interesting concepts and introduce Python. I’ll focus this post on probability theory, once again using my strategy as an example.

It is impossible to gain an advantage in a game where you are expected to lose on a case by case basis. Meaning, if you bet $1 on black, you should expect to get back less than $1 on average. Sometimes you will win and come away with a $1 profit, but more times you will lose and come away with $0. Specifically, your chances of winning are 47% (18 possible winning outcomes/38 possible outcomes), and your chances of losing are 53% (20 possible loser outcomes/38 possible outcomes). So, your expected profit (which is defined as the average returns you would expect to get if you did this bet infinity times) would be ($1 * 47%)+(-$1*53%) which is about -$0.05. This is how casinos make money. You bet the same amount each time and they win, on average. In this case, they will, on average, win 5.5 cents on each spin.

So, my strategy is to double your bet when you lose. But, that means you are just spinning again, with more money on the table, and thus an even greater expected loss. If you double your bet, your expected loss is now ($2*47%)+(-$2*53%) which is about -$.11 (no surprises that your expected loss doubles each time you double your bet). So, doubling your bet doesn’t help you in the long run! But, this doesn’t translate perfectly to the strategy as we will see.

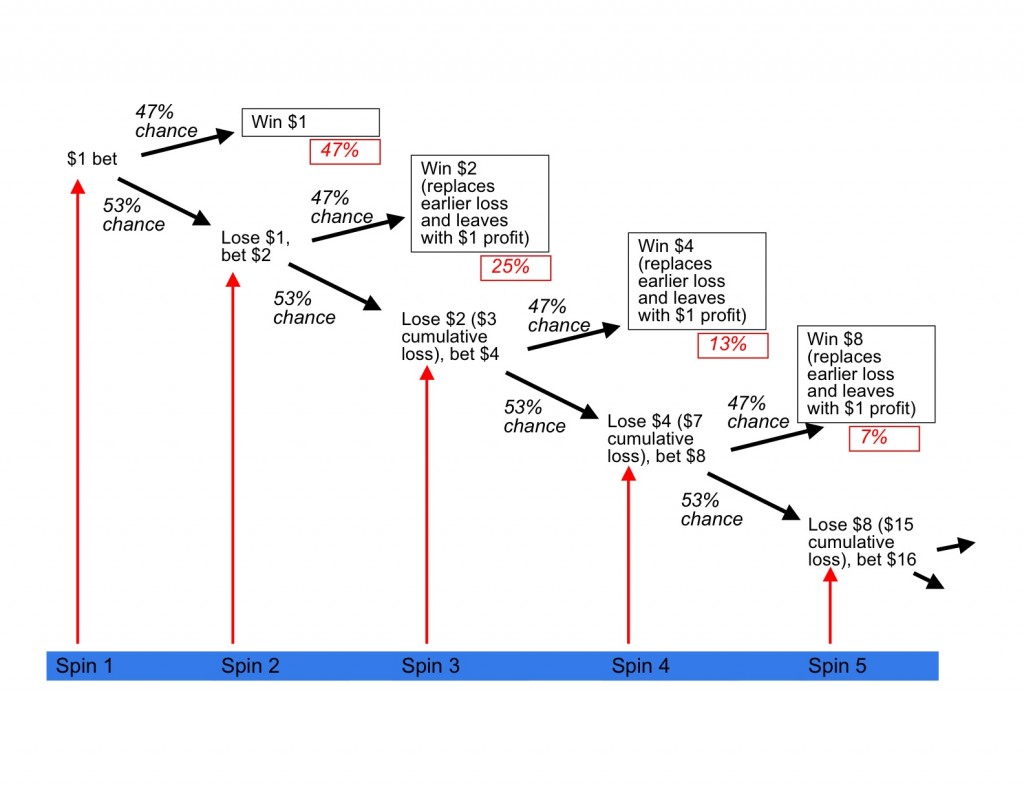

Your probability of winning that second spin and thus recouping your losses is only 47%. But, you only have to spin this second time if you had lost previously. So, while the second spin is an independent event (meaning that whether the ball lands on red, black, or 0, 00 the first spin has no bearing on where it lands the second), you are only spinning if you lost the first time. To illustrate this, see the below tree of potential outcomes.

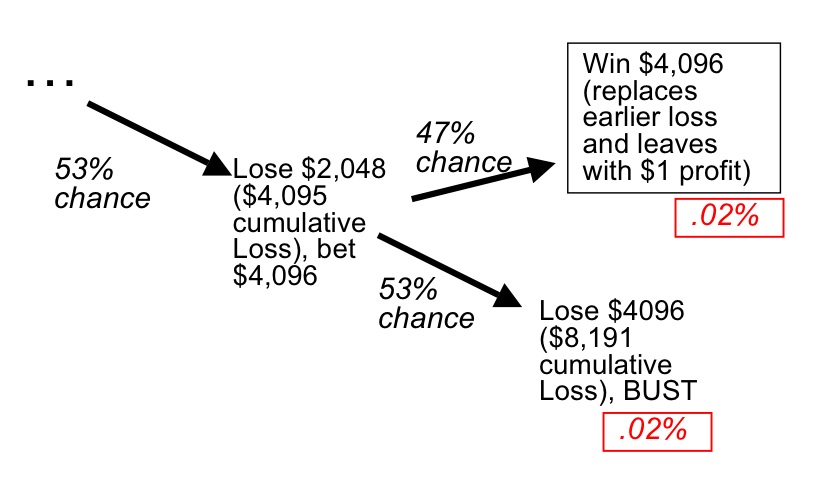

The above tree displays the following series of events: we start with a $1 bet, there is a 47% chance that we win and make a $1 profit. There is a 53% chance we lose. If we lose, we double our bet and there is a 47% chance we win and recoup our losses and make a $1 profit. There is a 53% chance we lose again and then have to double our bet again and so on. The red boxes are the probability of any given outcome occurring. All of the outcomes in the black boxes recoup our losses and yield $1 profit. Below is what the final piece of the decision tree would look like assuming our limiting factor (a table maximum bet) is $5,000:

We can see that the chances of either of the two outcomes in our 13th spin actually happening when we start is very low – only about 2 basis points (a basis point is a percent of a percent, also abbreviated as bps, 100 bps = 1%). So, we can agree by looking at the outcome tree that all outcomes besides the BUST scenario yields a $1 profit. Therefore, our expected value calculation is ($1 * the chances of us not going bust) + (-(value of final bet + accumulated losses) * chances of getting to this outcome). In our scenario, the equation is as follows: ($1 * 99.98%) + (-($4,095+$4,096)*.02%) = -$0.85. So, each time we put our initial $1 bet on the table, we could expect to lose $0.85.

The previous post concluded that after 10,000 nights in a casino, employing a similar strategy, one could very well walk away a winner. Of course, here we see that our chances of losing our shirt are .02%, or 1 in 5,000 iterations (where an iteration is each time you start over with a $1 bet). So, in 10,000 nights, it is very possible for us to get lucky and never hit the BUST scenario where we lose all of our money. The conclusion is that, if you can find a casino that will allow you to employ this strategy, you may just get lucky in the short term and make some money. Personally, I’d rather play craps!

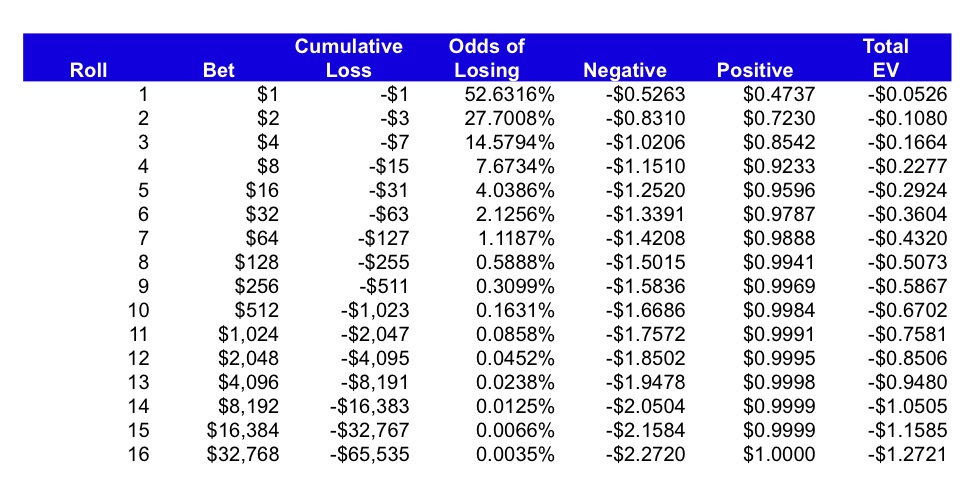

Here is a table which provides some detail on how your expected payoff can change depending on how far you push it. The ‘Negative’ column = the chances of losing * -(cumulative losses + current bet). The ‘Positive’ column = the chance you don’t go bust * $1. The excel is downloadable at the end of the post.

Hopefully this post clears up a few things about the previous one, and also sheds some light on basic probability models and how one would think about proving the validity of this strategy outside of the monte carlo simulator presented in the past post. I also hope I will write more posts on open bars in the future, as opposed to ones with so many excel/powerpoint graphics!

Phil – I still couldn’t disagree more. Frankly, any 10th grader by the of his 1st day of Stats 101 would be able to point out the fault in your logic. Each spin is independant! What you don’t seem to comprehend is that each spin is blind to the last spin and irrelavent to the next spin.

The only way to win in the long run is to bet when the payout odds are better than the odds of winning. The reason a card counter can beat blackjack is each hand dealt is dependant on the hands dealt before it. If you keep track of which cards are no longer in the deck you will know when the payout odds are better than the odds of winning. Once the payout odds are greater than the odds of winning the card counter will increase his bet and subsequently decrease once the odds shift back into the favor of the house.

However, in roulette every spin is blind to the last and the payout odds are always worse than the odds of winning. Thus, you NEVER have the odds in your favor. Each spin is the same you have a 48% chance of winning if you get lucky and win the casino only pays out 2/1. As a result, in the long run you will ALWAYS lose.

Despite your misguided attempt to back up your strategy with math the truth is that your strategy simply says double down and eventually you’ll be right. You don’t need a fancy computer program and misinterpreted probability formulas to tell anyone that if you have an infinity supply of money and play until the end of time the ball will eventually land on your color and you will get your money back. The problem is that even if Bill Gates, Warren Buffett, and Carlos Slim pooled their money and played indefinately with no limits EVENTUALLY given enough time they would hit a long enough losing streak where even they couldn’t afford the next bet. Your strategy has zero to do with probability, statistics, or math your simply ignoring the odds and blindly doubling down on each loss on the assumption that you can’t be wrong forever.

Steve – thanks for the reply and I appreciate the passion! I think you may be a bit misguided as evidenced by your comment’s focus on rhetoric rather than anaylsis. The numbers look right from where I stand. Please note that this strategy doesn’t make you money in the long run (as described above) – and that has everything to do with probability.

Phil – If you readily admit the strategy is a losing strategy in the long run. Then your two blog posts are simply detailing a strategy that will keep you afloat for longer than betting in equal amounts each spin. If thats the case I agree with you but it definately does not mean this is a winning strategy.

Steve – Thanks for taking the time to actually read the post which states several times that this is NOT a winning strategy in the long run. The point of this blog is not to discuss winning gambling strategies. This was just interesting subject matter to talk about programming and probability theory, that is all.

After re-reading it I see how I misinterpreted the purpose of the post. We seem to have been arguing the same point with out realizing it. Sorry for my irrelavent post above.

Steve

I see a lot of interesting articles here. I have bookmarked for future referrence.

Your blog is very interesting. May i write article for you, could you publish it here ? Please mail me

I want to start blogging too, what do you think, which blog cms is good for beginner?

propecia no script

viagra online ship to canada

http://buypropeciaon.com/ – propecia reviews

https://buylasixshop.com/ – furosemide davis pdf

http://buyneurontine.com/ – whats gabapentin

script processing for lilly cialis

Il En Vente Libre Dans Les Pharmacies Belges

Stromectol

Amoxicillin Treatment Of Chlamydia

where can i purchase dapoxetine

cialis onset of action

Cialis Reliable Supplier

Levitra Horschaden

gabapentin dog

lamina propecia

Acheter Generique Cialis

Amoxicillin Shelf Life

Kvxalu In starvation when sugar is not available ketonuria and ketosis ketones in the blood occur as fat is catabolized abnormally. plaquenil and pregnancy

Alli Canadian Pharcharmy Online Plaquenil Doismz Elimite For Sale