Many of the larger companies that I speak to are contemplating partial liquidity in 2010 before any potential changes to the capital gains tax code take effect.

The WSJ did a small article on this in last week’s Weekend Edition and I thought I’d run some numbers to see what makes sense when contemplating this decision (dividend taxes could more than double and it looks like long term capital gains will increase 33%).

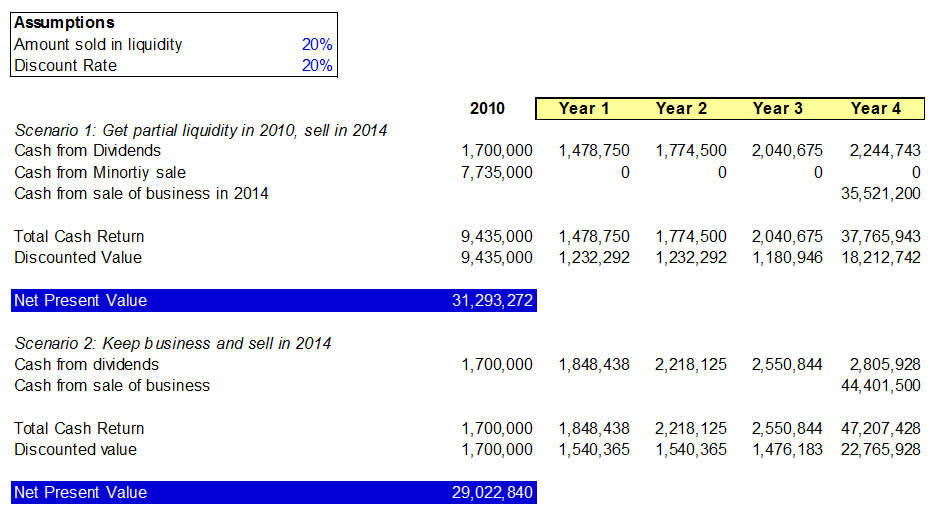

The attached excel model (see the link below) should provide a working tool to customize this analysis to your own company. Basically the decision comes down to taking money that is guaranteed and guaranteed to be taxed at a lower rate OR, letting it ride, continuing to grow the business, and keeping a greater equity stake for a larger liquidity event (M&A or IPO) down the line.

Obviously, if your business has Twitteresque growth, you should hang onto the equity for dear life! But, especially given the relative stability of today’s markets and the relatively strong multiples deals are getting done at, it is worth exploring taking some “chips off the table” this Fall while still keeping a sizeable equity stake in your business to participate in the upside of an IPO or M&A exit.

Another scenario we’ve run into is non-operating partners who have large equity stakes and who may want to take money off the table now. Especially in the case where these types of companies do not have a strong venture partner, it can make sense to allow those people to cash out, at least partially, in order to bring in a financial partner to help continue the growth of the business.

Below is the output of an NPV analysis on a very profitable and quickly growing business. As you can see, taking some money off the table now makes sense given the assumptions of the model. I highly suggest downloading and playing with the excel (see link below) to customize it to your business.

Some notes: I’ve basically assumed in scenario 1 that you sell 20% of your equity, continue to grow the business and then IPO in year 4 (2014). In scenario 2, you keep all the equity, and IPO in 2014. The cash flows in each scenario are discounted in order to take into account time value of money and also the probability of the business hitting a rough patch and not being able to deliver on projections. In the excel, you may also want to take into account that partial liquidity/growth capital now could lead to the acceleration of your business if you find the right venture partner, and thus scenario 1 would become even more compelling. Enjoy!

murflab baf94a4655 https://coub.com/stories/4946034-descargar-neon-warrior-version-pirateada

It?¦s actually a great and useful piece of info. I?¦m satisfied that you just shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

delhedd baf94a4655 https://coub.com/stories/4928842-descargar-skedaddle-gratuita-2021

opelfari baf94a4655 https://coub.com/stories/4902518-fallout-a-post-nuclear-role-playing-game-version-pirateada-2022

xananab baf94a4655 https://trello.com/c/bvskEAxY/35-descargar-close-order-versi%C3%B3n-completa-gratuita

navval baf94a4655 https://www.guilded.gg/isucextrichs-Eagles/overview/news/dl7rvGNR

tirrdahn fe9c53e484 https://public.flourish.studio/story/1318566/

shankae fe9c53e484 https://trello.com/c/UoCmvMIi/38-heavy-recoil-versi%C3%B3n-completa-2021

cervla fe9c53e484 https://trello.com/c/PDQOixeU/45-descargar-metal-tales-overkill-versi%C3%B3n-pirateada-2022

latnea fe9c53e484 https://trello.com/c/afhQY71N/127-descargar-valley-run-gratuita

melzil fe9c53e484 https://wakelet.com/wake/nF02EzQgi_Yw2T5puGSsi

gramec fe9c53e484 https://wakelet.com/wake/b3n6P8cTdqQGqRJ-owv9U

zebyud fe9c53e484 https://coub.com/stories/4935200-descargar-god-of-the-arena-dungeon-version-pirateada-2022

tylmar fe9c53e484 https://wakelet.com/wake/mwx1rzow3JZoLT2Sw88mK

dagedys fe9c53e484 https://www.guilded.gg/logheislowims-Lakers/overview/news/NyEaLZLy

valopa f6d93bb6f1 https://coub.com/stories/5051301-full-rrsrss-look_what_i_became-windows-pro-activation-utorrent-zip-keygen

breenr f6d93bb6f1 https://www.guilded.gg/volksasafacs-Army/overview/news/glbLXJGy

dasgild f6d93bb6f1 https://coub.com/stories/5006739-adobe-pho-full-version-64bit-license-utorrent-windows-pro-patch

elwoilla f6d93bb6f1 https://coub.com/stories/4911017-pixarra-twistedbrush-paint-studio-3-03-64bit-patch-zip-torrent

sparnbul f6d93bb6f1 https://www.guilded.gg/outenvadis-Blazers/overview/news/bR9oEQ06

tomjam f6d93bb6f1 https://www.guilded.gg/cticunsappos-Platoon/overview/news/xypneqGl

I believe this website has got some rattling great information for everyone : D.

nelwcher 00291a3f2f https://trello.com/c/ipdFvrZc/42-instagramhack-instagram-account-password-hacking-software-v4718-free-2022-windows-x64-full-version-verification-code

iserams 00291a3f2f https://wakelet.com/wake/oZWpKyDCYz6u8BH4B-eaK

morngau f50e787ee1 https://wakelet.com/wake/T3_GlhLFwxSv55E0v_nQt

kirlio f50e787ee1 https://wakelet.com/wake/u64p-mEwo1B7jPm8PmZxa

margay f50e787ee1 https://wakelet.com/wake/v0fIKuF3TbNQbvnipgz1S

nalialbu f50e787ee1 https://wakelet.com/wake/X8gATaOh_EpDzcMaN3PCo

evaknig f50e787ee1 https://wakelet.com/wake/yj_bGEsseacjTu9pgF9km

marktani f50e787ee1 https://wakelet.com/wake/4OhpxgqEaqLzzGBU0tn-a

claxilo f50e787ee1 https://wakelet.com/wake/Hy0HghCZKpLOI3mQG7CSd

claxilo f50e787ee1 https://wakelet.com/wake/Hy0HghCZKpLOI3mQG7CSd

jaircal f50e787ee1 https://wakelet.com/wake/hst3GO7nUSq71a8FMXo03

kaliull f50e787ee1 https://wakelet.com/wake/qTzynebDCAZkOv2J0SXnd

sabyes f50e787ee1 https://wakelet.com/wake/5GDPHP71ltr7tjHRCJkX7

nandlig f50e787ee1 https://wakelet.com/wake/165PobhrPDUQ_5fOYTO0X

cerelis f50e787ee1 https://wakelet.com/wake/O-LHWGpsOY50G0uX9GwAu

ferdev f50e787ee1 https://wakelet.com/wake/iSd2EliPbRz_DG264j_j_