There is a lot of buzz on the Goldman Sachs investment in Facebook. If you haven’t heard, Goldman is buying $1.5 Billion worth of facebook common stock at a $50 Billion valuation to give to their clients. The gist is that they’ll be selling this stock to some of their choice clients in anticipation of a Facebook IPO.

I was watching MSNBC, or one of those business news channels (something I never do) on my plane ride down to the Caribbean last week and the talking head mentioned how Goldman is essentially betting that Facebook can charge a subscription fee for their service and generate large revenues that way. When I heard this statement, I realized how misunderstood tech “startups” truly are when it comes to mainstream investors.

Facebook is a powerful platform that will drive more and more revenues from advertising, virtual goods, eCommerce, and potentially other revenue streams (more niche social applications like dating, more robust gaming capabilities, etc). But, I don’t think they will ever charge subscriptions – the value is in the information they can glean which comes from large numbers of engaged users which in part comes from the fact that facebook is free. I don’t even think debunking this theory deserves more thought than that.

So, what about $50 Billion, is that crazy? Well, there are lots of rumors about what Facebook’s current revenues and cash flows look like. I’ve heard that a lot of the reported numbers are inaccurate, so I’m going to refrain from looking at a multiple of revenue or cash flow since we don’t really know what the numbers are, and I don’t think that’s the right way to look at things. Plus, what could possibly be a comp for facebook?! (as an aside, the best comps would probably be “game changing” companies that got to scale – Netscape, eBay, Google, etc).

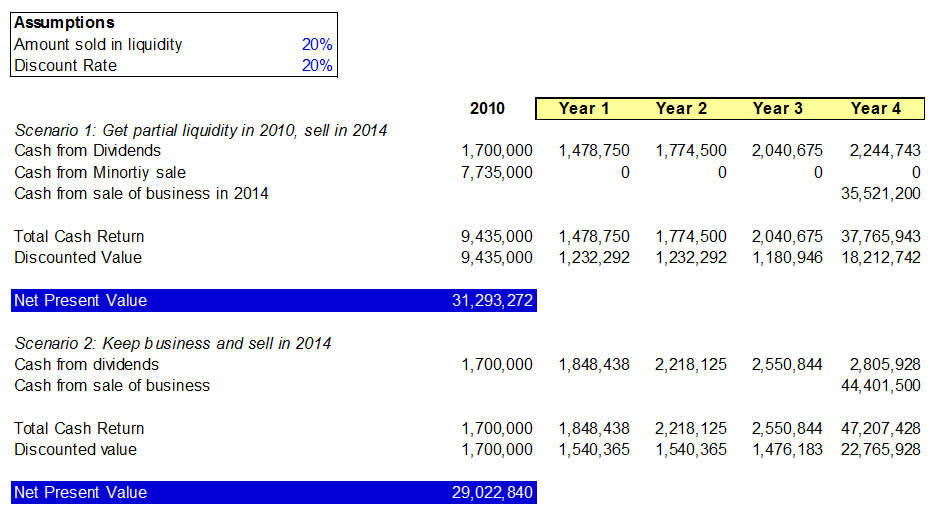

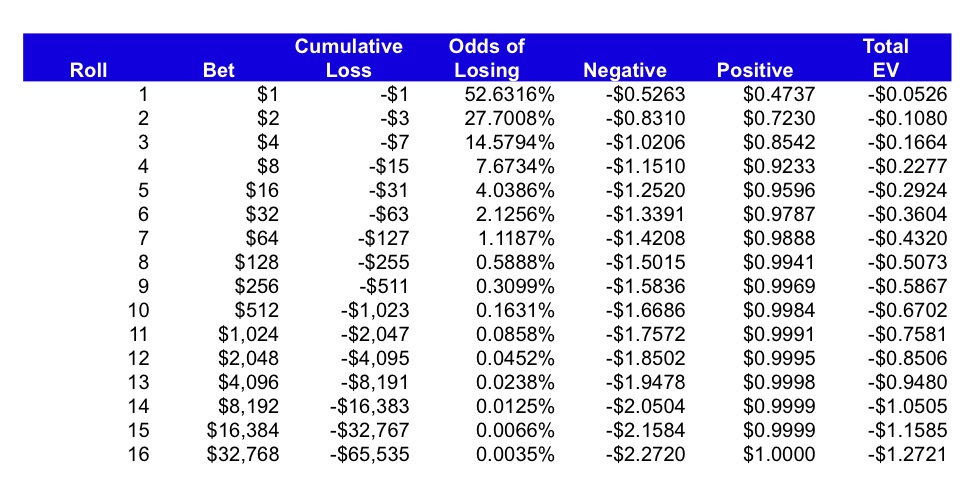

One way to think about its value is to understand what the future gross profit Facebook can generate from each user is, apply a discount rate, and get to an enterprise value. Here we are thinking about value in essentially the same way as a discounted cash flow valuation (which I usually think is pretty weak, but works in this case). Think about it this way – a typical brick and mortar retailer will value a customer’s email address at $8-$13 (let’s say $10). That’s because they think they can sell you enough goods where they will get that money back in gross profit over your lifetime as a customer. So Borders spends $$ to get your email by incentivizing sales people to get you to sign up for loyalty programs, or offering you discounts, so that they can get your info and market to you. Assume they think you’ll buy $25 worth of books for the next 3 years, at a 20% gross margin, that’s $5 per year in gross profit, and at a 15% discount rate, that’s around $11 in expected value (which is greater than the $10 they spent to get your email in the first place). Checkout the excel here.

Now, let’s apply the same logic to Facebook. You’ll notice that I’ve put a 10 year horizon on the life of a Facebook user, and increased the discount rate to 25%, while also increasing the gross margin to 70%. Hopefully that seems intuitive.

In order for Facebook to be worth $50 B, they would have to think that each of their users is worth (approximately) $50 B/ 500 mm users = $100 / user. That means that the expected discounted gross profit from each customer has to be about 10x what a brick and mortar retailer would value an email address. Again, checkout the excel here. And, if you believe that Facebook’s information is different from an email address in that it is about 100x deeper, and they can reach you much more effectively and frequently, then this makes sense.

What also makes sense is that Goldman Sachs is doing something smart with this $1.5 Billion offering – as they usually do with large sums of money. They may be simply angling to take Facebook public and willing to invest at a high valuation for that reason. But, they are probably also giving their best clients a chance to participate in what can potentially be one of the most successful IPOs of all time at a private company price. And, with Groupon looking at a $15 Billion public valuation (per Goldman), it seems they have a close touch on the market for late stage tech deals. And, the demand that exists is apparently overwhelming.

The bottom line is that Facebook is one of the few companies that represents a true platform capable of tackling many other businesses. They certainly have the talent and infrastructure, but they also have the information and mind share in their users’ lives. Think about what companies like Travel Zoo and Open Table (links are to “interesting” stock graphs) have been able to do recently due to adapting Groupon-like deals. Think about the success that Yelp (article on adoption of their mobile checkin app) had launching their location based app. These are “platform” companies capable of launching new and profitable business lines. But, they pale in comparison to Facebook. Think about Zynga building a multi billion dollar business mostly through Facebook. This is the power of facebook and why it deserves that $50 Billion valuation, and why it will probably continue to increase in value.