Last time I wrote about lead generation and some thoughts on how to price leads. Now, I’d like to walk through an example of how to get to a starting price. I’ll lay out some of the basic math, some of the finer points that have to be considered on a case by case basis, and what I consider to be the best way to get the data necessary for this type of analysis in a nascent and undefined market where secondary sources are lacking.

Example: Company A is the buyer of leads, Company X is the seller of leads (aka the lead gen company).

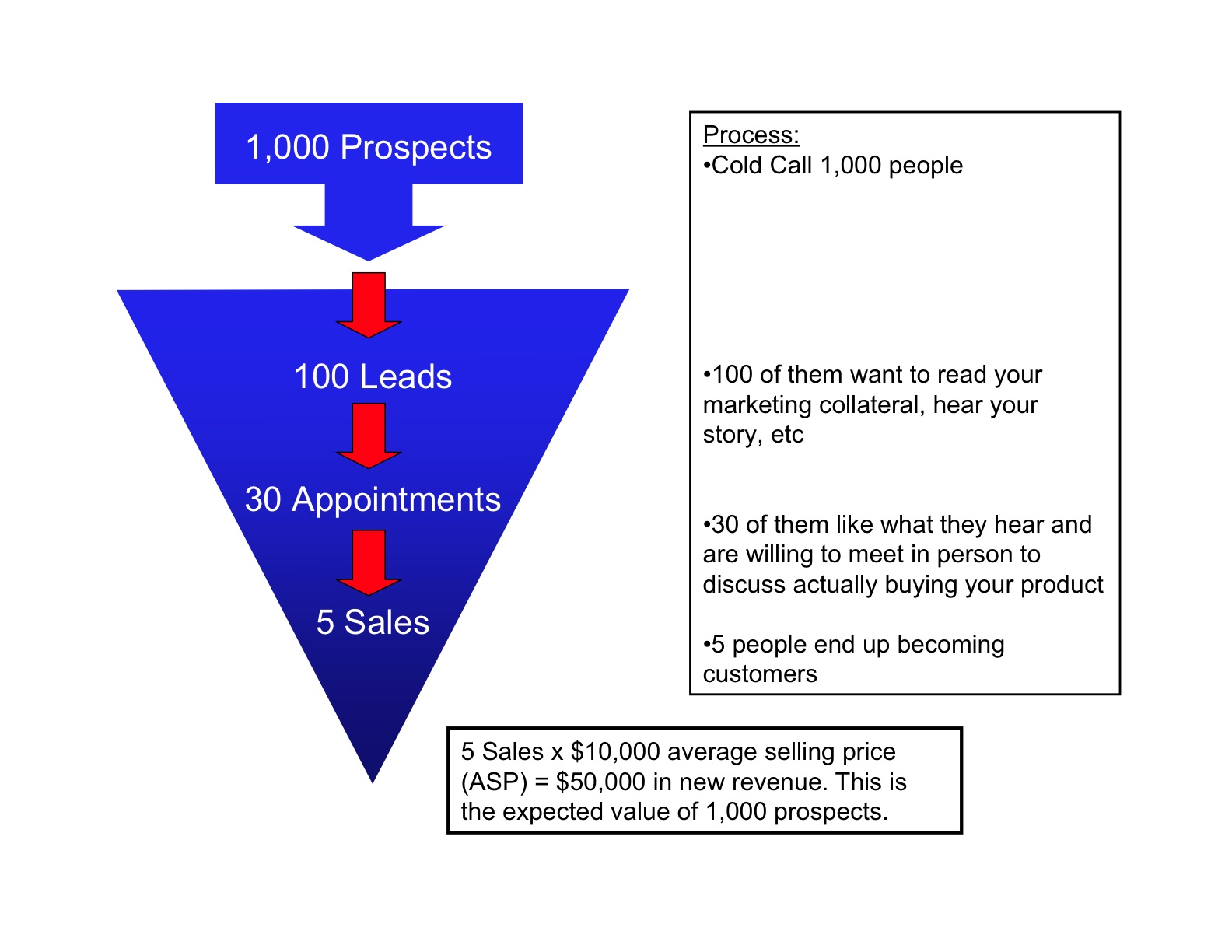

Company A makes 1,000 outbound calls to get 100 leads, which converts to 30 appointments, which converts to 5 sales with an average selling point of $10,000. So, for those 1,000 outbound calls, Company A grosses $50,000 (these numbers are totally fictitious by the way).

Company X’s leads are “more qualified” because people opt-into them only when looking to make a purchase decision. Therefore, 90% turn into appointments. Every 100 qualified leads => 90 appointments => 15 sales = >$150,000 in new revenue.

This is where things get tricky. We know how much revenue our leads are potentially worth. But what does this translate to in terms of what they are worth to Company A (taking into account the extra FTEs freed up that don’t have to spend their time prospecting)? Let’s assume that the internal sales person makes 20 prospecting calls in an hour and their time is worth $25/hr. Our 100 leads convert to 90 appointments which would be the result of 3,000 outbound calls (3,000 calls=>300 leads => 90 appointments). These calls cost Company A (3,000/20)*25=$3,750, or $37.50 per qualified lead. Of course, this number doesn’t include a whole lot of other factors that could get in the way, but you get the idea (we could also factor in the lower cost of converting Company X leads in appointments even from the “lead” part of the funnel since they require fewer conversations given the higher lead => appointment conversion rate, and thus less time. But, let’s keep this simple).

These numbers are good starting points in getting a picture of how much to charge per lead. Basically, we want to get a sense for where our leads fit into the customer’s pipeline, and how much it would cost Company A to get the same quality of lead without us. That’s what it’s all about!

These are just preliminary thoughts. But how to get this data? My advice would be to join the relevant LinkedIn groups for salespeople in your industry, and cold email them. Why are sales people in this industry giving you accurate information (or even talking to you in the first place)? Because you are an entrepreneur, they are intrigued enough at the prospect of talking to a potential employer, and are therefore willing to ingratiate themselves through providing (hopefully) insightful and accurate data around their sales efforts. Plus, salespeople just like to talk.

Here are some questions I’d ask the people you get a chance to speak to: the all in costs of each sales person (base + bonus + benefits. If you’re going to be replacing FTEs with your leads, then you need to know the ROI you’re providing Company A); what the sales cycle is (how long does it take, what is the overall process), and where your leads will fit into this equation; whether you’d have the same appointment to sale conversion rate on qualified leads as on prospected ones (qualified leads are actively searching and therefore will be evaluating your competitors whereas cold sourced leads may not be, but cold sourced leads may not really be in the market for the product); the organizational challenges of managing a large sales force; the ability your leads may offer for Company A to specialize its sales force (i.e make some people dedicated closers, and others focused on prospecting, or get rid of prospecting all together which may raise morale and increase efficacy). There are, of course, many more relevant questions. But, hopefully this list would provide a solid starting ground. Remember, the bottom line is figuring out where your leads fit in and why, how much value they are offering your client, and starting from there.

Each industry has their own idiosyncrasies, and you have to keep in mind why your pricing makes sense versus your “competition” (internal sales teams in our example, but quite easily other lead gen companies or outsourced sales resources). Are you going to under price and offer an ROI analysis for potential buyers of your leads? Are you going to replace an existing lead service that offers unqualified leads at a discounted price? Will these be exclusive leads? All very interesting questions!

If you have any feedback on any of my posts or just want to say hello, please email me: phil (at) philstrazzulla (dot) com.