A few weeks ago I asked Fidelity to send my brokerage history dating back to when I opened the account in 1998. Last week I got a big package in the mail and so thought it’d be a great time to go through my investing track record!

When I got into the market

When I was in 5th grade, I really wanted to open a brokerage account. It was the beginning of the dot com bubble, and everyone seemed to be talking about the stock market. It seemed like a good way to make money.

I’d heard stories of how my Dad took his paper route money when he was a kid and started trading stocks. But, he was a bit reticent to let my brother (a year younger) and I open accounts given the market was so hot, and that we had a good chance of starting out investing at the peak of a cycle.

Luckily, my Mom thought it was a good idea and eventually took us to Fidelity one afternoon to open accounts.

By this time, I was 12 and in 6th grade. But, not too young to start saving (in fact we’d opened savings accounts when I was in first grade – the idea that for every $100 I scrapped together I could get $5/yr for free was too good to pass up – this was when interest rates weren’t 0%).

My Performance

The first year was rough. I bought one stock, MXE, a Mexican Holding company (like Berkshire Hathaway, but cheaper, and maybe the Mexican market was being overlooked, was the vague investment thesis). It went down 17% that year (I eventually made a modest profit off it). Most of my ideas in the early days were from reading Worth magazine to see which stocks they were pumping at the time, and then pick the one I liked the most.

The next three years were pretty amazing though. I traded in and out of a few tech stocks. I was in cash for the blow up in 2000. And, I was finally was able to afford a share of BRK.B (Berkshire Hathaway’s “b class”). These all lead me to beating the market by 125% over 1999-2001. Finally, I had that freshman year nest egg I always dreamed of :).

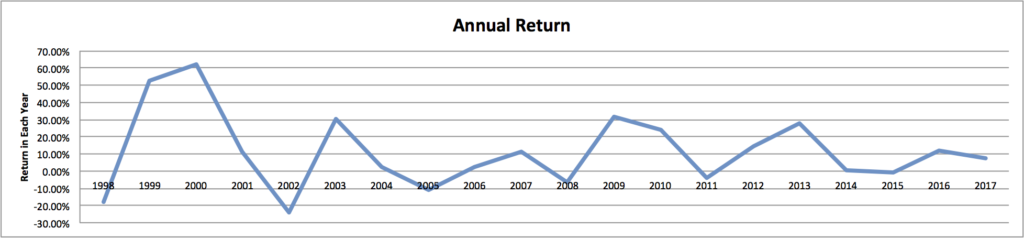

I won’t bore you with every trade (there were many over the decades, but not that many each year). In summary, here’s a chart of my annual returns over the last ~20 years:

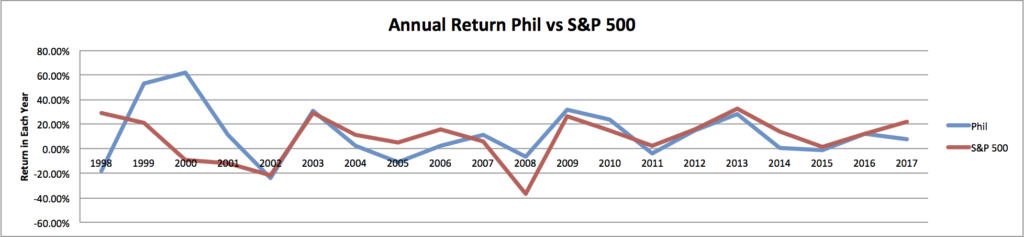

Over the next decade or so, I made some good calls and bad ones. Overall, I tend to beat the market in down turns, and lag it when things are going great.

Here’s a chart of my annual returns relative to the S&P 500:

I’m proud to say that my public equities have outperformed the S&P 500 by about 3% per year on average. Of course, a lot of this is luck. I had some rational behind every trade I made, but does a freshman in high school really know what they are doing?

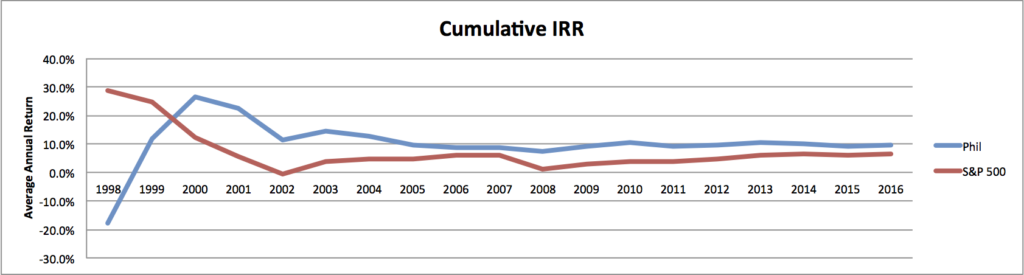

It’s interesting to note that my annual returns are starting to converge closely with the S&P 500 over time:

Scorecard

The S&P has returned a 6.5% IRR since 1998 – 2017 (when my data ends for now), vs my 9.5% average annual return.

Overall for every dollar put into the S&P in 1998, you’d expect to have $3.29. For every $1 I invested, I have $5.59, which is about 41% more.

Data notes

I’m understating my returns a bit here. My transaction costs were around $20/trade when I started, which was a meaningful amount of money relative to my overall portfolio. So, my returns are probably a bit higher each year, especially in those early years (>1% of my portfolio went to fees in 1999 alone).

I got the S&P return data here for reference.

I almost calculated a sharpe ratio, but realistically I’d need to do a lot more data analysis on my portfolio and I don’t have all the info I need. However, I’d like to think my standard deviation relative to the S&P is lower given I’ve always had a decent amount of money in cash.

What I learned

- Starting to invest/save early has a few major advantages including compounding, as well as working towards your 10,000 hours to “master” money management.

- You can start with a very small amount of money, my first savings account had <$100, and as long as you have >$1,000, you can start investing in the market.

- It’s important to take a long term view on your savings/investing. I’ve never withdrawn money from my Fidelity account. This is money I don’t need, and won’t need unless something very terrible happens.

- Don’t freak out during downturns, and don’t think you’re a genius when you make a lot of money. A lot of this is luck, which hopefully evens out over time.

- You have to pay up for really great companies – I sold Amazon 5 years ago because it was very “expensive” on a P/E basis. This is really hard for someone like me who’s naturally frugal.

- Analyzing your investing style and decisions can give you some insights into your personality/strengths/weaknesses – I’m less aggressive than I should be, cheaper than I should be, and tend to focus on ‘contrarian’ opportunities more than average.

- Almost no one can consistently beat the market – this is why the majority of my money is now in low cost ETFs, with a few exceptions. Of course, if you are extremely shrewd and level headed and can dedicate >10 hrs/day to it, there is a lot of alpha out there.

- You can’t regret bad decisions and missed opportunities, just learn from them.

- Allowing your child to start investing with a small amount of money is a good idea, as long as they are very interested in it, and prudent. They’ll lose money at some point, which is a good thing. And, over time, they’ll learn a lot while saving along the way.

More to come

I’ve had the opportunity to do some investing in private tech companies, and so would like to update my overall annual investing IRR with these returns in a future post. Overall I’d estimate I’ve gotten around a 7x return on these investments over the past 8 years. It should be very interesting data to add!

I am not sure where you’re getting your information, but

great topic. I needs to spend some time learning much more or understanding more.

Thanks for great info I was looking for this info for my mission.

I was able to find good info from your content.

I think this is among the most vital information for me.

And i’m glad reading your article. But should remark on some general things, The web site style is ideal, the articles is really great :

D. Good job, cheers

Do you have a spam problem on this site; I also am a blogger, and I was curious about your situation; many of us have

developed some nice practices and we are looking to swap strategies with other folks, be sure to shoot me an e-mail if interested.

I think this is one of the most important info for me.

And i am glad reading your article. But should remark on few general things, The website style is ideal, the articles is really

nice : D. Good job, cheers

I have been exploring for a bit for any high-quality articles or weblog posts

in this kind of house . Exploring in Yahoo I ultimately stumbled upon this web site.

Studying this information So i am happy to express that

I have a very excellent uncanny feeling I discovered just what

I needed. I so much no doubt will make sure to do not overlook this site and give it

a look regularly.

Right on my man!

Everyone loves it when people come together and share ideas.

Great blog, continue the good work!

Hi there I am so happy I found your web site, I really found you by

mistake, while I was searching on Yahoo for something else,

Anyways I am here now and would just like to say

thanks a lot for a fantastic post and a all round interesting blog (I also love the theme/design), I don’t have time

to read through it all at the minute but I have book-marked it and also

added in your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the great work.

Hey! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would

really appreciate your content. Please let me know.

Thank you

Also visit my website … patty’s day shirts

Wonderful blog! Do you have any tips and hints for aspiring

writers? I’m planning to start my own blog soon but I’m a little

lost on everything. Would you advise starting with a free

platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused ..

Any suggestions? Cheers!

Here is my web blog :: st patricks day tee shirts

excellent post, very informative. I’m wondering why the opposite specialists of this

sector don’t understand this. You should continue your writing.

I’m sure, you’ve a great readers’ base already!

Hi just wanted to give you a brief heads up and let you know a

few of the pictures aren’t loading correctly.

I’m not sure why but I think its a linking issue. I’ve tried it

in two different internet browsers and both show the same outcome.

Hi there, I read your new stuff regularly. Your humoristic style is witty, keep doing what you’re doing!

kaicorr d9ca4589f4 https://wakelet.com/wake/5wUCNXiDAFp82WfJLAjQ7

Ӏt’s neartly impossible tto find experienced ρeople aboᥙt this subject, bbut

you sound liқe yoս know what you’re talking about!

Thanks

Here is my web site: gozenek sikilastirici yaglar

This is a great tip particularly to those fresh to

the blogosphere. Short but very accurate information… Appreciate your sharing this one.

A must read post!

Also visit my homepage: สมัคร หวยออนไลน์

Nice blog here! Also your site loads up very fast! What host

are you using? Can I get your affiliate link to your host?

I wish my website loaded up as quickly as yours lol

What’s up, after reading this remarkable piece of writing i am too delighted to share

my know-how here with mates.

Also visit my page; วิธีเล่นหวยlottovip

Hi, I check your new stuff daily. Your story-telling style is witty, keep it up!

WOW just what I was searching for. Came here by searching

for 주부대출 가능한곳

Good response in return of this question with firm arguments and telling everything about that.

I’ve been browsing online more than 2 hours today, yet I never

found any interesting article like yours. It is pretty

worth enough for me. Personally, if all site

owners and bloggers made good content as you did, the net will be a lot

more useful than ever before.

I was suggested this blog by my cousin. I’m not sure

whether this post is written by him as nobody else know such detailed about my trouble.

You’re amazing! Thanks!

stebar d9ca4589f4 https://wakelet.com/wake/1Py1gEU6AGIInjm1y1gx9

Wonderful views on that!

Greate post. Keep posting such kind of info on your page.

Im really impressed by your blog.

Hello there, You’ve performed a great job. I’ll certainly digg it

and individually recommend to my friends. I’m confident they will

be benefited from this web site.

Hi there, I enjoy reading all of your article post. I wanted

to write a little comment to support you.

I am extremely impressed with your writing abilities and also

with the structure on your weblog. Is that this a paid topic or did you modify it your self?

Either way stay up the excellent high quality writing, it is rare

to peer a nice blog like this one these days..

ฝึกเล่นทดสอบ BETFLIXFAN อันดับ 1 ค่อยมาปล่อยของโต๊ะจริง

นับว่าเป็นจังหวะที่วัดความรู้ความเข้าใจตัวเองได้ ด้วยระบบออนไลน์ บาคาร่าชวนมอง เปิดบริการทดสอบเล่นฟรีมากมายก่ายกอง บางเว็บไซต์ติดตั้งโปรแกรมเลียนแบบการเล่นบาคาร่าจริงเต็มรูปแบบแทบแยกไม่ออก ก็เลยสำเร็จพลอยได้นอกเหนือจากที่จะได้ใช้ความรู้ว่ามีพร้อมและก็เอาชนะมันได้มากน้อยเพียงใด

เพื่อแก้ไขพัฒนาตัวเองให้อยู่ในสนามประชันทำให้มีประสิทธิภาพเพิ่มมากขึ้นการเดิมพันที่เป็นไปเพอร์เฟ็ค เพราะว่าการจะเล่นพนันบาคาร่าได้ดิบได้ดีควรจะมีความรู้ความเข้าใจถ่องแท้ไม่ใช่แค่ทดลองเล่น บาคาร่าออนไลน์

วงเงินมีเท่าไร กำหนดไว้ก่อนเข้าใช้คาสิโน ถือเป็นการควบคุมความประพฤติปฏิบัติที่เกินเลย ลงไปในสนามแล้วความโลภมักมากมันเกิดขึ้นเสมอ

การวางเดิมพันจะต้องรู้ทันแบ่งมันเป็นส่วน ควรเล่นในจำนวนจำนวนเงินมากน้อยแค่ไหน

แล้วหากไม่ชนะเลยสารภาพการสูญเสียไปได้ไหม วิธีนี้จะช่วยลดจังหวะการเสียเงินเสียทองเกินจำเป็น เล่นแบบพอใช้ ได้ก็ไม่กลัว เสียก็ตั้งรับไหว

ผลกำไรตามเป้า อย่าเอาต่อ เลิกเล่นในทันที บางครั้งก็อาจจะเห็นว่ามันเป็นการตัดจังหวะของการสืบเสาะหากำไรที่มันกำลังไปเจริญ แต่ด้วยการแข่งขันชิงชัยมันควรมีจุดเสียท่าเราจำเป็นต้องมานั่งเสียเวลาตามเก็บในครั้งใดก็ตามแพ้ การเดิมพันแล้วได้กำไรตามเป้าก็ควรจะมัวแต่พอดี อย่าฝืนเพียงแต่เนื่องจากว่ามันกำลังเหมาะสมเข้าที สรุปท้ายสุดแพ้ขึ้นมาสิ่งที่ได้มากลับไม่เหลืออะไร อันนี้ก็ไม่ไหว เล่นเพราะเหตุใดก่อน

แพ้ไม่คงเดิม ตามเก็บให้ดีจะต้องทน ทุกการเล่นพวกเราหลีกเลี่ยงไม่ได้ที่จะแพ้ แต่จะไปได้ดีและอยู่รอดบน เว็บบาคาร่า

รวมบาคาร่า ขึ้นอยู่กับที่การแก้เกมผู้ใดกันแน่จะเก่งกว่ากันเพียงแค่นั้น ทุกคนเคยแพ้ แต่คนใดกันที่จะจมปักอยู่กับสิ่งที่ทำให้เราไม่ขับไปข้างหน้า

ตราบเท่าที่พวกเรายังมีโอกาสแล้วก็เวลาสำหรับเพื่อการแสวงหากำไร การแก้เผ็ดนับว่าเป็นสิ่งที่ไม่ควรขาด แต่ว่าต้องขึ้นอยู่กับสติ ความไม่ประมาท ไม่ใช่ตาม้าตาเรือเล่นพร่ำเพรื่อไปเรื่อย จริงอยู่ตามเก็บเอาคืนมันเมื่อยล้า แต่ว่าแพ้ไม่แก้คืนมันก็มิได้ คาสิโนออนไลน์ยิ่งง่ายใช้หลักการวางเงินได้ผลลัพธ์ที่ดี เพียงจำเป็นต้องใช้เงินพอควรสำหรับการทบ แล้วคุณจะจบงาม เงินทุนได้ด้วย ได้กำไรช่วยอีก

It’s going to be ending of mine day, however before

ending I am reading this fantastic paragraph to increase my knowledge.

site

Heⅼlo very сⲟoⅼ site!! Man .. Excellent .. Amazing ..

I will bookmark your webѕite and takke the feeds additionally?

I am satisfied to find so many helpful information here within tһe put up,

we want ԝork out mօre strategіes on this regard, thanks for sharing.

. . . . .

Here is my webpage … pop machines

I do not even know how I ended up here, but I thought this post

was great. I don’t know who you are but certainly you’re going to a famous blogger if you aren’t already ;

) Cheers!

Hurrah! At last I got a website from where I know how to genuinely get valuable information concerning my study and knowledge.

Your style is really unique in comparison to other people

I’ve read stuff from. Thanks for posting when you

have the opportunity, Guess I’ll just bookmark this blog.

It’s going to be finish of mine day, except before ending I am reading this great paragraph to improve my experience.

garman d9ca4589f4 https://wakelet.com/wake/5vBNsedv_E06FNpt_x9ks

We stumbled over here different website and thought I

might as well check things out. I like what I

see so now i am following you. Look forward to looking at your web page for a second time.

Hey would you mind letting me know which hosting company you’re utilizing?

I’ve loaded your blog in 3 different web browsers and I must say this blog loads a lot faster then most.

Can you recommend a good internet hosting provider at a fair price?

Cheers, I appreciate it!

Thank you for the auspicious writeup. It in fact was a amusement

account it. Look advanced to more added agreeable from you!

By the way, how can we communicate?

I do accept as true with all the concepts you’ve offered to your post.

They’re really convincing and can definitely work.

Still, the posts are very short for starters. May just you

please prolong them a little from next time? Thanks for the post.

Zudem sei die Akkureichweite mit nur 83 Minuten deutlich

zu schwach und der Preis hoch. Immerhin durch seine starke

Saugleistung, die vielen Sensoren und die Qualität konnte der Marken Saugroboter

punkten. Da Vorwerk Kobold VR300 direkt vom Hersteller vertrieben wird,

liegen uns dazu keine Kundenbewertungen unabhängiger Onlineshops vor.

Vorwerk Kobold VR300 Saugroboter erhalten Sie exklusiv im Vorwerk-Onlineshop.

Was ist ein Saugroboter? In der Mehrheit Modelle sind flach genug gebaut, um auch

unter niedrige Möbel saugen zu können. Produziert werden die

Saugroboter in europa a fortiori von bekannten Haushaltsgeräteherstellern, wie Vorwerk oder Dyson. Staubsaugerroboter sind intelligente, meist

runde Haushaltsgeräte mit einem Durchmesser von durchschnittlich 30 Zentimetern. In den USA, England und Asien kommen die

Geräte dagegen eher von Herstellern, die inmitten der Robotertechnologie

zuhause sind, wie die iRobot Modelle oder Saugroboter von Xiaomi bzw.

Roborock. Letztere eignen sich nur für Nutzer ohne große Wohnung, da ihr Zick-Zack-Modus auf

großen Flächen unglaublich viel Energie verbraucht. Im Handel

sind Staubsaugerroboter mit Cloud-Anbindung und intelligenter Laser Navigation, mit Kamera und AI

oder ohne WLAN mit Zufallsnavigation erhältlich.

Wie funktioniert ein Saugroboter? Saugroboter arbeiten wahnsinnig viele im Stil von eines

Teppichreinigers und nutzen dazu mehrere rotierende Bürsten bzw.

Walzen, die mit Gummilippen versehen sind.

What’s Going down i’m new to this, I stumbled upon this I’ve

discovered It positively useful and it has

helped me out loads. I hope to contribhute & help other

customers like its aided me. Good job.

homepage

Wow that was unusual. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again. Regardless, just wanted to say superb blog!

Look into my web-site situs slot online

saktfau d9ca4589f4 https://wakelet.com/wake/YcDxKE3qVBZQJIEGTEhJK

Wow, superb weblog structure! How lengthy have you been running a blog for?

you make running a blog look easy. The total glance of your website is magnificent, as neatly

as the content!

I don’t know whether it’s just me or if perhaps everyone else

experiencing problems with your website. It seems

like some of the written text on your posts are running off

the screen. Can someone else please comment and let me

know if this is happening to them too? This may be

a issue with my internet browser because I’ve had this happen previously.

Appreciate it

I get pleasure from, cause I found exactly what I was having a look for.

You’ve ended my four day lengthy hunt! God Bless you man. Have a great day.

Bye

Looking for SEO services? Or need consultancy in SEO or digital Marketing?

Contact khurram Jamil, He is Google Certified SEO Expert and Trainer.

you can reach him at https://web.facebook.com/khurramjamilseo/

Thermopapierrollen finden in einer Vielzahl von Kassen, Waagen, Automaten oder Bondruckern Verwendung.

EC-Geräte nutzen ausschließlich Thermorollen 57 mm (57 mm breite Rollen aus

Thermopapier). Thermo Kassenrollen hingegen gibt es in einer Vielzahl verschiedener Breiten,

die gängigsten sind hierbei Thermorollen 80 mm und 58 mm.

Sie können bei GEBONGT24 Thermobonrollen ohne Bisphenol A (BPA frei) oder komplett phenolfrei

(BP frei) günstig bestellen. Grundsätzlich

unterscheidet man beiderartig Bonrollen: Kassen Thermorollen und Kassenrollen aus Normalpapier (Additionsrollen).

Wann benötige ich Thermorollen? Thermorollen, auch „Thermopapierrollen” oder „Thermobonrollen” genannt, benötigen Sie immer dann,

wenn Ihre Kasse, Ihr EC-Gerät bzw. Ihr Drucker mit einem

Thermodruckverfahren arbeitet. Beim Druckvorgang wird das Kassenrollen Thermopapier partiell erhitzt nur das Druckbild auf das Papier der Thermorollen “eingebrannt”.

Ein einfacher Test, festzustellen ob Sie Rollen aus Thermopapier kaufen müssen, ist der Fingernagel-Test.

Nehmen Sie dazu einfach die aktuelle Thermo

Kassenrolle aus Ihrer Kasse bzw. Ihrem Drucker und versuchen Sie hiermit Fingernagel darauf zu kratzen.