Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

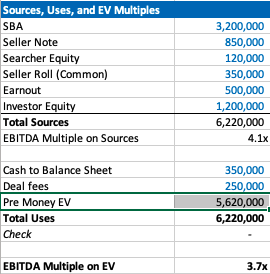

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

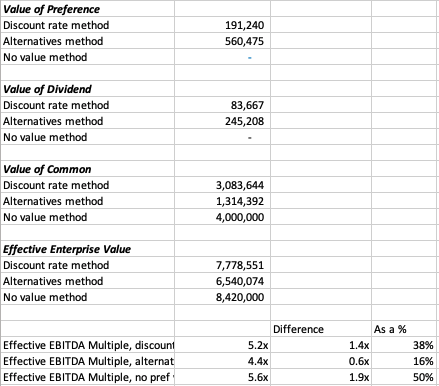

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

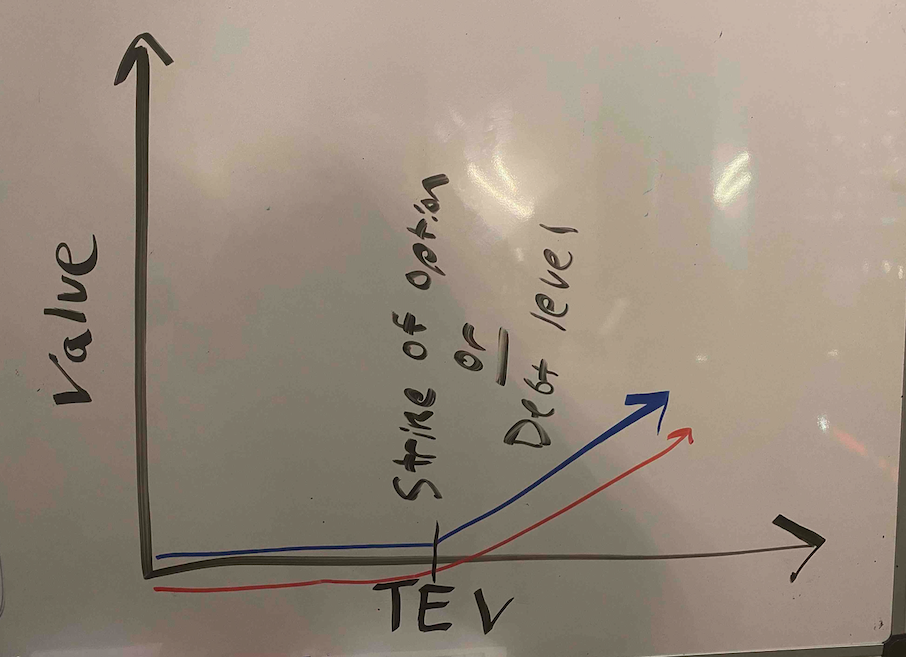

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

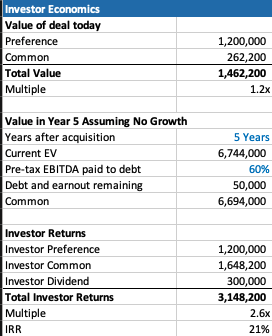

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

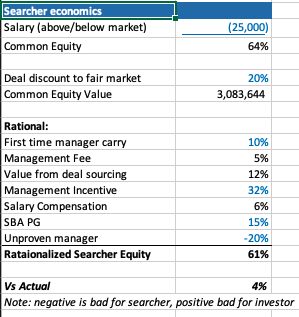

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

What’s up Dear, are you genuinely visiting this site regularly,

if so afterward you will without doubt get nice know-how.

I just like the valuable info you provide in your

articles. I will bookmark your blog and check once more right

here regularly. I’m relatively sure I’ll be informed lots of new stuff right right here!

Best of luck for the next! https://community.aodyo.com/user/milano

My partner and I absolutely love your blog and find almost all of your post’s to be exactly what I’m looking for.

can you offer guest writers to write content for you personally?

I wouldn’t mind producing a post or elaborating on a number of the subjects you write regarding here.

Again, awesome web log! https://www.exchangle.com/milano

Today, while I was at work, my cousin stole my iPad and tested to see if it

can survive a forty foot drop, just so she can be a youtube sensation. My iPad is now destroyed and she

has 83 views. I know this is completely off topic but I had to

share it with someone!

Greetings! Very helpful advice within this post! It’s the little

changes that produce the largest changes.

Thanks a lot for sharing!

It is perfect time to make a few plans for the long run and it’s time to be happy.

I’ve read this put up and if I may I wish to recommend you few interesting issues or advice.

Perhaps you can write subsequent articles relating to this article.

I want to learn more things approximately it!

Check out My Blog – alles rundum über Tierkrankenversicherung für Hunde,

Katzen, Pferde

https://team-dewein.de/versicherungsmakler-ulm/tierkrankenversicherung/

Get PETS Insurance from Germany! 🙂

I didn’t know that.

Fantastic site. A lot of useful information here. I’m sending it to

a few buddies ans also sharing in delicious. And naturally, thank you in your sweat!

Aw, this was an exceptionally good post. Taking the time and actual effort to produce a good article… but what can I say… I put things off a whole lot and

don’t manage to get nearly anything done.

واژینیسموس چیست : اگر به دنبال

پاسخ به این سوال که واژینیسموس چیست سری

به دنیای وب زده اید در ادامه ای

مقاله ما به طور کامل به ان سوال پاسخ خواهیم داد.

همچنین سعی کرده ایم راه حل های کاملی برای این

مشکل ارائه کنیم و به تشریح کامل روش

های درمانی این عارضه بپردازیم.

در ادامه با کلینیک اعصاب و روان هیربد همراه باشید.

در برخی از خانم ها، عضلات واژن ممکن است به طور غیر

ارادی، گاها یا دائمی به هنگام تلاش برای دخول دچار انقباض شود، به چنین شرایطی واژینیسموس می

گویند. واژینیسموس در واقع یک اختلال محسوب می شود.

به این اختلال در اصطلاح پزشکی

واژینیسم نیز گفته می شود. افراد دچار اختلال

واژینیسموس دخول دردناکی را در هنگام رابطه جنسی تجربه

می کند زیرا در زمان ورود آلت تناسلی به واژن

عضلات یکسوم، به طور ناخودآگاه دچار انقباض می شوند.

این اختلال به دو شکل اولیه (بدون هیچ تجربه مقاربتی از قبل) و شکل

ثانویه (با تجربه مقاربت راحت در گذشته) تقسیم میشود.

لازم است بدانید که، انقباض عضلات کاملا

غیر ارادی است و در نتیجه

فرد هیچ کنترلی بر آن ندارد. افراد دچار واژینیسم به دلیل ترس از دردناک بودن دخول

موفق به انجام رابطه جنسی به طور کامل نمی شوند و این مشکل برای آن ها

بار روانی بسیار زیادی به

همراه دارد که در بسیاری از موارد باعث تشدید اوضاع و مشکل آن ها می شود.

به واژینیسموس به انگلیسی نیز vaginismus گفته

می شود. این اختلال با واژه های مختلفی در

فارسی تعبیر و تفسیر می شود. برخی آن

را دخول غیر ممکن می نامند و برخی از واژه هایی همچون ترس شدید به هنگام نزدیکی یا انقباض غیر ارادی واژن برای توصیف چنین

شرایطی استفاده می کنند. بروز این انقباضات مانع از دخول جنسی می شود یا این امر را برای فرد

بسیار دردناک می سازد.

هر چند بروز چنین مشکلاتی می تواند با رابطه جنسی و کیفیت زندگیتان تداخل

داشته باشد اما باز هم باید اعتماد

به نفستان را حفظ کنید زیرا این مشکل درمان پذیر است.

اگر دوست دارید عملکرد جنسی خود

را مورد محک قرار دهید می توانید از آزمون معتبر زیر استفاده کنید.

I’ll immediately snatch your rss feed as I can not in finding your email subscription hyperlink

or e-newsletter service. Do you’ve any? Kindly allow me

understand in order that I may subscribe. Thanks.

I enjoy what you guys are usually up too. This type of clever

work and exposure! Keep up the awesome works guys I’ve incorporated you guys to my own blogroll.

you are actually a good webmaster. The web site loading velocity

is incredible. It seems that you’re doing any distinctive trick.

In addition, The contents are masterwork. you’ve done a excellent activity on this topic!

I just like the valuable information you supply for your articles.

I will bookmark your weblog and take a look at again right here frequently.

I’m slightly sure I’ll learn many new stuff proper here!

Good luck for the next!

Wonderful, what a weblog it is! This webpage provides useful

facts to us, keep it up.

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you!

By the way, how could we communicate?

excellent points altogether, you simply received a emblem new reader.

What would you recommend about your post that you simply made some days ago?

Any sure?

Look into my website asapcashoffer

Generally I do not learn post on blogs, however I would like to say that

this write-up very forced me to check out and do it!

Your writing taste has been surprised me. Thanks,

quite great post.

I am really pleased to glance at this blog posts which includes

tons of valuable information, thanks for providing these kinds of information.

Wonderful beat ! I would like to apprentice while you amend your website, how could

i subscribe for a blog website? The account helped me a acceptable

deal. I had been tiny bit acquainted of this your broadcast provided bright clear idea

Thanks for your marvelous posting! I truly enjoyed reading it, you are a great author.

I will be sure to bookmark your blog and may come back later in life.

I want to encourage you to continue your great writing, have a

nice holiday weekend!

Hi there everybody, here every one is sharing such experience,

thus it’s nice to read this website, and I used to go to see

this blog daily.

Today, I went to the beach front with my children. I found a sea shell and gave it

to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear

and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic but I had

to tell someone!

you are actually a excellent webmaster. The web site loading velocity is amazing.

It seems that you’re doing any unique trick. In addition, The contents are masterwork.

you have performed a great process in this matter!

My bropther recommended I might like this web site.

He was once entirely right. This post actually made my day.

You can noot considr just how a lot time I had spent ffor this info!

Thank you!

Cá cược trận đấu site cá cược thể thao

Pretty! This was an extremely wonderful article. Many thanks

for providing this info.

you are really a just right webmaster. The website loading pace is incredible.

It kind of feels that you’re doing any distinctive trick.

In addition, The contents are masterpiece. you’ve done a fantastic job on this topic!

It’s going to be finish of mine day, however before end I

am reading this fantastic post to increase my knowledge.

I have read so many articles about the blogger lovers however this article is really a

nice article, keep it up.

Oh my goodness! Incredible article dude! Thank you, However I am encountering issues

with your RSS. I don’t know the reason why I cannot subscribe to it.

Is there anybody having identical RSS problems? Anybody who knows the solution can you kindly respond?

Thanx!!

This blog was… how do I say it? Relevant!! Finally I’ve

found something that helped me. Thanks!

Everythikng iis very open with a reakly clear description of the challenges.

It was definitely informative. Yourr site is very helpful.

Thanks foor sharing!

web site

Have you ever thought about creating an ebook or guest authoring on other websites?

I have a blog based on the same information you discuss and would really like to have you

share some stories/information. I know my subscribers would enjoy your work.

If you are even remotely interested, feel free to shoot

me an e-mail.

What’s up, I log on to your new stuff like every week. Your story-telling style

is awesome, keep doing what you’re doing!

When I initially commented I clicked the “Notify me when new comments are added”

checkbox and now each time a comment is added I get several e-mails with

the same comment. Is there any way you can remove me from that service?

Cheers!

my blog post: land for sale

Wonderful views on that!

I didn’t know that.

Someone essentially lend a hand to make seriously articles I might state.

This is the very first time I frequented your web page and

to this point? I surprised with the research you made to create this actual post amazing.

Great job!

It’s a pity you don’t have a donate button! I’d certainly donate to this fantastic blog!

I guess for now i’ll settle for bookmarking and adding your RSS feed to my Google account.

I look forward to new updates and will talk about this website with my Facebook

group. Chat soon!

Thanks for the marvelous posting! I actually enjoyed reading it, you could be a great author.I will remember to bookmark your blog and may come back very soon. I want to encourage

you continue your great writing, have a nice afternoon!

What’s up, I wish for to subscribe for this web site to

get latest updates, so where can i do it please

help.

Have you ever thought about writing ann e-book or guest authoring on other blogs?

I have a blog baswed on the same subjects you discuss and

would really like to have you share some stories/information. I

know my subscribers wwould value your work. If you are even remotely interested, feel

free to send me an e mail.

Cs go bets web page Parimatch การพนันมวย

I’m gone to inform my little brother, that he should

also pay a quick visit this website on regular basis to take updated from most

recent news.

I have read so many posts concerning the

blogger lovers however this article is genuinely a fastidious

article, keep it up.

I do not even know how I ended up here, but I

thought this post was good. I do not know who you are but

certainly you’re going to a famous blogger if you aren’t already ;

) Cheers!

Hey! Would you mind if I share your blog with my twitter group?

There’s a lot of folks that I think would really appreciate your content.

Please let me know. Cheers

Yes! Finally someone writes about agen sabung ayam.

Every weekend i used to go to see this site, as i wish for enjoyment, since this this site conations actually

pleasant funny material too.

WOW just what I was searching for. Came here by searching for porn