Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

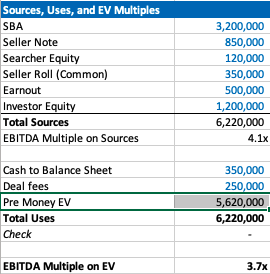

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

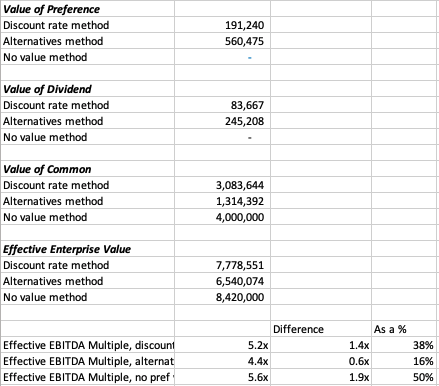

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

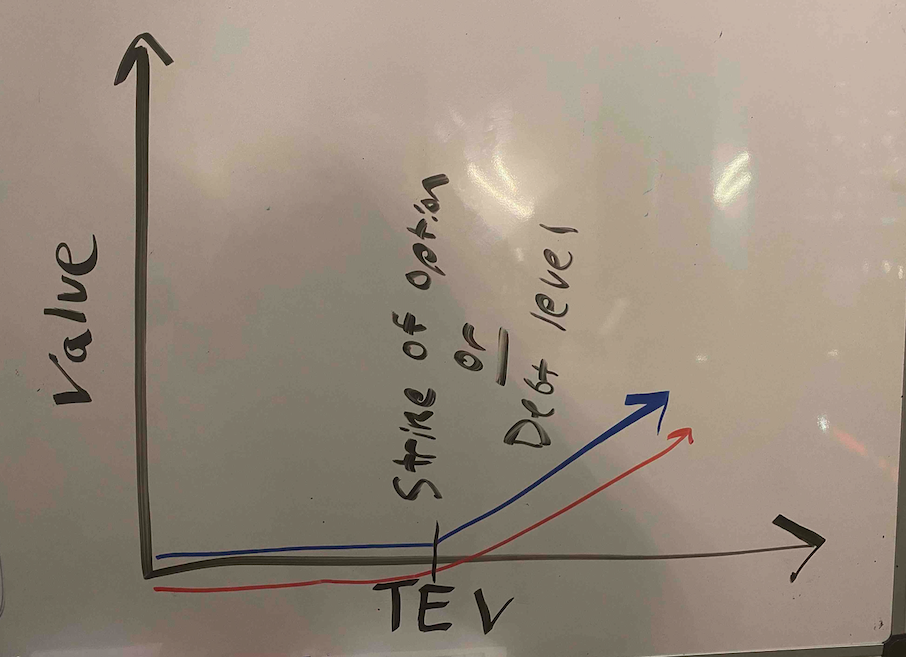

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

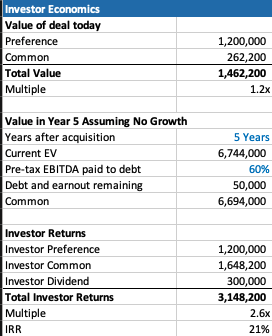

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

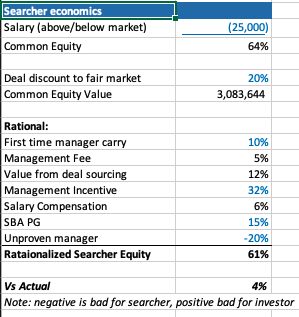

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

you’re really a exscellent webmaster. The website loading velocity is incredible.

It kind of feels that you are doihg any distinctive trick.

Moreover, The contents are masterpiece. you have performed a wonderful

activity in this topic!

My page; http://Www.Rienoessl.At

Hi! Do you know if they make any plugins to help with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not

seeing very good success. If you know of any please share. Appreciate it!

I am extremely impressed along with your writing talents and also with

the layout to your blog. Is this a paid subject matter or did you modify

it yourself? Anyway stay up the excellent high quality writing, it is uncommon to peer

a nice weblog like this one nowadays..

Every weekend i used to visit this site, as

i wish for enjoyment, for the reason that this this web

site conations actually fastidious funny data too.

Just wish to say your article is as astounding. The clearness in your

post is simply nice and i can assume you are an expert on this subject.

Well with your permission allow me to grab your feed to keep up to date with forthcoming post.

Thanks a million and please carry on the gratifying work.

Hello! I know this is kinda off topic but I was wondering

which blog platform are you using for this website? I’m getting tired of WordPress because I’ve had issues

with hackers and I’m looking at options for another

platform. I would be great if you could point me in the direction of

a good platform.

Hello there! Would you mind if I share your blog with

my facebook group? There’s a lot of people that I think would really enjoy your content.

Please let me know. Thanks

I don’t know if it’s just me or if perhaps everyone else encountering issues with your site.

It appears as if some of the text in your content are running off the

screen. Can someone else please provide feedback and let

me know if this is happening to them too? This could be a problem with my web browser because I’ve had

this happen previously. Thank you

great submit, very informative. I ponder why the other specialists of

this sector don’t understand this.

You must continue your writing. I am sure, you’ve a huge readers’ base already!

แหล่งรวมเว็บสล็อต มาพร้อมระบบรวมทั้งบริการดีๆสำหรับสมาชิกทุกท่าน ลงทะเบียนเป็นสมาชิกได้แล้วเวลานี้เพื่อให้ทุกคนสามารถร่วมบันเทิงใจและก็ทำเงินได้อย่างไร้ข้อจำกัด เป็นแหล่งรวมเกมที่ใหญ่ที่สุดของพวกเรา บริการดีๆต่างๆมากไม่น้อยเลยทีเดียว เปิดให้บริการจากผู้ผลิตโดยตรงจากต่างแดน ได้อย่างเพลิดเพลินเจริญใจไร้ขีดกำจัด สามารถทำธุรกรรมการคลังต่างๆได้ด้วยตนเอง แนวทางการเล่นผ่านอุกปรณ์โทรศัพท์มือถือ วางพนันด้วยเงินจริง ที่รวมค่ายทุกค่ายไว้ภายใน เว็บพนันสล็อตออนไลน์ ของเราไว้ครบทุกเกม เว็บเดิมพันสล็อต เก็บรวบรวมไว้ในค่ายเกมเดียวจบครบเชื่อมั่นได้100% ได้เปิดให้บริการที่สุดแสนจะพิเศษสำหรับสมาชิกทุกคน สล็อตเครดิตฟรีที่จะช่วยให้ผู้เล่นมือใหม่ ถ้ามีปัญหาหรือปัญหาประการใดก็สามารถติดต่อหาทีมงานได้ทันที

มีโบนัสแตกหนักแตกหลายครั้งมีผู้เล่นคนจำนวนไม่น้อยซึ่งสามารถปราบเงินรางวัลแจ็คพอตก้อนโต ลุ้นรับเงินรางวัลเวลานี้เปิดประสบการณ์ใหม่ที่ไม่เคยได้รับจากที่ไหนยืนยันว่าไม่ผิดหวังอย่างแน่นอน อย่าคอยช้าสมัครตอนนี้ลุ้นรับเงินรางวัลตอนนี้เปิดประสบดารณ์ใหม่ที่ไม่เคยได้รับจากที่ไหนรับรองว่าไม่ผิดหวังอย่างไม่ต้องสงสัย สามารถร่วมสนุกกับเกมต่างๆเยอะมากได้อย่างไร้กลุ้มอกกลุ้มใจพร้อมมีระบบรวมทั้งบริการดีๆต่างๆล้นหลาม สามารถทำธุรกรรมต่างๆผ่านระบบฝาก-ถอนได้ด้วยตัวเองสะดวกมั่นคงรวมทั้งไม่มีอันตราย100%สามารถร่วมบันเทิงใจกับเกมสล็อตแตกง่ายได้อย่างเพลิดเพลิน สำหรับสมาชิกทุกท่านที่ยังไม่มีประสบการณ์การเล่นมาก่อนการฝึกหัดเล่นในโหมดทดสอบเล่นสล็อตฟรีจะช่วยให้ทุกคนสามารถเล่นได้อย่างถูกวิธีรู้เรื่องแบบและก็อัตราการจ่ายเงินรางวัล อย่ารอช้าสมัครในขณะนี้ลุ้นรับเงินรางวัลในตอนนี้เปิดประสบการณ์ใหม่ที่ไม่เคยได้รับจากที่ไหนยืนยันว่าไม่ผิดหวังอย่างไม่ต้องสงสัย

ทางทีมงานของเราได้เปิดให้บริการที่สุดแสนจะพิเศษสำหรับสมาชิกทุกคนซึ่งสามารถทำธุรกรรมต่างๆได้ด้วยตัวเองเร็วด้านใน10วินาที สล็อตยอดนิยมที่มาแรงที่สุดในปี2022สามารถการันตีเรื่องความมั่นคงไม่เป็นอันตรายเล่นได้จ่ายจริง100%

เป็นคนมั่งคั่งในตอนข้ามคืนกันเลยทีเดียวอัตราการได้รับเงินรางวัลสูงถึง90% จะช่วยทำให้การลงทุนของทุกคนได้รับผลตอบแทนที่คุ้มอย่างแน่นอน

สล็อตซุปเปอร์

Why is it I always really feel like you do?

Does your website have a contact page? I’m having problems

locating it but, I’d like to send you an e-mail. I’ve got some ideas for your blog you might be interested in hearing.

Either way, great website and I look forward to seeing it develop over time.

Gay tube video http://www.fux.com

Hi! I’ve been reading your website for a while now and finally got the bravery to go ahead

and give you a shout out from Dallas Tx! Just wanted to say

keep up the great work!

Hi there, i read your blog from time to time and i own a similar one and i was just curious if you

get a lot of spam feedback? If so how do you protect against it, any

plugin or anything you can recommend? I get so much lately it’s driving me crazy so any help is very much

appreciated.

Very descriptive article, I liked that bit. Will there be a part 2?

Hi, i think that i saw you visited my blog so i came to “return the favor”.I’m attempting to find things to improve my web site!I suppose its ok to use some of your ideas!!

This design is steller! You most certainly know how to keep a reader amused.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job.

I really enjoyed what you had to say, and more than that, how you presented it.

Too cool!

Heya! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up

losing months of hard work due to no backup. Do you have any solutions to prevent

hackers?

Everything is very open with a precise description of the challenges.

It was truly informative. Your site is useful.

Many thanks for sharing!

This is my first time pay a visit at here and i

am genuinely happy to read all at one place.

Slot Deposit Pulsa Terpercaya Dan Slot Terlengkap Indo787

slot deposit pulsa

Slot deposit pulsa tanpa potongan slot online resmi

Indo787, salah satu pihak penyelengara agen judi online terbaik

I savor, cause I found just what I used to be taking

a look for. You have ended my four day lengthy hunt! God Bless you man. Have a great day.

Bye

I enjoy reading a post that will make people think. Also, many thanks

for allowing me to comment!

Ahaa, its nice conversation regarding this piece of writing here at this blog, I have read all

that, so at this time me also commenting at this place.

Howdy would you mind letting me know which webhost you’re working

with? I’ve loaded your blog in 3 different web browsers and I must

say this blog loads a lot quicker then most.

Can you recommend a good hosting provider at a reasonable price?

Thanks, I appreciate it!

Awesome blog! Is your theme custom made or did you

download it from somewhere? A design like yours with a few simple adjustements

would really make my blog stand out. Please let

me know where you got your design. Thanks a lot

I think that everything published made a ton of sense.

However, what about this? what if you wrote a catchier title?

I mean, I don’t want to tell you how to run your blog,

but suppose you added a headline that makes people

want more? I mean Thoughts on Search Fund Economics – Phil Strazzulla's Blog is a little vanilla.

You could look at Yahoo’s home page and watch how they

write news titles to grab viewers interested.

You might add a video or a picture or two to

grab readers excited about what you’ve written. Just my opinion, it could make

your posts a little livelier.

Hello Dear, are you genuinely visiting this site on a regular basis,

if so then you will absolutely take good know-how.

You are so awesome! I don’t suppose I have read through anything like that before.

So wonderful to find somebody with original thoughts

on this topic. Seriously.. many thanks for starting this up.

This website is something that is required on the internet, someone with a bit of originality!

Hi there, You’ve done a great job. I will certainly digg

it and personally suggest to my friends. I am confident they will be benefited from this website.

Hmm is anyone else encountering problems with the pictures on this blog loading?

I’m trying to figure out if its a problem on my end

or if it’s the blog. Any feedback would be greatly appreciated.

My brother recommended I may like this web site. He was

once entirely right. This publish truly made my day.

You cann’t consider simply how a lot time

I had spent for this info! Thanks!

What a information of un-ambiguity and preserveness of valuable familiarity regarding unexpected emotions.

This is very interesting, You are an overly professional blogger.

I have joined your feed and stay up for in quest of more of your great post.

Additionally, I’ve shared your site in my social

networks

My brother suggested I may like this website.

He used to be totally right. This submit actually made my day.

You can not believe just how much time I had spent for this info!

Thanks!

Excellent, what a webpage it is! This website provides useful data to us, keep it up.

I’ve learn a few just right stuff here. Definitely value bookmarking for revisiting.

I wonder how much effort you set to create any such great

informative website.

My brother recommended I may like this website.

He used to be totally right. This put up actually made my day.

You cann’t believe simply how much time I had spent for this info!

Thank you!

Right now it sounds like Drupal is the preferred blogging platform out there

right now. (from what I’ve read) Is that what you’re using on your blog?

Howdy! I know this is kind of off topic but I was wondering

if you knew where I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having trouble

finding one? Thanks a lot!

For most up-to-date news you have to pay a visit internet and on the web I found this website as a finest web page for newest updates.

What’s up to all, the contents present at this website

are genuinely remarkable for people experience, well, keep up the good

work fellows.

Have you ever considered creating an e-book or

guest authoring on other sites? I have a blog based

upon on the same topics you discuss and would really like

to have you share some stories/information. I know

my visitors would enjoy your work. If you’re even remotely interested, feel free

to shoot me an e mail.

Heeya this is kinda of off topic but I was wondering if blogs usse WYSIWYG editors or iff you have to manually

code with HTML. I’m starting a blog soon butt have no coding skills so I wanted to gget advice from someone

with experience. Any help would be gratly appreciated!

Also visit my web site; reallifecam, real life cam, reallife cam, reallifecam, voyeur-house

You are so cool! I do not believe I’ve read through something like that

before. So great to discover somebody with a few original thoughts on this issue.

Really.. thank you for starting this up. This web site is one

thing that is needed on the web, someone with a little originality!

Also visit my web page … timberland

I take pleasure in, result in I discovered just what I was

looking for. You’ve ended my 4 day long hunt! God Bless you man. Have a great day.

Bye

my blog post … 美女人妻

Gay tube video http://www.4tube.com

It’s remarkable to pay a visit this site and

reading the views of all friends regarding this paragraph, while I am also keen of getting experience.

If you desire to take a great deal from this paragraph then you have to apply such techniques to

your won blog.