Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

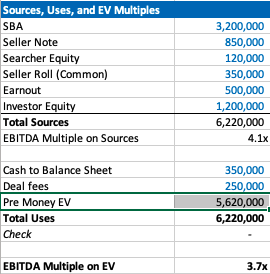

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

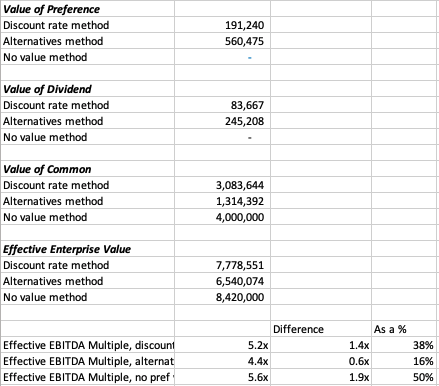

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

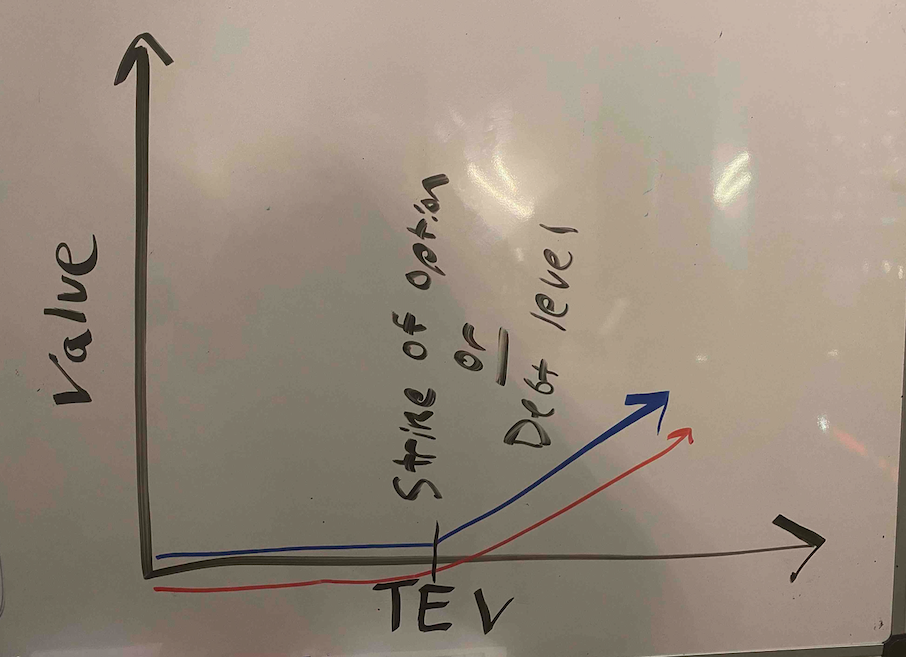

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

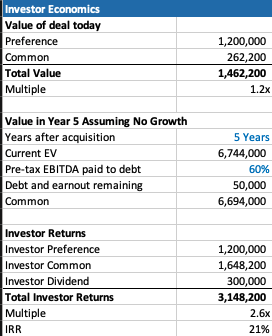

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

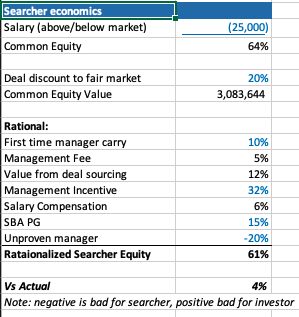

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

Wonderful beat ! I would like to apprentice while you amend your site, how can i subscribe for a blog website?

The account helped me a acceptable deal. I had been tiny bit

acquainted of this your broadcast provided bright clear idea

What’s Happening i’m new to this, I stumbled upon this I’ve discovered It absolutely helpful and it has aided me out loads.

I’m hoping to contribute & assist other customers like its aided me.

Good job.

I have been surfing online more than 2 hours today,

yet I never found any interesting article like yours. It is pretty

worth enough for me. In my view, if all site owners and bloggers

made good content as you did, the net will be a lot more useful than ever before.

Thank you for the good writeup. It in fact was a amusement account

it. Look advanced to far added agreeable from you! However,

how could we communicate?

I don’t know whether it’s just me or if perhaps everyone else experiencing issues with your site.

It seems like some of the written text on your posts are running

off the screen. Can somebody else please comment and let me know if this

is happening to them too? This could be a problem with my internet browser because I’ve had this happen previously.

Appreciate it

I know this web page offers quality depending posts and other information,

is there any other web page which offers such things in quality?

Greetings from Florida! I’m bored at work so I decided to check out your blog on my iphone during lunch break.

I really like the info you provide here and can’t wait to take a look when I get home.

I’m amazed at how quick your blog loaded on my cell phone

.. I’m not even using WIFI, just 3G .. Anyhow,

very good blog!

This is my first time pay a visit at here and i am really happy to read

all at single place.

Hal yang diperlukan untuk membuat akun permainan ialah selamanya pada kondisi online.

Sambungkan perangkat dengan hendak dipergunakan dengan koneksi jaringan dengan kuat.

Internet amat diperlukan dalam pabrikasi akun permainan.

Bila tak tersedia wifi, gunakan sambungan yang betul-betul kuat

daripada kartu atau paket internet. Pastikan perangkat dengan hendak digunakan telah

menyala sepenuhnya.

Buka situs slot game online

I need to to thank you for this good read!! I definitely enjoyed

every bit of it. I’ve got you saved as a favorite to check out new things you post…

What’s up, all is going sound here and ofcourse every one is sharing information, that’s

really good, keep up writing.

Great weblog here! Additionally your website rather a lot up fast!

What host are you using? Can I am getting your associate hyperlink for

your host? I desire my web site loaded up as fast as yours lol

Thhe common expectation is thaat BetMGM NY will be available to download in time foor Super Bowwl LVI, which is scheduled foor Feb.

13, 2022.

Feel frfee to surf to my site: 바카라 사이트

Somebody necessarily assist to make seriously articles I would state.

That is the first time I frequented your website page and so far?

I amazed with the analysis you made to create this particular post amazing.

Magnificent job!

Hi it’s me, I am also visiting this web page daily, this

web site is in fact pleasant and the users are in fact sharing good thoughts.

When some one searches for his vital thing, so he/she needs to be

available that in detail, thus that thing is maintained over here.

I am actually pleased to glance at this blog posts which consists of plenty of useful data, thanks for providing these data.

This is a topic that is near to my heart…

Best wishes! Where are your contact details though?

We are a group of volunteers and opening a new

scheme in our community. Your site offered us with valuable information to work on. You’ve done a formidable job and our entire community will be thankful

to you.

We are a gaggle of volunteers and starting a brand new scheme in our community.

Your web site offered us with valuable information to work

on. You’ve performed an impressive process and our entire neighborhood shall be grateful to you.

Hmm it looks like your blog ate my first comment (it was super long) so I guess I’ll just sum it up what I submitted and say,

I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still

new to the whole thing. Do you have any points for novice blog writers?

I’d certainly appreciate it.

Aw, this was a really nice post. Taking

a few minutes and actual effort to produce a

great article… but what can I say… I procrastinate a whole lot

and don’t seem to get anything done.

It’s very effortless to find out any matter on web as compared to textbooks, as I found this piece

of writing at this web page.

Hi there! I could have sworn I’ve been to this

site before but after reading through some of the post I

realized it’s new to me. Anyways, I’m definitely delighted

I found it and I’ll be book-marking and checking back often!

Hi there colleagues, its enormous paragraph

regarding educationand completely explained, keep it up all

the time.

you’re actually a just right webmaster. The site loading speed is incredible.

It sort of feels that you’re doing any distinctive trick.

Furthermore, The contents are masterwork. you have done a wonderful job

on this matter!

Fantastic goods from you, man. I have understand your stuff previous to and you’re just

too excellent. I actually like what you have acquired here, certainly

like what you’re stating and the way in which you say it. You make it enjoyable and

you still take care of to keep it smart. I can’t wait to read much

more from you. This is actually a terrific website.

Hi to every one, the contents present at this site are genuinely remarkable for people

knowledge, well, keep up the good work fellows.

I am actually happy to read this blog posts which contains tons of useful facts, thanks for providing

these kinds of information.

Hi, I do believe this is a great web site. I stumbledupon it 😉 I am going

to revisit yet again since i have saved as a favorite it. Money and freedom is the best way to change, may you be rich and continue

to guide other people.

Wow, that’s what I was exploring for, what a data!

existing here at this web site, thanks admin of this site.

you’re really a good webmaster. The web site

loading pace is amazing. It sort of feels that you’re doing

any unique trick. Also, The contents are masterpiece.

you have performed a wonderful task in this topic!

I’m not sure exactly why but this website is loading very slow

for me. Is anyone else having this issue or is it a problem on my end?

I’ll check back later on and see if the problem still exists.

I think the admin of this web page is actually working hard

in favor of his site, for the reason that here every information is

quality based stuff.

If you wish for to increase your know-how only keep visiting this website and be updated with the hottest

information posted here.

Great blog here! Also your site rather a lot

up very fast! What host are you the usage of?

Can I get your associate link in your host? I wish my site loaded up as quickly

as yours lol

Hi i am kavin, its my first occasion to commenting anyplace, when i read this piece of writing i

thought i could also make comment due to this brilliant post.

Greetings from Carolina! I’m bored to death at work so I decided to check

out your website on my iphone during lunch break. I really like the

info you provide here and can’t wait to take a look when I

get home. I’m amazed at how quick your blog loaded on my phone ..

I’m not even using WIFI, just 3G .. Anyhow,

great blog!

I do believe all the ideas you’ve introduced for your post.

They’re very convincing and will certainly work. Still, the posts are too quick for novices.

Could you please extend them a little from next time?

Thanks for the post.

I like the valuable information you supply in your articles.

I will bookmark your weblog and test once more here frequently.

I’m quite sure I will be informed lots of new stuff proper here!

Good luck for the next!

Und welche technischen Unterschiede macht das?

Kostencheck-Experte: Pauschal lassen sich Kostenunterschiede zwischen beiden Verglasungsarten nur schwer festlegen,

weil sich die Fenster meist auch noch in anderen Ausführungsmerkmalen unterscheiden. Technisch darf

man den Unterschied nicht nur in der zusätzlichen Glasscheibe sehen – oft sind auch die Konstruktionsmerkmale von Fenstern mit 3fach Verglasung deutlich hochwertiger.

Frage: Lohnt sich Dreifach-Verglasung überhaupt finanziell?

Bei identisch ausgeführten Fenstern liegt der Preisunterschied

aber meist innerhalb von 15 % – 20 %. Um diesen Prozentsatz sind moderne 3fach verglaste Fenster meist teurer.

Wenn’s um einen Neubau geht und man erst recht

auf die Fensterkosten schaut, ist es am besten sich nach

dem U-Wert des Fensters zu richten. Fenster mit gleichen U-Werten sparen auch gleich viel Heizenergie ein – ob es sich dabei um Zweifach-

oder Dreifach-Verglasung handelt, ist unerheblich.

Kostencheck-Experte: Das kommt immer darauf an, womit man vergleicht.

Allerdings ist es wichtig, dabei auf den Gesamt-U-Wert des Fensters zu achten – angegeben wird häufig nur der U-Wert der

Verglasung (Ug). Dreifach verglaste Fenster lohnen sich umso mehr

dann, wenn man sie mit einem Fenster mit sehr hohen U-Werten vergleicht (etwa inwendig von 2,0 oder darüber).

Does your website have a contact page? I’m having a tough time locating it but, I’d

like to shoot you an e-mail. I’ve got some suggestions

for your blog you might be interested in hearing. Either way,

great site and I look forward to seeing it develop over time.

I’m not sure where you’re getting your information, but good topic.

I needs to spend some time learning much more or understanding

more. Thanks for fantastic information I was looking for this information for my

mission.

Hello my family member! I want to say that this article is amazing,

nice written and include approximately all significant infos.

I would like to peer extra posts like this .

I’m impressed, I have to admit. Rarely do I come across a blog that’s

equally educative and engaging, and without a doubt, you have hit the nail on the

head. The issue is something that not enough men and women are speaking intelligently about.

Now i’m very happy I stumbled across this during my hunt for something regarding

this.

Great blog here! Also your web site loads up fast! What host are you using?

Can I get your affiliate link to your host?

I wish my website loaded up as fast as yours lol

Rolex, Omega, TAG Heuer oder Breitling? Die Auswahl an Luxusuhren Marken ist sehr

vielschichtig und bevor man sich für eine luxuriöse Armbanduhr entscheidet, sollte man vorher genau wissen, was man kauft.

Auch innerhalb der Marken von Luxusarmbanduhren gibt es große Preisunterschiede.

Eine vordergründige Eigenschaft (und damit oft auch eine

wesentliche Kaufentscheidung) von Luxusuhren ist der Preis,

welcher bei einigen hundert so weit wie mehreren Tausi tendieren kann.

So kann man eine TAG Heuer Formula 1 Herrenuhr bereits für circa 1.000 Euro erstehen, während die Modelle aus der TAG Heuer Carrera Serie schnell 4.000 Euro und mehr kosten. Auch bei anderen Luxusuhren-Herstellern wie Longines, Cartier,

Maurice Lacroix, Glashütte, Chopard, Junghans oder Hublot muss man tief ins Portmonee greifen, um sich eine Luxusuhr kaufen zu können. Automatikuhren von Tissot oder Certina bekommt bereits ab 500 Euro.

Maßgeblich für den Kaufpreis von Luxus-Armbanduhren ist a

fortiori Material sowie das Uhrwerk eines teuren Zeitmessers.

Neben der technischen Komponente spielen natürlich auch der Wert und die Exklusivität der Marke einer Luxus-Uhr eine wesentliche Rolle beim Kaufpreis.

Uhrwerke der Superlative, wie das Chronographen Kaliber 4130 von Rolex

dagegen gehören zur absoluten Spitzenklasse und treiben den Preis einer damit ausgestatteten Herren-Luxusuhr schnell

auf circa 12.000 Euro. Im oberen Ende der Preisskala

findet man hier bspw. Luxus-Armbanduhren von Patek Philippe,

welche oft nur im hohen fünfstelligen Preisbereich zu

erstehen sind. Luxusuhren wie die Perpetual Calendar, Gondolo oder

Nautilus gehören mit zu den teuersten Luxus-Herrenuhren der Marke und bewegen sich zwischen 30.000 und 70.000 Euro.

Eine solch teure und luxuriöse Analoguhr ist dann aber nicht nur ein normalere Zeitmesser, sondern oftmals auch

eine echte Geldanlage und beliebtes Erbstück in der Familie.

Thanks for sharing your thoughts. I really appreciate your efforts and I am waiting for your next write ups thanks once again.

Pretty section of content. I just stumbled upon your web site

and in accession capital to assert that I acquire actually enjoyed account your blog

posts. Any way I will be subscribing to your augment and even I achievement you access

consistently rapidly.

Wer im Urlaub oder im Büro nicht nur Fotos sehen möchte,

die der Saugroboter während seiner Arbeit macht,

sondern dieses Gerät auch mit allen seinen Funktionen steuern möchte, für den ist ein Saugroboter mit einer App-Fernsteuerung genau das richtige.

Im Gegensatz zur klassischen Fernbedienung, über die heutzutage praktisch

jeder Saugroboter verfügt, sind Geräte mit einer App-Fernsteuerung erst

zunehmend populär werden. So sind sie z.B.

Allerdings sind solche Geräte meist erheblich vielseitiger als ihre klassischen Konkurrenten ohne

App-Fernsteuerung. Lage, den Wohnraum mit einer integrierten Kamera mit Bewegungssensor zu überwachen, sie können Mails mit Fotos an den Besitzer schicken und

gezielt in Wohnräumen nachschauen, ob das Licht

(oder z.B. Im Grunde können Saugroboter auch völlig ohne

Licht arbeiten. Zu beachten ist aber: Staubsaugerroboter mit Kamera-Navigation finden sich in abgedunkelten Räumen nicht

länger zurecht, ihre Navigation versagt hier völlig.

Dagegen funktioniert die Steuerung über virtuelle Wände bzw.

Leuchttürme auch in völlig dunklen Räumen hervorragend, da hier mit

unsichtbaren Infrarotstrahlen gearbeitet wird.