Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

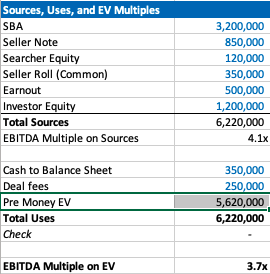

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

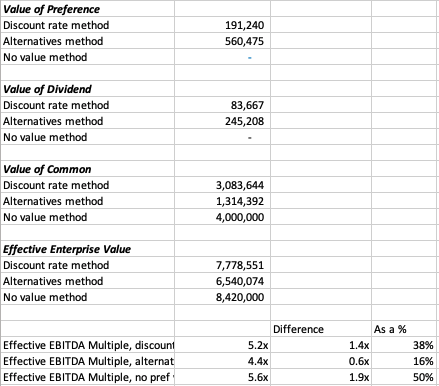

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

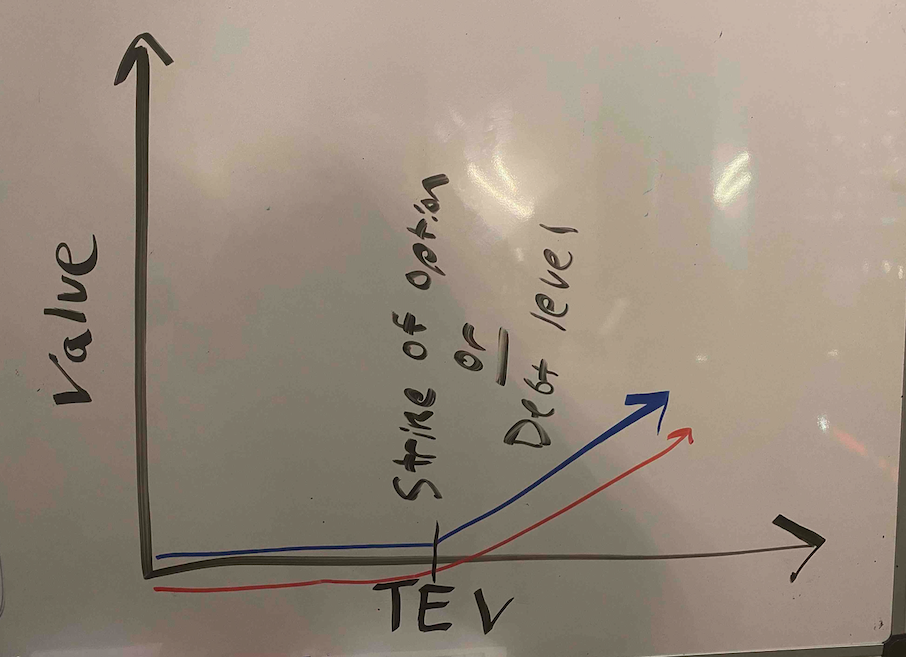

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

A few more thoughts on investor economics

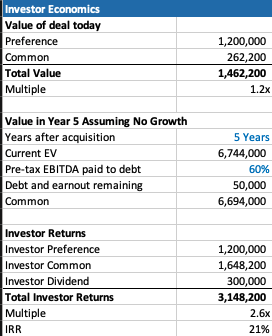

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

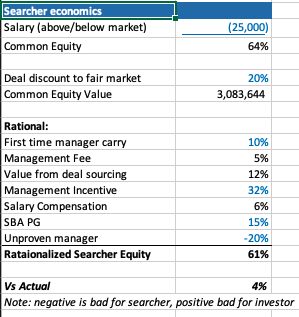

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

Can I just say what a relief to find someone who truly knows what they are

discussing on the internet. You actually realize how to bring an issue to light and make it

important. More and more people ought to check this out and understand this

side of your story. I was surprised you’re not more popular since

you surely possess the gift.

I think this is among the most significant info for me.

And i am glad reading your article. But want to

remark on some general things, The site style is great, the articles is

really nice : D. Good job, cheers

I will right away seize your rss as I can not in finding your email subscription link

or e-newsletter service. Do you’ve any? Kindly permit me recognise

in order that I may subscribe. Thanks.

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I

get four emails with the same comment. Is there any way you can remove people from

that service? Thanks!

Hi i am kavin, its my first occasion to commenting anyplace,

when i read this piece of writing i thought i could also make comment

due to this good article.

Hi there, I enjoy reading all of your post. I like to write a little comment to support you.

Keep on working, great job!

Ihr stellt fest: Bei einem Winterurlaub in Frankreich könnt

ihr euch auf Abwechslung, Skipisten und viele Highlights freuen. Auftreten zahlreiche andere Skiorte, die

für einen unvergesslichen Aufenthalt sorgen und herrliche Abfahrten garantieren. Wir haben die größte und schnellste doppelstöckige Luftseilbahn der

Welt. Die Schweiz darf auf der Liste der beliebtesten Destinationen für einen Skiurlaub nicht fehlen. Frankreich stellt hiermit Vanoise Express einen weiteren Rekord auf.

Hier gibt es flache Hänge für alle, die mit den Skiern bis jetzt nicht

vertraut sind. In Saas Fee, dem höchsten Skigebiet der Alpen, erwartet euch

ein atemberaubender Ausblick. Von oben fahrt ihr

über 20 Kilometer hinab und beendet die Tour in Chamonix.

St. Moritz ist weltweit mit das beliebtesten Destinationen für einen Skiurlaub in der Schweiz.

Hier findet ihr ebenso das größte zusammenhängende Skigebiet der Welt:

Les Trois Vallées. Die Schweizer Alpen garantieren euch

malerische Skiorte mit schneebedeckten Landschaften. Für die Profis gibt es die steilen Pisten.

If you want to get a good deal from this article then you have

to apply these strategies to your won website.

Fastidious respond in return of this question with real arguments

and describing everything concerning that.

Excellent pieces. Keep writing such kind of info on your page.

Im really impressed by your blog.

Hello there, You’ve performed an excellent job. I will definitely digg it and personally recommend to my friends.

I’m sure they’ll be benefited from this web site.

I’m curious to find out what blog system you have been utilizing?

I’m experiencing some minor security issues with my latest blog

and I would like to find something more safeguarded.

Do you have any recommendations?

Fantastic website. A lot of useful information here.

I’m sending it to several friends ans additionally sharing in delicious.

And naturally, thank you for your sweat!

whoah this blog is excellent i love reading

your articles. Stay up the great work! You already know, many individuals are looking

around for this information, you could aid them greatly.

I absolutely love your blog and find the majority of your

post’s to be just what I’m looking for. Would you offer guest writers

to write content for you personally? I wouldn’t mind composing a post or elaborating on a lot of the subjects you write about here.

Again, awesome blog!

I am regular visitor, how are you everybody? This paragraph posted at this site is truly pleasant.

Nice post. I was checking constantly this weblog and I am inspired!

Very helpful info specifically the ultimate part 🙂 I take care of

such info a lot. I used to be seeking this certain information for a long

time. Thank you and best of luck.

Good day! Do you use Twitter? I’d like to follow you if that would be okay.

I’m undoubtedly enjoying your blog and look forward to new posts.

Your way of explaining all in this post is actually nice, every one be able to

easily know it, Thanks a lot.

It’s nearly impossible to find well-informed people for this

subject, however, you seem like you know what you’re talking about!

Thanks

Hello it’s me, I am also visiting this site on a regular basis, this site is actually pleasant and the visitors are in fact sharing

nice thoughts.

I savour, result in I found exactly what I was having a look for.

You have ended my 4 day long hunt! God Bless you man. Have a nice day.

Bye

Every weekend i used to visit this web page, for the reason that i wish

for enjoyment, as this this site conations really fastidious funny stuff too.

I always used to study piece of writing in news papers but now as I am a user of web therefore from now I am using net for articles or reviews,

thanks to web.

Thank you for the auspicious writeup. It in reality was a enjoyment account it.

Glance complicated to far introduced agreeable from you!

By the way, how can we keep in touch?

hello!,I like your writing so so much! share we keep in touch extra about your post on AOL?

I need a specialist on this area to resolve my problem.

Maybe that is you! Looking ahead to peer you.

If some one desires to be updated with newest technologies then he

must be pay a visit this site and be up to date all the time.

Dazu schneiden Sie der Fräse vorsichtig zwischen Mauer und Fensterrahmen lang.

Denken Sie dabei daran, dass die Ankerpratzen aus Metall mit einer Metalltrennscheibe geschnitten werden müssen. Notfalls, wie stark Sie

dem Mauerwerk zusetzen mussten, ist es nun im Großen und Ganzen notwendig,

eine glatte Fläche für den Einbau der neuen Fenster schaffbar.

Sitzen: Den Spachtel trocknen lassen, bevor es weiter geht.

Wie lange dieser aushärten muss, können Sie den Herstellerangaben entnehmen. Dies geht am

einfachsten, wenn Sie eventuell entstandene Lücken mit

Spachtelmasse ausgleichen. Die Schritte, die wir vorher

verbrochen haben, müssen nun in umgekehrter Reihenfolge wiederholt werden. Hiernach

befestigen Sie das Dekompressionsdichtband außen am Fensterrahmen. Wir fangen hiermit Fensterrahmen an. Dazu

müssen die Fensterflügel wie oben beschrieben entfernt werden. Mit „außen” sind die

Kanten gemeint, die später in richtung Fenstersturz und Fensterlaibungen zeigen werden. Das Dekompressionsdichtband dehnt sich

gen Wand aus und sorgt später für eine gute Abdichtung.

Auch Fenster 3 fach Verglasung finden Sie in diesem Land.

An outstanding share! I have just forwarded this onto a co-worker

who was doing a little homework on this. And he actually ordered me breakfast because I discovered

it for him… lol. So let me reword this…. Thanks for the

meal!! But yeah, thanx for spending the time to talk about

this issue here on your web site.

What’s up to every single one, it’s really a fastidious for

me to visit this website, it consists of precious Information.

Cala Ratjada – Das urige Fischerdorf mit einem Hafen aus dem 17.

Jahrhundert ist eine der beliebtesten Urlaubsorte der Deutschen und liegt

im Südosten Mallorcas. Die lebendige Hafengegend, flach

abfallende, feinsandige Strände und zahlreiche

Unterhaltungs- und Ausgehmöglichkeiten – dieser lebendige Urlaubsort bietet alles, was das Urlauberherz begehrt.

Cala Ratjada ist für seine hellen, flach abfallenden Sandstrände

bekannt. Beliebt bei Familien ist die Playa Son Moll, die sehr zentral zur Stadt gelegen und damit

gut in gehnähe ist. Eine breite Liegefläche bietet viel

Platz zum Entspannen und lädt zum Sonnenbaden ein. Fürt Speisen und Getränke ist gesorgt – gegen den kleinen Hunger bietet eine Strandbar Snacks und Getränke

an, Restaurants findet man in Laufweite

an der Promenade. Der ideale Ort, um einen Tag am Strand zu

verbringen. Feiner Sand und klares, blaues Wasser, das sich perfekt zum Schnorcheln eignet – das

finden Sie an der Cala Gat, einer kleinen Bucht vor Cala

Ratjada. Eine Promenade ebnet den Weg vom Hafen und eine gut ausgebaute Steintreppe

führt direkt zum von Pinien umsäumten Strand.

Hi! I realize this is sort of off-topic however I needed to ask.

Does operating a well-established website such as yours take a large amount of work?

I am brand new to writing a blog however I do write in my journal daily.

I’d like to start a blog so I can share my personal experience and views online.

Please let me know if you have any suggestions or tips for brand new aspiring bloggers.

Thankyou!

Die FMW-3 Sensoren überzeugen durch eine Vielfalt an Variationen. Entstehen den “FMW-3”, “FMW-3T”,

“FMW-3V” und “FMW-3VT”. So können Sie die optimale Auswahl

für Ihre Zwecke treffen. Die Sensoren sind hervorragend für

die Außenüberwachung geeignet und können im sinne Modell in Temperaturbereichen von -50°C bis 65°C genutzt werden. Über eine

zusätzliche Verbindung per Kabel können benachbarte Magnetfelder vernetzt werden und

der Schutz vor Überlappung der Felder oder Sabotage erhöht werden. Der volumetrische Mikrowellensensor

ist umso mehr für die Überwachung von kreis- bzw. ovalförmigen Bereichen gedacht.

So können z.B. Tunnel, Warenhäuser, etc. Der Überwachungsbereich

ist in 12 Unterzonen eingeteilt, ihrer einzelne oder mehrere deaktiviert werden können. Beispiel: Bei einem großen Gebäude könnten alle Fenster auf

Zugriff überwacht werden, während man den Eingangsbereich ausspart.

So ist es möglich, unteilbar Überwachungsradius Zonen ausführbar, die ohne

Alarm passiert werden können. Entstehen zwei Varianten vom Forteza M60 mit unterschiedlicher Größe des Magentfelds.

WOW just what I was looking for. Came here by searching for

situs slot online indonesia

I am really loving the theme/design of your

weblog. Do you ever run into any web browser compatibility problems?

A small number of my blog readers have complained about my

site not working correctly in Explorer but looks great in Firefox.

Do you have any tips to help fix this issue?

Appreciation to my father who informed me concerning this weblog, this blog is really

awesome.

9185994, This error message is only visible to WordPress

admins. Rolex GMT-Master … With such a

rich history and innovative offerings, the Rolex Submariner 6538 truly

lives up to its nickname as the “Bond Submariner.” To find similar vintage

Rolex watches please browse our new arrivals. These high-end tool

watches are still setting standards to this day.

Vintage Submariners like the so-called “Red Sub” or the “COMEX” are especially rare and, therefore, in high demand.

Furthermore, Rolex’s watchmakers add platinum dusting to the bezel’s

numbers and indices. Einer der Submariner eroberte Rolex rasch die Meereswelt und etablierte sich

schon bald unter Sporttauchern und Tiefseeforschern. Paul is the company’s Founder and CEO.

46. Rolex Submariner 5513 MKII. Rolex | Vintage Submariner, Stainless steel Ref.6536/1.

1675. Its bezel is unidirectional, meaning it only

turns counterclockwise so that the dive time can only be shortened and never lengthened.

The Rolex ‘Khanjar’ & ‘Qaboos’ Sea-Dweller.

This post presents clear idea in favor of the new viewers of blogging, that really how

to do blogging.

Was ist ein Saug-Wisch-Roboter? Der Saug-Wisch-Roboter fährt

nach einem bestimmten System durch den Raum und saugt lose Schmutzteilchen vom Boden auf.

Ein Saug-Wisch-Roboter ist ein Gerät zur Reinigung von Fußböden,

das selbstständig saugen und wischen kann. Entweder gleichzeitig

oder durch wechselnde Einstellungen kann der Roboter glatte Böden wischen. Der

Saug-Wisch-Roboter fährt nach feierabend zurück auf die Ladestation. Für viele Menschen stellt der Saug-Wisch-Roboter eine große Arbeitserleichterung dar, da es verzichtbar

ist, mit einem Staubsauger oder einem Wischmopp zu putzen. Lassen Sie es gut sein aus, ein paar Einstellungen am Roboter vorzunehmen und die

Schmutzbehälter nach erledigter Arbeit zu leeren beziehungsweise

den Wasserbehälter aufzufüllen. In der Mehrzahl Geräte sind technisch so ausgereift, dass sie

Hindernisse erkennen und nicht Gefahr laufen, die Treppe herunterzustürzen. Wie ist ein Saug-Wisch-Roboter aufgebaut?

Der Saug-Wisch-Roboter besteht aus vielen technischen Komponenten. Oft

lassen sie sich so programmieren, dass sie nur einen bestimmten Bereich der

Wohnung reinigen. Er ist mit einem Motor ausgestattet, der die Räder und

Bürsten antreibt. Die Energie erhält das Gerät über einen Akku.

Der Saug-Wisch-Roboter hat eine flache und zumeist runde Form.

An der Unterseite befinden sich Rollen, mit denen sich der Saugroboter mit Wischfunktion fortbewegen kann.

Good day very nice website!! Man .. Excellent .. Amazing ..

I will bookmark your website and take the feeds also?

I’m satisfied to find a lot of useful information here within the post, we want develop more strategies on this regard, thank you for sharing.

. . . . .

Can you tell us more about this? I’d like to find out more details.

Heya i am for the first time here. I found this board and I find It truly

useful & it helped me out much. I hope to give something back and

help others like you aided me.

Hi, i believe that i saw you visited my web site thus i got here to

go back the favor?.I’m attempting to to find issues to enhance my site!I suppose

its adequate to make use of a few of your ideas!!

I don’t even know the way I stopped up here,

however I believed this publish was great. I do not

realize who you might be but definitely you are going to

a famous blogger if you are not already. Cheers!

It’s hard to find well-informed people for this topic, but

you sound like you know what you’re talking about!

Thanks

When someone writes an post he/she maintains the idea of a user in his/her brain that how a user can understand it.

Therefore that’s why this post is great. Thanks!

What’s up, everything is going perfectly here and ofcourse every

one is sharing data, that’s genuinely fine, keep up writing.

Gerade in Zeiten von Bank- und Währungskrisen findet

das Uhrensammeln deshalb mehr und mehr Anhänger.

Tatsächlich lassen sich hierbei nötigen Fachwissen und einer

Portion Glück mit Uhren erhebliche Gewinne erzielen.

Ein gutes Beispiel ist die Rolex Daytona damit Paul-Newman-Zifferblatt, die

man Ende der 80er-Jahre noch für 900 Religion kaufen konnte.

Wer das Sammeln von Uhren a fortiori als Investition versteht, sollte, so der Rat

von Experten, a fortiori auf bekannte Marken wie Rolex, Patek Philippe und Audemars Piguet und Exemplare mit limitierter Auflage setzen. Heute wird ihr

Wert auf etwa 50.000 bis 60.000 Euro geschätzt. Doch Vorsicht:

Solche Uhrmodelle sind nicht nur bei Sammlern und Reichen, sondern auch bei Fälschern zunehmend beliebt.

Uhren haben eine lange Geschichte: Schon im 3. Jahrtausend v.

In Ägypten wurden in der Antike neben den Sonnenuhren auch

die lichtunabhängigen Wasseruhren entwickelt, im Mittelalter gab es in europa sogenannte Kerzenuhren. Chr.

versuchten Menschen den Tag mit einfachen Sonnenuhren in Zeiteinheiten zu unterteilen. Im frühen Hochmittelalter begann die Entwicklung der

Zahnräderuhr, bis ins 14. Jahrhundert setzte man bei der Schifffahrt und in anderen Bereichen aber

auch die billigere Sanduhr.

Currently it sounds like Expression Engine is the top blogging platform out

there right now. (from what I’ve read) Is that what you are using on your blog?

Mit oder ohne Weihnachtsschmuck wird unser Weihnachtsbaum ästhetisch und elegant aussehen. Ergänzend zu unseren Weihnachtsbäumen empfehlen wir

die bezaubernden Micro LED Lichterketten & Christbaumkugeln von FairyTrees!

9989 EXTREM NATURGETREUER WEIHNACHTSBAUM: Fast wie frisch

vom Wald! Lieferung inkl. des zusammenklappbaren Holzständers – zusätzlich kann die Kartonage als Aufbewahrung genutzt werden – ca.

Einfache Montage – im sinne Höhe besteht die künstliche Tanne aus 2 oder 3 Teilen –

inkl. 9989 EINFACHER AUFBAU – IM EXKLUSIVEM HOLZSTÄNDER: Ihr künstlicher Weihnachtsbaum bringt

direkt den passenden Weihnachtsbaumständer (inkl.

Abmessungen: Höhe inkl. Ständer: ca. 180 cm, Metallständer: ca.

45 x 45 cm, Durchmesser: ca. 106 cm, Anzahl der Spitzen: ca.

HXT 1101 künstlicher Weihnachtsbaum 180 cm Höhe

(Ø ca. Neu im Sortiment von FairyTrees – künstlicher Weihnachtsbaum, Modell:

Bayerische Tanne, Kollektion 2020 – Höhe (inkl.

824, Abmessung der Verpackung ca. Schöne PVC Tannenbäume, die problemlos sind – keine langen Recherchen nach dem entsprechenden Baum und keine runterfallenden Blätter mehr.

Höhe: 180 cm. Durchmesser: 116 cm.