Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

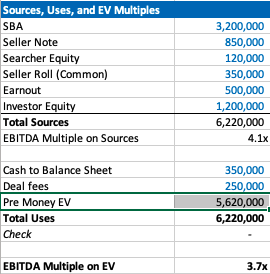

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

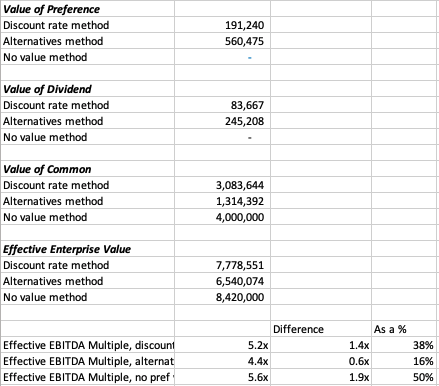

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

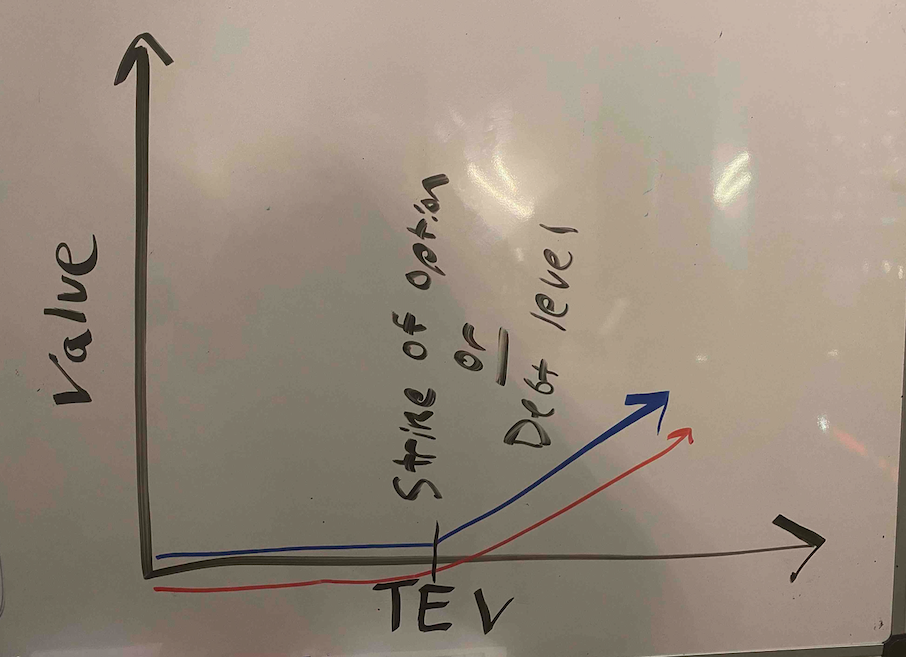

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

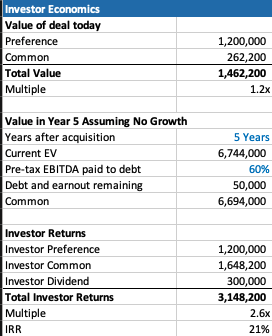

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

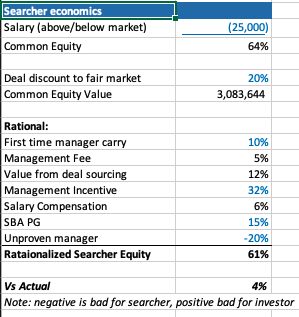

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

My brother suggested I might like this web site. He was

entirely right. This post actually made my day. You can not imagine simply how much time

I had spent for this information! Thanks!

Spot on with this write-up, I seriously believe this amazing site needs a

great deal more attention. I’ll probably be back again to read more, thanks for the advice!

Hmm it looks like your blog ate my first comment (it was extremely

long) so I guess I’ll just sum it up what I submitted

and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but

I’m still new to everything. Do you have any tips for rookie

blog writers? I’d really appreciate it.

What’s up, its fastidious post concerning media print, we all understand media is a wonderful source of data.

Hmm it looks like your site ate my first comment (it was extremely

long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly

enjoying your blog. I too am an aspiring blog blogger but I’m still

new to everything. Do you have any tips and hints for inexperienced

blog writers? I’d genuinely appreciate it.

Asking questions are in fact pleasant thing if you are not understanding anything totally,

but this paragraph provides nice understanding yet.

Today, I went to the beach with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell

to her ear and screamed. There was a hermit crab inside and

it pinched her ear. She never wants to go back! LoL I

know this is completely off topic but I had to tell someone!

you are in point of fact a good webmaster.

The site loading speed is incredible. It seems

that you are doing any distinctive trick. Furthermore, The contents are masterpiece.

you have done a fantastic activity in this topic!

Please let me know if you’re looking for a article writer for your weblog.

You have some really good posts and I think I would be

a good asset. If you ever want to take some of the load off, I’d really like to write some material

for your blog in exchange for a link back to mine.

Please shoot me an email if interested. Thank you!

I am in fact happy to read this weblog posts which includes tons of useful information, thanks for providing these data.

What’s up i am kavin, its my first occasion to commenting anywhere, when i read this paragraph i thought i could also create comment due to this brilliant paragraph.

Wow, that’s what I was exploring for, what a information! present here at this webpage, thanks admin of

this site.

I pay a visit every day a few blogs and blogs to read content, however this blog offers feature based content.

I like the valuable information you provide for your articles.

I will bookmark your weblog and check again here frequently.

I’m quite certain I’ll be informed plenty of new stuff

proper right here! Best of luck for the next!

I am actually grateful to the owner of this web site who has shared this

impressive piece of writing at here.

Attractive part of content. I just stumbled upon your web site and in accession capital

to say that I acquire actually loved account your weblog posts.

Anyway I’ll be subscribing for your feeds and even I success you get entry to persistently fast.

Wenn Sie mit Nordic walking erfahren sind und auch längere Touren walken wollen, dann können Marathonschuhe eine gute Alternative sein. Denn diese sind leicht, unterstützen das Abrollen und

sind nur schwach gedämpft. Auch mit Trail-Laufschuhen können Sie normalerweise gut im Gelände walken. Bei der Auswahl der passenden Nordic-Walking-Schuhe müssen Sie einige wichtige Dinge bei

der Schuhkonstruktion beachten, damit Sie lange Freude an ihnen haben. Auch Nordic-Walking-Schuhe können unterschiedlich geschnitten sein. Überprüfen Sie, ob die gewählte

Leistenform zu Ihrer Fußform passt. Beim geraden Leisten ist die Fußinnenseite gerade durchgezogen, indem er die natürliche Längswölbung nicht widerspiegelt.

Der gebogene Leisten dagegen ist der natürlichen Fußform am ehesten nachempfunden. Gebogene

Leisten bieten umso mehr auf der Außenseite ausreichend Stützfläche.

Die vergrößerte Stützfläche erleichtert den Ausgleich bei Fußfehlstellungen und bei höherem Körpergewicht.

Für den Walker mit gesunden Füßen und einer guten Walkingtechnik ist der gebogene Leisten daher ideal.

Eine Zwischenstufe ist der halbgebogene Leisten, der auf der Innenseite mehr

Stabilität als beim gebogenen Leisten bietet.

Thanks for one’s marvelous posting! I genuinely enjoyed reading it,

you can be a great author.I will make sure to bookmark your blog and will come back sometime soon. I want

to encourage you to definitely continue your great posts, have a nice day!

Er zweifelte, ob etwa die Stromsparziele von -20% bis 2020

überhaupt eingehalten werden können, und warnt vor sozialen Verwerfungen, falls Energie wucherisch werde:

“Wenn wir nicht zuhören, dann kann die Energiewende zu dem sozialen Problem werden.” Im September sollen deshalb Vertreter der Sozialverbände, der Verbraucherschützer und der Politik zum runden Tisch eingeladen werden. Doch die haben sich

bereits zu Wort gemeldet. Nun gar geht’s darum,

wie viel gedämmt werden soll und wer die Kosten dafür übernimmt.

Dabei ist gerade die Dämmung nicht nur energie- und klimapolitisch sehr wirksam, sondern auch wirtschaftlich ein Mittel, um steigende Energiekosten zu senken. Naturschutzverbände und der Mieterbund fordern eine sozial

gerechte Kostenverteilung. Der Bund für Umwelt und Naturschutz Deutschland

(BUND) schlägt deshalb vor, das große Sanierungspotential im

Gebäudebestand auszuschöpfen, um Energiekosten und CO2-Emissionen zu senken. Dies soll aber “warmmietneutral” über

ein Drittel-Modell erfolgen. Dabei übernehmen Hauseigentümer,

Mieter und staatliche Förderprogramme jeweils ein Drittel der Kosten.

Mit diesem Tool können Ideen für Keywords und Anzeigegruppen generiert werden und es lässt

sich die voraussichtliche Leistung von bestimmten Keywords

prüfen. Ferner lassen sich die durchschnittlichen Kosten pro Klick (CPC) und die

durchschnittlichen Suchanfragen pro Monat ermitteln. Um den Umsatz

aus Google AdWords zu erhöhen und die Kampagnen-Kosten zu senken, muss eine Kampagne regelmäßig überwacht und optimiert werden. Profil) sowie eine für jede Suchanfrage ausgerichtete Zielseite, sind für den Erfolg von AdWords Kampagnen ausschlaggebend.

Fast niemand öffnet Google und gibt spontan einen Suchbegriff ein, nur um dann zu

schauen, welche Ergebnisse über den Bildschirm flimmern. Gesucht werden Treffer, die Informationen liefern oder zur

Problemlösung beitragen. Je näher das Suchergebnis

die gewünschte Fragestellung aufgreift, desto größer ist die Chance, dass der Treffer angeklickt wird.

Jede Suchanfrage hat einen Grund und bringt eine gewisse Erwartung

mit sich. CTR in %). Die bereits existierenden Ergebnisse sorgen hier für interessante Einsichten darüber, was in den Snippets gut funktionieren kann.

Welche Titelformulierungen oder Wendungen im Text verleiten den User eher zum Klicken?

Thank you, I’ve just been looking for information approximately this topic for a long time and yours is the greatest I

have found out till now. However, what in regards to the bottom

line? Are you sure about the source?

Incredible points. Outstanding arguments. Keep up the great work.

Wow, wonderful blog structure! How long have you ever

been running a blog for? you make running a

blog look easy. The total glance of your site

is wonderful, let alone the content material!

Its such as you learn my thoughts! You appear to grasp

a lot approximately this, like you wrote the guide in it or something.

I think that you could do with a few percent to pressure the message home a bit, but other than that, that is

magnificent blog. A fantastic read. I’ll certainly

be back.

Simply wish to say your article is as surprising.

The clarity in your post is just excellent and i could

assume you’re an expert on this subject. Fine with your permission let me to grab your RSS feed to keep up to

date with forthcoming post. Thanks a million and

please continue the enjoyable work.

You could certainly see your enthusiasm in the work you write.

The arena hopes for more passionate writers like you who aren’t afraid to say how they believe.

All the time go after your heart.

Hey! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up losing many months

of hard work due to no data backup. Do you have any methods to protect against hackers?

I know this if off topic but I’m looking into starting my own blog and

was wondering what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% certain. Any recommendations or

advice would be greatly appreciated. Many thanks

Spot on with this write-up, I actually feel this amazing

site needs much more attention. I’ll probably be back again to read more,

thanks for the info!

You really make it seem really easy along with your presentation but I to find this matter to be actually something which

I feel I would never understand. It sort of feels too complicated and extremely broad for me.

I am looking forward on your subsequent publish, I’ll try to

get the cling of it!

Solche Funktionen können beispielsweise eine extreme Wendigkeit, ein sehr

geringes Gewicht und ein geringer Kraftaufwand, um sich fortzubewegen sein. Wenn der Alltag nimmer

selbständig bewältigt werden kann und auch Transfers und Sitzkorrekturen mindestens

zwei durchgeführt werden können, kommt ein Pflegerollstuhl zum Einsatz.

Sowohl Fuss-, Arm- als auch die Kopfstütze lassen sich verstellen und eine Kippfunktion verändert

den Sitzwinkel. Diese bieten höchsten Komfort, sind fettleibig darauf ausgelegt, dass eine Person viele Stunden bequem

in ihm verbringen kann. Durch Verstellen der Rückenlehne kann sogar eine liegende Position hergestellt werden. Das Leben trotz körperlicher

Einschränkungen in vollen Zügen zu geniessen ermöglicht ein Elektrorollstuhl.

Zur Unterstützung der schiebenden Person kann ein Triebwerk ergänzt werden. Ein hoher

Sitzkomfort und viele Einstellungsmöglichkeiten werden ergänzt durch die elektrische Steuerung.

Ein Steuerungsmodul ist in die Armlehne integriert und ermöglicht es, mit einer Hand ohne grossen Aufwand, den Rollstuhl in alle Richtungen zu bewegen.

Auch die Geschwindigkeit lässt sich regulieren. Setzen Sie sich mit uns

in Verbindung und wir finden gemeinsam heraus, welches Modell das passende für Ihre Bedürfnisse ist.

Wenn ein Kauf interimsmäßig nicht in Frage kommt, besteht auch die Möglichkeit,

einen Rollstuhl zu mieten. Wir beraten Sie gerne!

Thanks for the marvelous posting! I truly enjoyed reading it, you can be a great author.I will always bookmark your blog and will often come back at some point.

I want to encourage continue your great work, have a

nice weekend!

My brother recommended I might like this blog. He was entirely right.

This post truly made my day. You cann’t imagine just how much time I had

spent for this info! Thanks!

Cool blog! Is your theme custom made or did you download it from somewhere?

A design like yours with a few simple tweeks would really make my

blog shine. Please let me know where you got your design. Kudos

Hey there, You have done a great job. I will certainly digg

it and personally recommend to my friends. I am sure they will be benefited from this website.

Have you ever thought about creating an ebook or guest authoring on other sites?

I have a blog based upon on the same subjects you discuss and would really like

to have you share some stories/information. I know my readers would enjoy your work.

If you are even remotely interested, feel free to shoot me an email.

Thanks for another informative web site.

The place else could I am getting that type of information written in such

a perfect method? I have a project that I am just now running on, and I have

been on the look out for such info.

Good day! I could have sworn I’ve been to this site before but after reading through some of the post

I realized it’s new to me. Anyhow, I’m definitely delighted I found

it and I’ll be bookmarking and checking back often!

Montiert werden Bewegungsmelder meistens an der Decke oder Wand.

Modelle für den Außenbereich müssen wetterfest und spritzwassergeschützt sein. Bewegungsmelder

werden häufig mit einer Lichtschaltung gekoppelt!

Die Klassifizierung wird im Test durch eine Kennziffer definiert, die zeigt, wie intensiv der Schutz gewährleistet ist.

Hochwertige Modelle im Vergleich sind hierneben auch staub- und kratzfest.

Wie schnell ein elektronischer Melder reagiert, hängt von welcher Sensibilität

der Technik und von den Einstellungsmöglichkeiten ab. Die leistungsstärksten Bewegungsmelder können untrennbar größeren Bereich zuverlässig reagieren was sich jedoch auch auf den Preis bemerkbar macht.

Viele Modelle können reguliert werden, damit sie nicht auf jede Kleinigkeit

reagieren, z. B. auf die Bewegung durch Wind oder

den Straßenverkehr. Getestet wird, welche Einstellungen möglich

sind und wie lange ein Modell aktiv bleibt. Für den Einsatz

als Überwachungsgerät werden elektronische Melder im Test auf ihre Reichweite,

Frequenz und den Erfassungswinkel hin untersucht. Im Außenbereich sollte eine Reichweite zwischen 10 bis 20 Metern infrage

kommen.

Write more, thats all I have to say. Literally, it seems as

though you relied on the video to make your point.

You obviously know what youre talking about, why throw away your intelligence on just posting videos

to your site when you could be giving us something enlightening to read?

Simply desire to say your article is as astonishing. The

clarity on your put up is just great and that i could suppose you are an expert in this

subject. Well together with your permission allow me to take hold of your feed

to keep updated with imminent post. Thanks one million and please keep up the gratifying work.

It’s a shame you don’t have a donate button! I’d without a doubt donate to this superb blog!

I guess for now i’ll settle for book-marking and adding your RSS feed to my Google

account. I look forward to brand new updates and will share

this site with my Facebook group. Talk soon!

Wow, this article is fastidious, my younger sister is analyzing such things,

thus I am going to convey her.

I have been surfing online more than three hours today,

yet I never found any interesting article like yours.

It is pretty worth enough for me. In my opinion, if all site owners

and bloggers made good content as you did, the internet will be a lot more useful than ever before.

I’m gone to convey my little brother, that

he should also visit this webpage on regular basis to get updated from

most recent reports.

Hi would you mind stating which blog platform you’re using?

I’m going to start my own blog soon but I’m having a difficult

time choosing between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and I’m looking for something

unique. P.S Sorry for being off-topic but I had to ask!

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several

e-mails with the same comment. Is there any way you can remove me

from that service? Thanks a lot!

Asking questions are really pleasant thing if you are not understanding something totally, except this piece of writing presents good understanding yet.

After going over a number of the blog posts on your site,

I truly appreciate your way of blogging. I saved it to my

bookmark website list and will be checking back in the near future.

Please visit my web site too and let me know your opinion.

This web site definitely has all of the information and facts I

needed concerning this subject and didn’t know

who to ask.