Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

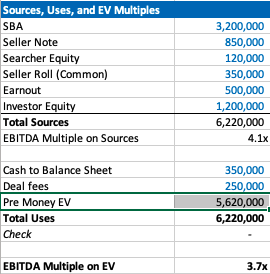

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

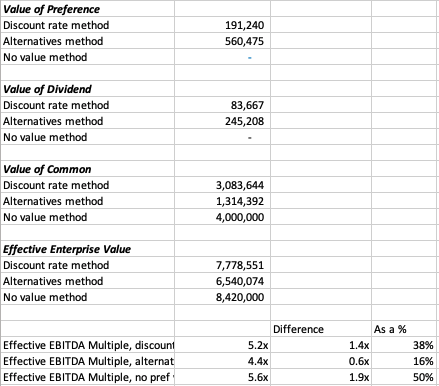

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

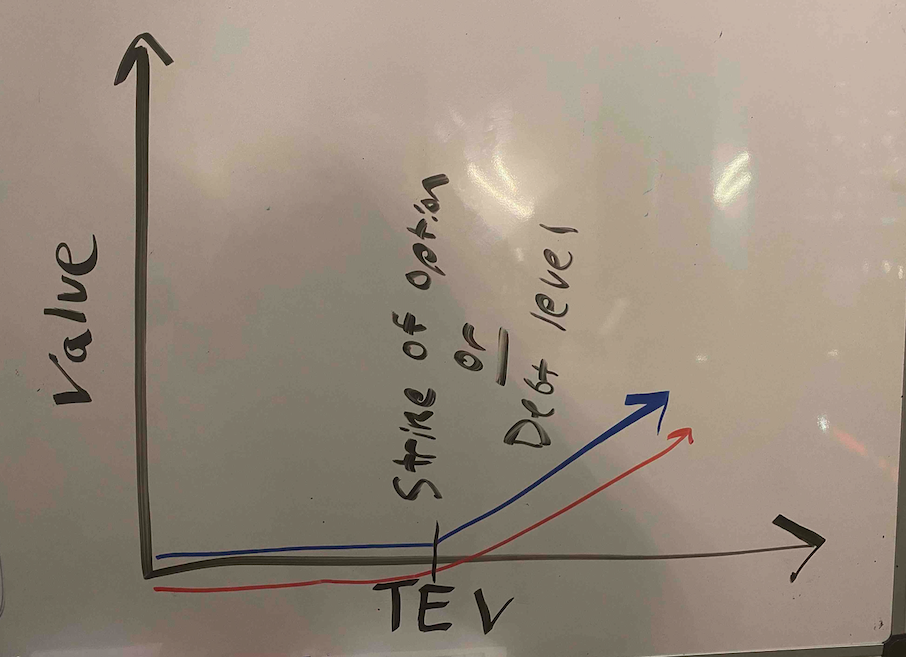

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

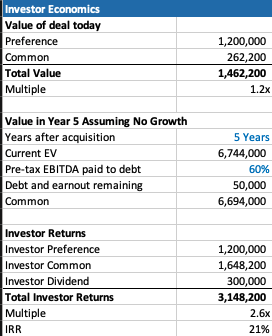

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

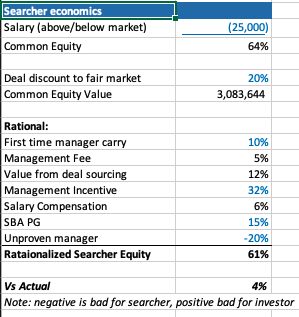

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

Hey there, You’ve done a great job. I will definitely digg it and personally suggest to my friends.

I’m confident they’ll be benefited from this website.

Incredible points. Solid arguments. Keep up the amazing work.

always i used to read smaller content that also clear their motive, and that is also happening with this post which I am reading here.

I like what you guys tend to be up too. This type of clever work and reporting!

Keep up the excellent works guys I’ve included you guys to blogroll.

Appreciation to my father who stated to me regarding this webpage, this

weblog is really amazing.

Having read this I thought it was really enlightening.

I appreciate you finding the time and energy to put this

informative article together. I once again find myself spending way

too much time both reading and posting comments.

But so what, it was still worth it!

Hello there! This is my first visit to your blog!

We are a collection of volunteers and starting a new

initiative in a community in the same niche. Your blog provided us valuable information to work on. You have done a wonderful job!

If you would like to obtain a good deal from this piece of writing

then you have to apply such methods to your won website.

I’d like to find out more? I’d want to find out more details.

Pretty part of content. I just stumbled upon your blog and in accession capital to say that I

get actually enjoyed account your blog posts. Anyway I’ll be subscribing

in your feeds and even I success you get entry to consistently quickly.

Today, I went to the beach front with my kids. I found a sea shell and gave it

to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

Oh my goodness! Incredible article dude! Many thanks, However I am having

difficulties with your RSS. I don’t understand why I cannot subscribe to it.

Is there anyone else getting identical RSS problems?

Anybody who knows the answer will you kindly respond?

Thanks!!

Remarkable issues here. I am very happy to look your post.

Thanks so much and I am taking a look ahead to contact

you. Will you please drop me a mail?

This paragraph will assist the internet viewers for building up new

web site or even a weblog from start to end.

This design is wicked! You most certainly know how to keep a reader amused.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job.

I really enjoyed what you had to say, and more than that, how you presented it.

Too cool!

Excellent blog here! Also your website loads up very fast!

What host are you the usage of? Can I get your

affiliate hyperlink to your host? I wish my site

loaded up as fast as yours lol

It’s enormous that you are getting ideas from this piece of writing as well as from our

dialogue made here.

Greetings from Los angeles! I’m bored to tears at work so I decided to browse your website on my iphone during lunch break.

I enjoy the knowledge you present here and can’t wait to take

a look when I get home. I’m surprised at how

quick your blog loaded on my phone .. I’m not even using WIFI,

just 3G .. Anyhow, superb site!

Saved as a favorite, I love your website!

I like reading through an article that can make men and women think.

Also, thank you for allowing for me to comment!

This is my first time visit at here and i am truly impressed to read all at alone

place.

Howdy very cool website!! Man .. Excellent ..

Amazing .. I will bookmark your blog and take the feeds additionally?

I’m glad to search out a lot of helpful information right here within the publish, we’d like develop more techniques in this regard,

thanks for sharing. . . . . .

Hey, I think your website might be having browser compatibility issues.

When I look at your website in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, superb blog!

hello!,I really like your writing so a lot!

percentage we keep in touch more about your article

on AOL? I need a specialist in this space to resolve my problem.

Maybe that is you! Looking ahead to look you.

I don’t know if it’s just me or if everybody else encountering problems with your website.

It appears like some of the written text within your posts are running off the screen. Can someone

else please provide feedback and let me know if this is happening to them as well?

This may be a issue with my web browser because I’ve had this happen previously.

Thank you

I all the time emailed this weblog post page to all my associates, since if like to read it then my contacts will too.

Heya i’m for the primary time here. I came across this board and I find It

truly helpful & it helped me out much. I’m hoping to offer one thing again and help others like you aided me.

Admiring the persistence you put into your website and detailed

information you provide. It’s awesome to come across a blog every once

in a while that isn’t the same unwanted rehashed information. Excellent read!

I’ve saved your site and I’m adding your RSS feeds to my Google account.

Awesome website you have here but I was wanting to know

if you knew of any community forums that cover the same topics talked about here?

I’d really love to be a part of group where I can get comments from other experienced individuals that share

the same interest. If you have any suggestions,

please let me know. Bless you!

Awesome site you have here but I was curious if you knew of any message boards that cover the same topics discussed here?

I’d really like to be a part of online community where I can get

responses from other knowledgeable people that share the

same interest. If you have any recommendations, please let me know.

Appreciate it!

Hi there this is kind of of off topic but I was wondering if

blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding skills so I wanted to get guidance from someone with experience.

Any help would be enormously appreciated!

Hi there, of course this paragraph is truly pleasant and I

have learned lot of things from it concerning blogging.

thanks.

Hello, I enjoy reading all of your article. I like

to write a little comment to support you.

Hello, its good post regarding media print, we all be familiar with media is a impressive source of facts.

Good day! Do you use Twitter? I’d like to follow you

if that would be okay. I’m absolutely enjoying your blog and look forward

to new updates.

Spot on with this write-up, I absolutely feel this website needs far more attention. I’ll

probably be back again to see more, thanks for the info!

I know this if off topic but I’m looking into starting my own blog and

was curious what all is needed to get set up?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% positive.

Any tips or advice would be greatly appreciated.

Cheers

I’m really enjoying the theme/design of your blog.

Do you ever run into any browser compatibility problems?

A few of my blog visitors have complained about my

site not working correctly in Explorer but looks great in Safari.

Do you have any ideas to help fix this problem?

Nice blog right here! Also your website quite a bit up

fast! What host are you using? Can I get your affiliate link

to your host? I wish my web site loaded up as quickly as yours

lol

Saved as a favorite, I love your site!

Hi to every one, the contents present at this website are really

remarkable for people experience, well, keep up the nice work fellows.

Does your site have a contact page? I’m having problems locating it

but, I’d like to shoot you an e-mail. I’ve got some suggestions

for your blog you might be interested in hearing. Either way,

great website and I look forward to seeing it expand over time.

you are actually a good webmaster. The web site loading velocity is incredible.

It kind of feels that you’re doing any unique trick.

Moreover, The contents are masterwork. you’ve performed a

excellent task in this topic!

Greetings I am so thrilled I found your blog, I really found you by mistake, while I was researching

on Bing for something else, Anyways I am here now and would just like to say

cheers for a fantastic post and a all round entertaining blog (I also love

the theme/design), I don’t have time to

read it all at the moment but I have book-marked it and

also included your RSS feeds, so when I have time I will be

back to read much more, Please do keep up the great work.

Yes! Finally something about inqura.net.

What’s up, its fastidious paragraph on the topic of media print, we all

be aware of media is a wonderful source of information.

Hi, I think your blog might be having browser compatibility issues.

When I look at your blog in Opera, it looks fine but when opening in Internet

Explorer, it has some overlapping. I just wanted to give you

a quick heads up! Other then that, wonderful blog!

I have read so many articles on the topic of

the blogger lovers except this post is genuinely

a fastidious article, keep it up.

Hey this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if

you have to manually code with HTML. I’m starting

a blog soon but have no coding expertise so I wanted to get guidance from someone with experience.

Any help would be enormously appreciated!

Have you ever considered about including a little bit more than just your articles?

I mean, what you say is important and everything. Nevertheless think about if you

added some great pictures or videos to give your posts more, “pop”!

Your content is excellent but with images and video clips, this

blog could undeniably be one of the greatest in its field.

Great blog!