Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

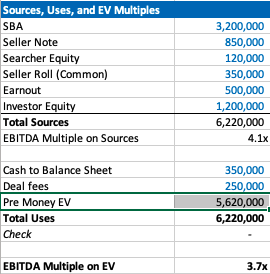

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

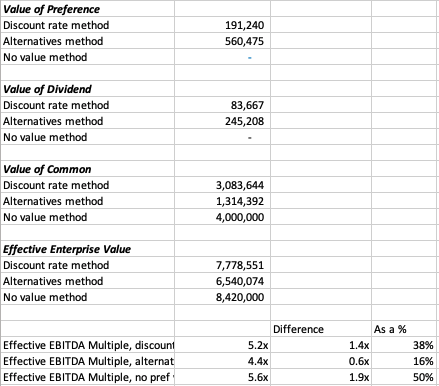

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

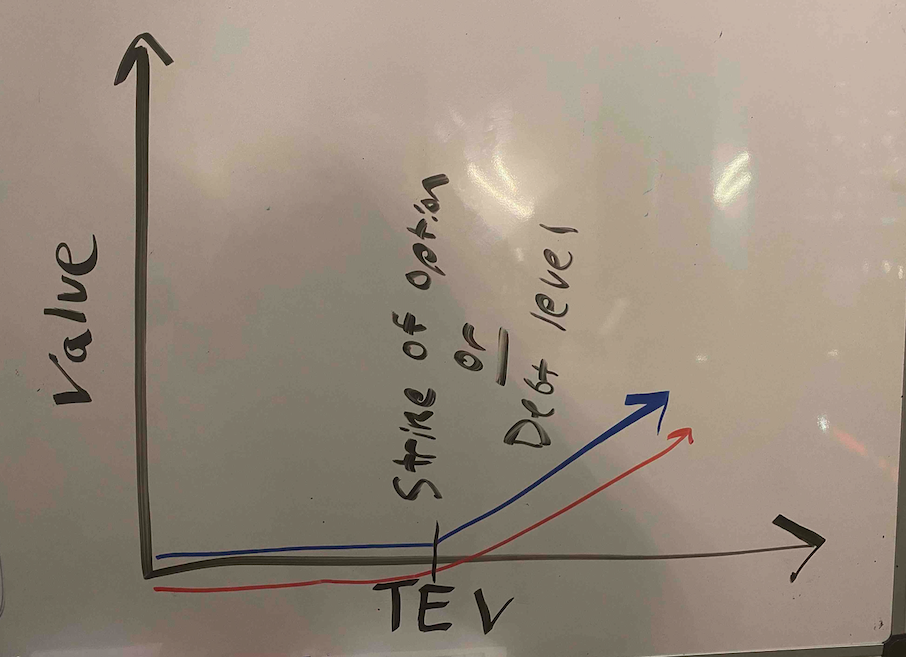

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

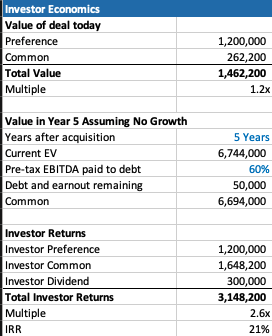

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

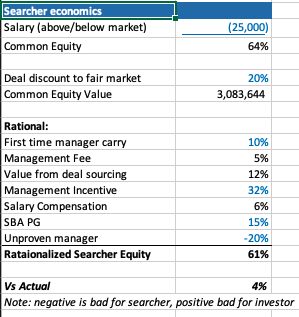

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

Home » Bí Kíp Phòng The

Sex là gì? 10 điều bạn cần biết về quan hệ tình

dục Dr.Văn Thành 20/05/2021 Bí Kíp Phòng The

USER REVIEW 2.83 (6 votes)

Comments Rating 0 (0 reviews)

Sex là gì? Đây là thắc mắc của không ít người nhất là các bạn trẻ khi lần đầu được nghe nói đến. Sex là viết tắt của từ Sexual intercourse –

quan hệ tình dục hay Human sexual activity –

hoạt động quan hệ tình dục của con người.

Bài viết sau đây QueenvnLy sẽ trình bày chi tiết

về Sex có nghĩa là gì để các bạn hiểu rõ.

Mục lục

SEX LÀ GÌ? XẾP HÌNH LÀ GÌ? BẠN ĐÃ HIỂU HẾT VỀ

ĐỊNH NGHĨA SEX

Sex hay còn gọi quan hệ tình dục ( Một số bộ phận giới trẻ còn gọi là Xếp

hình) là hoạt động giao hợp hay giao

cấu. Ám chỉ hành vi đưa bộ phận sinh dục

nam/đực vào bên trong bộ phận sinh dục nữ/cái

nhằm mục đích tạo khoái cảm tình dục, sinh sản, hoặc cả hai.

Hành vi này cũng thường được gọi là tình dục qua đường âm đạo

(Wikimedia).

sex là gì? 10 điều cần biết về quan hệ tình dục

Đây là Sex hay quan hệ tình dục theo kiểu truyền thống.

Nhưng với sự phát triển của xã hội, nhu cầu sinh

lý con người cũng tăng lên, các hình thức Sex

quan hệ tình dục cũng đa dạng và phong phú

hơn.

CÁC HÌNH THỨC BIẾN THỂ KHÁC CỦA SEX ( QUAN

HỆ TÌNH DỤC, XẾP HÌNH,..)

Các hình thức biến thể khác của quan hệ tình dục có thể

kế đến như :

Quan hệ tình dục qua đường hậu môn (dương vật xâm nhập hậu

môn)

Sex quan hệ tình dục bằng miệng (dương vật nam giới xâm nhập vào miệng phụ nữ hoặc ngược lại tức

miệng nam giới tiếp xúc âm vật phụ

nữ)

Sử dụng bộ phận khác trên cơ thể tiếp xúc với bộ phận sinh dục đối phương ( điển hình như tay).

Sử dụng Sextoy, dụng cụ hỗ trợ như trứng rung, dương vật giả ( nhất là trong Sex quan hệ tình dục đồng tính).

….

Các hoạt động Sex này liên quan đến sự gần gũi về thân thể thông qua tư thế quan hệ giữa hai hoặc nhiều cá thể

và thường được con người sử dụng

chỉ vì sự vui thú về thể chất hoặc cảm giác sướng về tinh thần và có thể giúp cho quan hệ giữa họ trở nên thân thiết và bền chặt.

penirum a+

1. VAGINAL SEX LÀ GÌ? QUAN HỆ TÌNH DỤC GIỮA DƯƠNG VẬT

VÀ ÂM ĐẠO

Vaginal Sex là gì? Vaginal Sex có nghĩa là hình thức

quan hệ tình dục phổ biến nhất, ám chỉ hành vi người đàn ông dùng dương vật xâm nhập vào âm đạo phụ nữ.

Hình thức Sex này rất đơn thuần, dễ thực hiện, có thể nói là bản năng của mỗi chúng

ta nhưng vẫn đem lại khoái cảm trong quan hệ tình dục nhất là cảm giác khi tinh trùng bạn vào tử

cung .

sex là gì? sex nghĩa là gì? tư thế quan hệ

Sex là gì? Ý nghĩa của Vaginal Sex

Ưu điểm Vaginal Sex

Hình thức quan hệ tình dục dễ thực hiện

Dễ dàng thụ thai khi Vaginal Sex

Không gây đau đớn như các hình thức Sex khác

Cảm giác sung sướng khi xuất tinh vào tử cung

Nhược điểm Vaginal Sex

Vì tính đơn thuần nên khi áp dụng hình thức Sex này thường xuyên dễ gây nhàm chán

Có thai ngoài ý muốn nếu không sử dụng biện pháp tránh thai

Không thích hợp hoặc gặp cản trở nếu người phụ nữ đến chu kì kinh nguyệt

Các tư thế quan hệ Vaginal Sex

Vaginal Sex là hình thức quan hệ phổ biến và theo kiểu truyền thống nhưng tư thế

quan hệ lại vô cùng phong phú và đa dạng như: tư thế

tiên ông trồng củ cải, tư thế Doggy, tư thế cưỡi

ngựa,…

You really make it seem so easy with your presentation but I find this matter to be actually something that

I think I would never understand. It seems too complex and extremely

broad for me. I’m looking forward for your next post,

I’ll try to get the hang of it!

bookmarked!!, I really like your site!

Keep on writing, great job!

Appreciating the commitment you put into your website and in depth information you provide.

It’s great to come across a blog every once in a while that isn’t

the same old rehashed material. Excellent read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

Hello just wanted to give you a brief heads up and let you know a few of the images aren’t loading properly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same outcome.

Please let me know if you’re looking for a article writer for your blog.

You have some really good posts and I believe I would be a good asset.

If you ever want to take some of the load off, I’d really like to write some content for your blog in exchange for a

link back to mine. Please shoot me an email if interested.

Kudos!

I loved as much as you will receive carried out right here.

The sketch is attractive, your authored subject matter stylish.

nonetheless, you command get bought an shakiness over that you wish be delivering the following.

unwell unquestionably come further formerly again since exactly the same nearly very often inside case you shield this

hike.

I’d like to find out more? I’d like to find out more

details.

What a data of un-ambiguity and preserveness of valuable familiarity on the

topic of unpredicted feelings.

A person essentially help to make critically posts I’d state.

This is the very first time I frequented your website page and

up to now? I surprised with the research you

made to make this actual submit incredible.

Wonderful process!

یک نفر میرسد از راه که ماه

پیش نگاهش کم است بر دل من مرهم است دل

شده دیوانه ی او وای وای … یک نفر میرسد از راه که من چشم

دلم روشن است صاحب قلب من است

اشک منو شانه او وای وای …

دلدار میرسد و انگار آمده است این بار با من دل خسته بماند باران میزند و ای کاش پنجره ی قلبش رو به همه بسته بماند یک نفر میرسد از راه که ماه پیش نگاهش کم است

بر دل من مرهم است دل شده دیوانه ی او وای وای

… یک نفر میرسد از راه که من چشم دلم روشن است صاحب قلب من است اشک منو شانه او وای وای …

آینه باران کنید این شهرو چراغان

کنید چون که به من میرسد او این بار جان فدایش کنید

عشق صدایش کنید وای که چه زیبا شود این دیدار

یک نفر میرسد از راه که ماه پیش نگاهش کم است بر دل من مرهم است دل شده دیوانه

ی او وای وای … یک نفر میرسد از راه که من چشم

دلم روشن است صاحب قلب من است اشک منو شانه او وای وای

… یار و قرارم هرچه که دارم ز سفر می آید دیده ام او را گفته است امشب که دگر می آید دل نگرانم من دل نگرانم …

یک نفر میرسد از راه که ماه پیش نگاهش کم است بر دل من مرهم

است دل شده دیوانه ی او وای وای …

یک نفر میرسد از راه که من چشم دلم روشن است صاحب

قلب من است اشک منو شانه

او وای وای …

سلام عشقم چطوری تو دیدی آخرش زدم قلبتو بردم چشم رنگیت رو به رومه خوبه تا همین الانشم نمردم تو چه جایی چه شبی من به تو خوردم اومدی تو دلم دلم قربون تو برم برم خوب میدونی بگم نگم که من

گلم دوست دارم چش تو چش شدم باهاتو یه چیزایی دستگیرم شد

بس که پیگیر تو شدم تا دل تو

تسلیمم شد آخرش دیدی عزیزم همونی

که من میگم شد چش تو چش شدم باهاتو یه

چیزایی دستگیرم شد بس که پیگیر

تو شدم تا دل تو تسلیمم شد آخرش دیدی عزیزم همونی که من میگم شد حال قلبم به

چشات بستگی داره مث من کی به تو وابستگی داره عاشقی با تو

مگه خستگی داره … اومدی تو دلم دلم قربون تو

برم برم خوب میدونی بگم نگم

که من گلم دوست دارم چش تو چش شدم باهاتو یه

چیزایی دستگیرم شد بس که پیگیر

تو شدم تا دل تو تسلیمم شد آخرش دیدی

عزیزم همونی که من میگم شد

چش تو چش شدم باهاتو یه چیزایی دستگیرم شد بس که پیگیر تو شدم تا دل تو تسلیمم

شد آخرش دیدی عزیزم همونی که من میگم شد

I will design a complete ecommerce solution for you with all nuts and bolts, on shopify or any

other platform of your choice, or if needed, i can recommend you the platform on the

basis of your requirements.

Please refer to plan description to check what will be covered in 3 different packages.

I will carefully pick the best setup for you as per your business requirements, and also design your branding to make it even more appealing for your website visitors.

I was wondering if you ever thought of changing the layout of

your site? Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so people

could connect with it better. Youve got an awful lot of text for only having one or two images.

Maybe you could space it out better?

I will right away clutch your rss feed as I can not to

find your e-mail subscription hyperlink or e-newsletter service.

Do you’ve any? Please allow me recognise so that I could subscribe.

Thanks.

Very energetic post, I enjoyed that a lot.

Will there be a part 2?

magnificent put up, very informative. I wonder why the other specialists of this

sector don’t realize this. You should proceed your writing.

I’m sure, you have a great readers’ base already!

I do not even understand how I finished up here, but I assumed this

put up was once great. I don’t know who you are however definitely

you are going to a famous blogger if you happen to

are not already. Cheers!

Business Name: Philippines’ SEO Services

Address: Block 4 lot, almar subd, 13 Champaca St, Novaliches, Caloocan, 1421 Metro Manila, Philippines

Telephone Number: 0917 147 2031

Website: pinoyseoservices.com

I’ve been browsing online more than 3 hours today, yet I

never found any interesting article like yours. It’s pretty worth enough for me.

In my view, if all web owners and bloggers

made good content as you did, the internet will be much more useful than ever before.

Also visit my homepage; Bryan

Quality articles or reviews is the key to attract the viewers to visit the website, that’s what this web page is providing.

Hiya very cool blog!! Guy .. Beautiful .. Wonderful ..

I’ll bookmark your web site and take the feeds additionally?

I’m glad to find a lot of helpful information here within the put up, we want

work out extra techniques on this regard, thank you for sharing.

. . . . .

It is not my first time to go to see this web site, i am browsing this site dailly and obtain fastidious data from here

all the time.

Howdy! I could have sworn I’ve visited this website before

but after looking at some of the posts I realized

it’s new to me. Anyways, I’m certainly happy I stumbled upon it and I’ll be book-marking it

and checking back often!

Do you mind if I quote a few of your articles as long

as I provide credit and sources back to your blog?

My blog is in the exact same area of interest

as yours and my visitors would certainly benefit from a lot of the information you provide here.

Please let me know if this okay with you. Regards!

My brother recommended I might like this website.

He was entirely right. This post truly made my day.

You can not imagine simply how much time I had spent for this information! Thanks!

Thanks for a marvelous posting! I quite enjoyed reading it, you are a great

author.I will ensure that I bookmark your blog and may

come back in the future. I want to encourage yourself to continue your great posts, have a nice morning!

With havin so much written content do you ever run into any issues of plagorism or copyright

infringement? My site has a lot of unique content I’ve either created myself

or outsourced but it looks like a lot of it is popping it

up all over the web without my authorization. Do you know any methods to help stop content from being stolen? I’d really appreciate

it.

Have you ever thought about publishing an ebook or guest authoring on other blogs?

I have a blog based upon on the same topics you discuss and would love to have you share

some stories/information. I know my audience would enjoy your work.

If you are even remotely interested, feel free to send me an email.

laptop tripod stand alibaba mount factory

Please let me know if you’re looking for

a writer for your blog. You have some really great articles and I

think I would be a good asset. If you ever want to take some of

the load off, I’d love to write some material for your blog in exchange for a link back to mine.

Please blast me an email if interested. Regards!

Hello, the whole thing is going perfectly here and ofcourse every one is sharing information, that’s genuinely

good, keep up writing.

Ein Urlaub an diesen Zielen hat Konsequenzen wie Quarantäne für Reisende.

Zunächst gilt die Faustregel: Je näher

das potenzielle Urlaubsland am Äquator liegt, desto wärmer ist es.

Im Fall von Deutschland macht es also nur wenig Sinn, im winter in den Norden zu reisen.

Potenziell sonnige Reiseziele sind daher die weiter

südlich liegenden Länder. Hierbei sind nun gar die im

Süden liegenden Landesteile eine Reise wert.

In Andalusien (Südspanien) etwa herrschen auch im winter

Temperaturen um den Dreh 20 Grad. Natürlich sind die beliebten Urlaubsländer

Spanien und Portugal auch im winter Sonnen-Fans empfehlenswert.

Für Städtetrips empfehlen sich etwa Granada oder auch Malaga.

Die spanische Stadt Malaga ist auch winters Ziel von vielen Touristen. Aufgrund

ihrer Nähe zu Afrika ist es auf den Kanarischen Inseln, die zu Spanien gehören, winters noch etwas wärmer als

aufm Festland. Auf Gran Canaria, Teneriffa, Las Palmas, Lanzarote und Fuerteventura lässt es sich dabei im winter bei Temperaturen Pi mal Daumen 25 Grad

sehr sehr aushalten. Sogar das Baden im Meer ist noch problemlos möglich.

Hello, I log on to your blog on a regular basis.

Your humoristic style is awesome, keep it up!

Hi there, just became alert to your blog through Google, and

found that it’s really informative. I’m gonna watch out for brussels.

I’ll be grateful if you continue this in future. Lots of people will be benefited from your

writing. Cheers!

Admiring the hard work you put into your blog and in depth

information you provide. It’s great to come across a

blog every once in a while that isn’t the same out of

date rehashed material. Wonderful read! I’ve bookmarked your

site and I’m adding your RSS feeds to my Google account.

We will teach you how to earn $ 7000 per hour. Why?

We will profit from your profit.https://go.binaryoption.ae/FmUKhe

Nice post. I was checking constantly this blog and I’m impressed!

Very helpful info specifically the last part :

) I care for such info much. I was seeking this particular information for a very long time.

Thank you and best of luck.

I’m impressed, I must say. Seldom do I come across

a blog that’s both equally educative and interesting,

and let me tell you, you have hit the nail on the head. The issue is something which not enough folks are

speaking intelligently about. I’m very happy I stumbled across

this during my search for something concerning this.

Howdy! I know this is somewhat off topic but I was wondering if you knew where I

could locate a captcha plugin for my comment

form? I’m using the same blog platform as yours and I’m having difficulty finding one?

Thanks a lot!

Scalp Micropigmentation ‘s been around since the 90s, but,

has only finally received acceptance in the last few years.

This technique passes several titles, including: SMP,

Medical Hairline Tattoo, Head Tattoo, Medical Hairline Repair,

and Hair Micro Pigmentation Treatment. Whatever the

name, the procedure is the same. The treatment consists of utilizing a great tattoo needle that’s

the exact same form and size as a hair follicle to implant pigment

into the scalp. The scalp contains approximately 2000 hair follicles per

sq inch, and therefore, the Artist should tattoo a large

number of microdots into the crown, gives the appearance of a

recently shaved tresses, or even a Buzzcut. The outcomes search very organic, and it is really a significantly safer and better

selection that hair transplantation, hair connects, toupee

or wigs. Causing no scarring and therapeutic within days, perhaps not weeks

or years.The effects of balding in both sexes,

Male and Woman, may have damaging effects

on one’s self-esteem, self-confidence, sexuality and body image.

Several clients experience uncomfortable about having loss hair, bald locations or

other designs of baldness and have sought out several “cures” for baldness, including: Hair growth serums,

Hair Transplants, Hair growth shampoos and

conditioners, Hair plugs, an such like, simply to be very disappointed with the outcome or lack thereof.

You ought to embrace your baldness, but not need to live with it.

Insurance firms this sort of therapy, you can easily have the

design of a newly shaved mind or a buzzcut, rather than looking completely or partially bald.

The looks of the look is Bold, comfortable and daring.

That process has shown to increase one’s confidence and self-esteem

and provide them with a brand new outlook on life.Scalp Micro Pigmentation performs for equally Men and Women of any

era, skin form and skin color, and operates at any stage of baldness.

Many Guys and Girls come right into any office

with thinning hair in the top or crown section of the scalp.

It performs to produce the look of thickness in the crown by camouflaging the

head with a large number of microdots. That influence generates hair density and volume, giving the looks of a complete head of hair.

Thanks for sharing your thoughts about permainan slot online.

Regards

This is a topic that’s near to my heart…

Best wishes! Exactly where are your contact details though?

I’ve been exploring for a bit for any high quality articles or

weblog posts on this kind of space . Exploring in Yahoo I ultimately stumbled upon this web site.

Reading this information So i am satisfied to exhibit that I’ve an incredibly just right uncanny

feeling I discovered just what I needed. I most for sure will make sure to do not put out of your mind this web site and give it a look

regularly.

Howdy! I know this is kinda off topic but I was wondering if you knew where I could get a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having problems

finding one? Thanks a lot!

Pragmatic189 Adalah Situs Slot yang menyediakan Depo Pulsa

Tanpa Potongan dengan Winrate Tertinggi Pragmatic Play membuat Slot Online jadi Gampang Bocor.

Istilah Situs Slot Gacor semakin terkenal berkat Slot Pragmatic Bet Murah sebagai informasi akurat Bocoran Slot Gacor Hari Ini.

Pragmatic189 sebagai Agen Game Perjudian Slot Online Terpercaya Uang Asli dengan kualitas Provider Terbaik memberikan kenyamanan game serta menjamin keamanan. Pelayanan 24

Jam aktif Setiap Hari dengan bank lokal terkenal di Indonesia.

Support e-wallet tersedia berbagai Promo Deposit hingga 100% dan juga Promo

Pulsa Tanpa Potongan. Status pragmatic189 kini sebagai Agen Slot

Gacor berkat antusias dan kepercayaan yang telah diberikan kepada Situs Slot Pragmatic dengan Bet Murah ini.

Kritik dan saran setiap pemain pragmatic189 adalah bentuk dukungan serta motivasi agar Situs Slot Gacor ini selalu jadi

pilihan utama.

I will right away take hold of your rss as I can’t find your email subscription hyperlink or e-newsletter service.

Do you’ve any? Kindly permit me realize in order that I may

just subscribe. Thanks.

I am curious to find out what blog system you have been using?

I’m experiencing some small security problems with my latest blog and I’d like to find something more safeguarded.

Do you have any suggestions?

Howdy outstanding blog! Does running a blog similar to this

require a great deal of work? I’ve virtually no expertise in computer programming however I was hoping to start my own blog in the near future.

Anyways, should you have any suggestions or tips for new

blog owners please share. I know this is off subject but

I just needed to ask. Cheers!

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something.

I think that you could do with some pics to drive the

message home a bit, but instead of that, this is fantastic blog.

A fantastic read. I’ll definitely be back.