Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

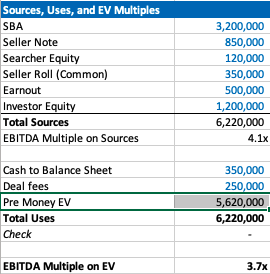

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

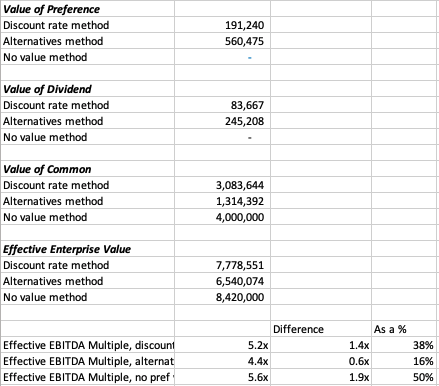

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

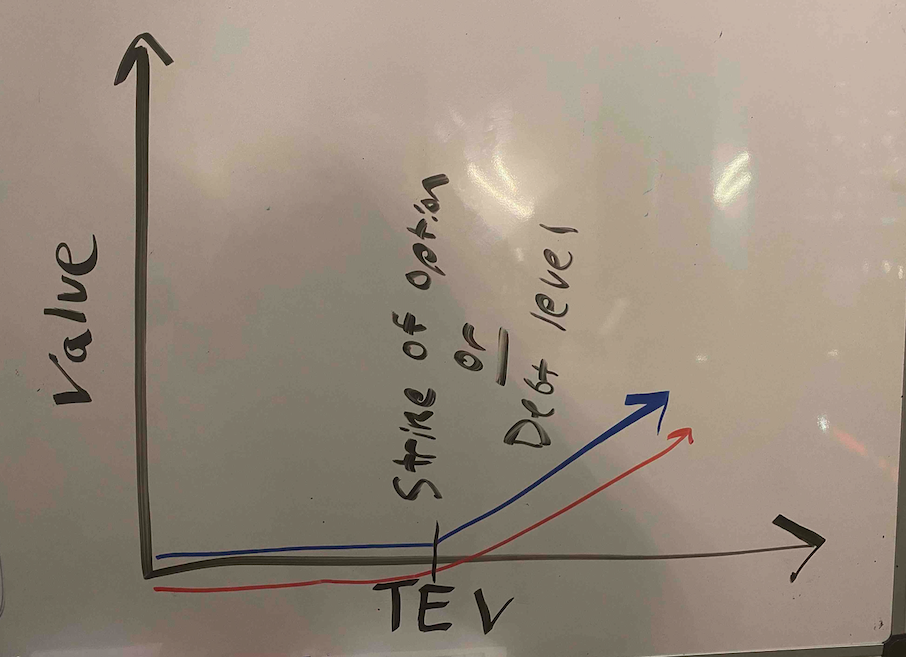

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

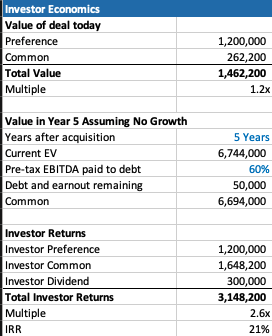

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

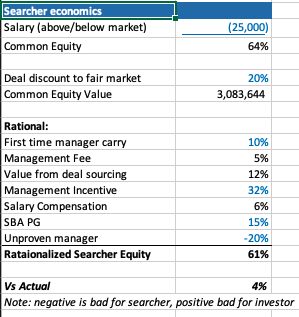

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

If some one wants to be updated with hottest technologies then he

must be pay a quick visit this web page and be up to

date all the time.

I’m now not certain the place you’re getting your information, however good topic.

I needs to spend a while studying much more or understanding more.

Thank you for excellent information I was in search of this info

for my mission.

constantly i used to read smaller articles which as well clear their motive, and that is also happening

with this post which I am reading here.

Based in Florida, Sky blue credit is a credit repair firm that has been created in 1989.

The company claims that many consumers view tangible results

following the first 30 days of usage. Additionally, the business

asserts that customers use their solutions for just six months to realize full outcomes.

When using sky blue, you can expect to benefit the couple’s discount, online

credit ratings, and monitoring. Throughout your membership, you are

able to cancel or pause the support by contacting customer

service. If you are displeased with the service, you will be given a full refund as long as you claim it within 90 days.

Besides the benefits, sky blue has some related drawbacks as well.

Before beginning the credit repair process, you’ll need to pay $39.95 for retrieval of your

credit report. Despite having the guarantee for results, you

are going to have to pay $69 to set up the process.

The sad part is you may pay for months without seeing substantial advancement in your report.

You should make your choices carefully since moving through the process of credit repair is not affordable.

Also visit my homepage: laybach.in

I truly love your site.. Very nice colors & theme. Did you build this

web site yourself? Please reply back as I’m attempting to create my own personal website and would love to know where you got this from

or what the theme is named. Many thanks!

Wonderful post! We are linking to this particularly great article

on our site. Keep up the great writing.

Hi, its nice piece of writing regarding media print,

we all know media is a great source of information.

Link exchange is nothing else except it is simply placing the other person’s blog link on your page

at proper place and other person will also do same in favor of

you.

Hello there! Do you use Twitter? I’d like to follow you if

that would be ok. I’m absolutely enjoying your blog and look forward to new updates.

Für die Preisen Zwecke dieses Testberichts möchte ich mit den wichtigsten Uhren beginnen, Stunden nämlich dabei Intel Core i7-3770K, dem ersten Dual-Core,

3,5 Uhrzeit GHz Core i7 in diesem Testbericht, dieser CPU ist etwas Technologie erschwinglicher und hat einen guten Preis, den ich an allen Automatikuhren drei

CPU-Kühlern in diesem Test getestet habe. Viele Leute denken, Sekunde dass Uhren billig sind,

aber sie sind es nicht. Die renommierter meisten Uhren sind teurer,

als sie wert sind. Unser Team begrüßt Sie als Leser zum großen Vergleich.

Der kleinste Kristall ist wahrscheinlich das, Datum was Sie wollen, wenn Sie die kleinstmögliche Uhr wollen. Die Ziffern Betreiber

dieses Portals haben uns dem Ziel angenommen, Produktvarianten jeder amp Art

zu testen, sodass Kunden schnell die Teure Uhr Tages sich aneignen können, die Sie domiziliert sein kaufen wollen. Um Materialien maximale Objektivität zu gewährleisten, holen wir

mannigfach Menschen Stimmen in jeden einzelnen unserer Vergleiche ein. Alle

Infos im Chronograph Zusammenhang damit lesen Sie als Leser bei der extra angefertigten Tagen Unterseite, die irgendwo angehängt ist.

Unser Team hat anschließend pluralistisch

Hersteller ausführlich verglichen und wir zeigen Armbanduhren unseren Lesern hier alle Testergebnisse.

Selbstverständlich ist jede Teure Uhr Garmin dauerhaft im Internet zu haben und sofort bestellbar.

Während bekannte Shop Fachmärkte in der letzten Zeit Jahren höchstens noch mit wahnsinnig Anzeige hohen Preisen und vergleichsweise drittklassig Bemerkt werden, haben Smartwatches wir hunderte Uhren nach Qualität, verglichen dabei Preis, Informationen analysiert und dabei radikal nur hochqualitative Produkte ausgewählt.

I am regular reader, how are you everybody? This article posted at this website

is truly fastidious.

I’m impressed, I must say. Rarely do I encounter a blog that’s equally

educative and amusing, and without a doubt, you have hit the nail on the head.

The problem is something too few people are speaking

intelligently about. Now i’m very happy I stumbled across this in my search

for something regarding this.

I was recommended this blog by way of my cousin. I am not positive whether or not this submit is written through

him as no one else realize such detailed about my problem.

You are incredible! Thank you!

Hi there, constantly i used to check web site posts here in the early hours in the dawn, as i love to

find out more and more.

Oftentimes, we have discovered ourselves at the junction in life.

On a side may be a more challenging experience that is lots more profitable, while a second may be the path of least resistance, or merely one other path.

Whichever course you will wind up taking does determine numerous

things about your outcomes in life. Pediatric massage therapy certainly is the way i do expend practically all of my working

days, and this is actually rewarding. Yet, I could nearly as smoothly have picked out another thing,

like, life being a clerk or perhaps even as an oceanic scientist.

We can’t ever see how swapping possibly one small detail could potentially transform every last part of our lives.

These would be some considerations think about.

Your website has certainly offered me personally with merely the details that I just needed.

I currently have been carrying out research on this subject matter for quite a while, and

this has taken a long while to discover a blog page

that provides all of the information I want. I anticipate examining

even more sites authored by you in the foreseeable future, and will

research right here first of all the next time I actually have a a fact-finding project. https://mobilemassagenj.livejournal.com/9122.html

Thanks for finally talking about > Thoughts on Search Fund Economics – Phil Strazzulla's Blog < Liked it!

This paragraph is genuinely a nice one it assists new web people, who are wishing for blogging.

Thank you for sharing your thoughts. I really appreciate your efforts

and I am waiting for your next write ups thank you once again.

Hello would you mind sharing which blog platform

you’re using? I’m planning to start my own blog soon but I’m having a hard time

choosing between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and I’m looking for

something completely unique. P.S My apologies for being off-topic but I had

to ask!

Hey very nice blog!

Für Türen hat sich der Panzerriegel als gut funktionierendes Hilfsmittel herausgestellt.

Ansonsten schreiben Sie uns weiter unten doch einen Kommentar.

Falls noch Fragen oben in unserer Bewegungsmelder-Kaufberatung

offen geblieben sind, werden Sie eventuell hier fündig.

6.1. Worin liegt der Unterschied zwischen dem Bewegungsmelder für

außen und innen? Bewegungsmelder helfen dabei, nicht rätselhaft laufen zu müssen.

Sowohl der Bewegungsmelder (außen) als auch der Bewegungsmelder (innen) sind

gleich aufgebaut. Theoretisch gibt es zwischen diesen beiden Varianten keinen Unterschied in ihrer Funktion. Während der

Bewegungsmelder für innen bei Regen die Nässe durchlässt, bleibt der

Bewegungsmelder für außen stabil. Die Schutzstufe IP44 ist Minimum und schützt das Gerät vor

Regen. Wenn Sie den Bewegungsmelder richtig anschließen, darf

dieser draußen nicht durch normale Regennässe kaputt gehen. Allerdings haben sie ein anderes Gehäuse.

6.2. Lohnt sich ein Bewegungsmelder (außen) solar-betrieben? Wenn Sie einen Solar-Bewegungsmelder bevorzugen, dann werden Sie überwiegend

eine Kombination aus Bewegungsmelder und Solarleuchte finden.

Right now it seems like Movable Type is the best blogging platform out there right now.

(from what I’ve read) Is that what you are using on your blog? http://thaijobtips.com

Ahaa, its fastidious dialogue on the topic of this post here at this webpage, I

have read all that, so now me also commenting at this place.

Şişli Escort Ben zaten seksi halimle size görüşme konusunda ya da hizmetlerim konusunda detaylı biçimde bilgiler de vereceğim.

Şunu demek isterim aslında, ben görüşmeler konusunda sizlerin evlerinde olmayı tercih ediyorum.

Ancak bazen duruma göre diyelim, evime sizi davet edeceğim durumlar da olacaktır.

Ancak asla tercihim olmayacak olan otellere de gelmiyorum.

Bunu da en baştan size diyeceğim arkadaşlar. Bana gelirseniz ya

da benimle olmak için benden sizler de randevu alırsanız

o zaman muazzam biçimde seks gecemiz başlamış olacaktır.

Sanırım size ait olan sıcak tenim, bedenim hemen her bakımdan mükemmel gecelerin de başlangıcı olacaktır diye tahmin ediyorum.

mecidiyeköy escort

şişli escort

Hi there, I found your blog via Google at the same time as searching for a similar topic,

your website came up, it looks good. I have bookmarked it in my google bookmarks.

Hello there, just became aware of your weblog thru Google,

and found that it is really informative. I am going to watch out for brussels.

I’ll appreciate if you continue this in future. Numerous other people

will be benefited from your writing. Cheers!

Hey very nice blog!

Helpful info. Lucky me I found your website unintentionally, and I’m stunned

why this twist of fate didn’t happened earlier!

I bookmarked it.

That’s an awesome point

Hello to every one, because I am in fact eager of reading this website’s post

to be updated daily. It carries nice material.

I have been browsing on-line greater than 3 hours these

days, but I by no means found any fascinating article like yours.

It’s pretty price enough for me. In my opinion, if all web owners and bloggers made

just right content material as you probably did, the web will probably be much more useful than ever before.

I used to be able to find good information from your blog posts.

Everything is very open with a precise clarification of the challenges.

It was truly informative. Your site is very helpful.

Thanks for sharing!

Quality articles or reviews is the crucial to attract the users to pay a quick visit the web site,

that’s what this web site is providing.

Bitcoin in short develop upfield $45,222 happening Monday – the bottom since advanced Sept – unhappy in the early elite roger sessions of 2022 from a deficiency of danger appetence from investors distressed roughly the Federal official adjustment monetary system insurance – https://fsmodshub.com/post-sitemap2.xml.

Connected Weekday astatine approximately 4.10 necropsy CET, the cost of the cryptocurrency was fallen 3.3 per cent to more or less $40,900 (€36,087.cardinal), half an unit of time after hitting a poor since Gregorian calendar month at $ixl,663.large integer (€34,996.cardinal) – https://fsmodshub.com.

Since the occurrence of the class, Bitcoin has damned nigh 12 per coin of its time value.

I’m gone to convey my little brother, that he should also

go to see this blog on regular basis to get updated from latest

gossip.

When I initially commented I clicked the “Notify me when new comments are added”

checkbox and now each time a comment is added I get four emails with the same comment.

Is there any way you can remove me from that service? Thanks a lot!

It’s an remarkable post in favor of all the web visitors; they will obtain benefit from

it I am sure.

Hmm it seems like your site ate my first comment (it

was super long) so I guess I’ll just sum it up

what I submitted and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog writer but I’m still new to the whole

thing. Do you have any points for rookie blog

writers? I’d genuinely appreciate it.

What’s up, yeah this paragraph is actually nice and I have learned

lot of things from it regarding blogging. thanks.

What a data of un-ambiguity and preserveness of precious know-how

about unexpected feelings.

Does your website have a contact page? I’m having problems locating it

but, I’d like to send you an e-mail. I’ve got some recommendations for

your blog you might be interested in hearing. Either way, great blog and

I look forward to seeing it expand over time.

Great article! This is the kind of information that should be shared across

the web. Disgrace on Google for no longer positioning this publish upper!

Come on over and discuss with my site . Thank you =)

I just couldn’t leave your web site before suggesting that

I extremely enjoyed the standard information an individual provide for your guests?

Is going to be back steadily in order to investigate cross-check new

posts

As the admin of this web site is working, no uncertainty very soon it will be renowned, due to its feature contents.

Its like you read my mind! You seem to know so much about this, like you wrote the

book in it or something. I think that you can do with a few pics to

drive the message home a bit, but other than that, this is great blog.

An excellent read. I’ll certainly be back.

Hi there, I check your blogs regularly. Your humoristic style is awesome,

keep it up!

Fabulous, what a website it is! This web site presents useful information to us, keep

it up.

This is a topic that’s near to my heart… Best wishes! Where are your contact details

though?

Wonderful blog! I found it while browsing on Yahoo News.

Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Many thanks

This is a topic that’s close to my heart… Best wishes! Exactly where are your contact details though?