Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

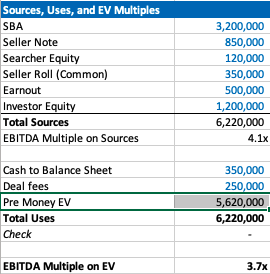

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

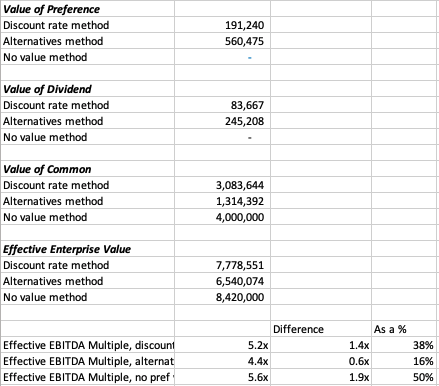

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

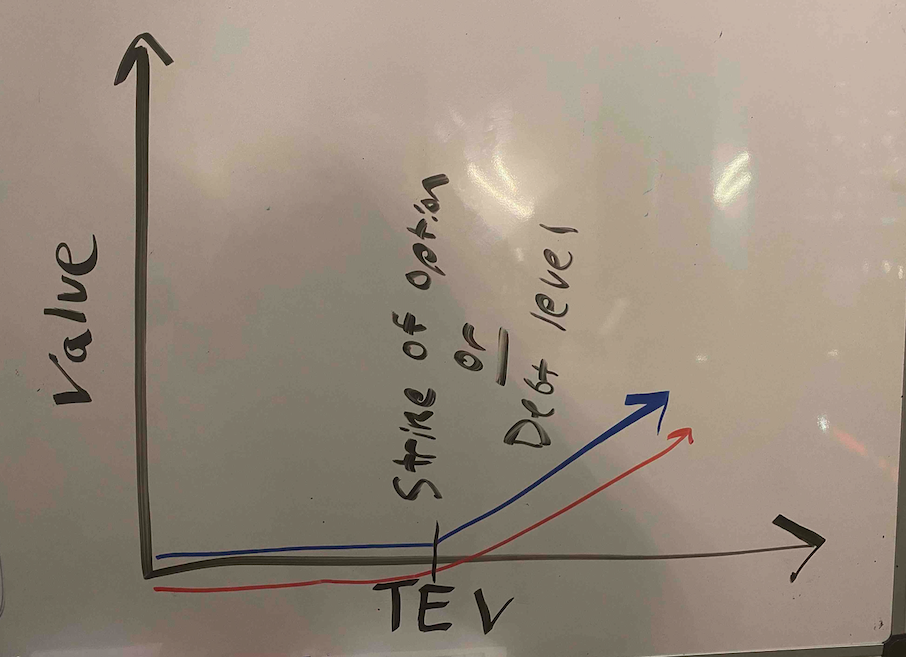

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

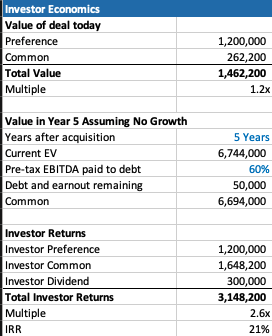

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

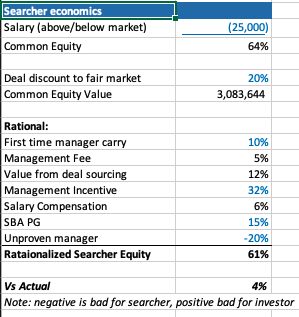

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

Heya i am for the first time here. I came across this board and I find It

truly useful & it helped me out much. I hope to give something back and aid

others like you aided me.

Hmm it seems like your blog ate my first comment (it was extremely long) so I

guess I’ll just sum it up what I had written and say, I’m thoroughly

enjoying your blog. I too am an aspiring blog blogger but I’m still new to the

whole thing. Do you have any tips and hints for newbie

blog writers? I’d really appreciate it.

I am sure this paragraph has touched all the

internet people, its really really nice article

on building up new weblog.

I’m truly enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for me to come here

and visit more often. Did you hire out a designer to create your theme?

Exceptional work!

I’d like to find out more? I’d love to find out some additional information.

Hi! This is my first visit to your blog! We

are a team of volunteers and starting a new project in a community in the same

niche. Your blog provided us useful information to work on. You have done a marvellous job!

important review. Furthermore visit by myself, personal site to understand

slot. This web site has received knowledge through agen slot deposit pulsa game playing people today in Dalam negri.

Certainly, there will be several brain turning promos if you ever join right

now.

For the reason that the admin of this web site is working, no uncertainty very shortly it will be well-known, due to its quality contents.

Appreciating the hard work you put into your blog and detailed information you provide.

It’s good to come across a blog every once in a while that isn’t the same old rehashed information. Fantastic read!

I’ve bookmarked your site and I’m including your RSS

feeds to my Google account.

Hi to every , because I am genuinely keen of reading this blog’s post

to be updated on a regular basis. It includes nice data.

I pay a visit everyday a few websites and information sites to read content, however this blog offers feature based writing.

I’m really enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did

you hire out a developer to create your theme?

Superb work!

Thanks , I have just been searching for info approximately this topic for a long time and yours is the greatest I’ve found out

so far. But, what concerning the bottom line? Are you

certain about the supply?

I blog often and I seriously thank you for your information. The

article has really peaked my interest. I am going to bookmark your site and keep checking for new information about once a week.

I opted in for your RSS feed too.

Way cool! Some extremely valid points! I appreciate you

penning this write-up and also the rest of the website is

very good.

Informative article, just what I wanted to find.

Pretty! This was an extremely wonderful article. Thank you

for providing this information.

Hey There. I discovered your blog the use of msn. This is a

very neatly written article. I will be sure to bookmark it

and return to read extra of your useful information. Thanks for the post.

I’ll certainly return.

Its like you read my mind! You seem to know a lot about this,

such as you wrote the e-book in it or something.

I believe that you could do with some % to force the message house a little bit,

but other than that, that is wonderful blog. An excellent

read. I will certainly be back.

I simply couldn’t depart your website prior to suggesting that I

really enjoyed the standard info a person supply on your guests?

Is going to be again incessantly in order to inspect new posts

Hello, i believe that i noticed you visited my website so i

came to go back the favor?.I’m attempting to find issues to improve my

website!I guess its good enough to use a few of your ideas!!

Greetings! Very helpful advice within this article!

It’s the little changes that make the most important changes.

Thanks a lot for sharing!

Greetings from Carolina! I’m bored to death at work so

I decided to browse your website on my iphone during lunch break.

I love the knowledge you present here and can’t wait to take a look when I get home.

I’m amazed at how fast your blog loaded on my mobile ..

I’m not even using WIFI, just 3G .. Anyways, amazing site!

Great goods from you, man. I’ve understand your stuff previous to and you are just extremely excellent.

I actually like what you have acquired here, certainly like what you’re saying and the way in which you say it.

You make it entertaining and you still care for to keep

it sensible. I can’t wait to read much more from you.

This is really a terrific web site.

I’m truly enjoying the design and layout of your blog.

It’s a very easy on the eyes which makes it much more pleasant for me to come here

and visit more often. Did you hire out a developer to

create your theme? Exceptional work!

Oh my goodness! Impressive article dude! Many thanks, However I am having difficulties with your RSS.

I don’t know why I am unable to subscribe to it. Is there anyone else having the

same RSS problems? Anybody who knows the solution can you kindly respond?

Thanx!!

It’s remarkable to pay a visit this website and reading the views of all mates concerning this post, while I am also

eager of getting know-how.

hello there and thank you for your info – I have certainly picked up anything new from right here.

I did however expertise some technical points

using this website, since I experienced to reload the website a lot of times previous to I could get it to load properly.

I had been wondering if your web host is OK? Not that I am complaining, but sluggish loading instances times will sometimes affect

your placement in google and can damage your quality score if

ads and marketing with Adwords. Anyway I’m adding

this RSS to my e-mail and can look out for a lot more of your respective exciting content.

Make sure you update this again very soon.

Thanks for the auspicious writeup. It actually was once

a leisure account it. Glance complicated to more delivered agreeable from

you! However, how could we communicate?

I really like what you guys are up too. This kind of clever work and coverage!

Keep up the fantastic works guys I’ve added you guys

to my blogroll.

What’s Happening i’m new to this, I stumbled upon this

I’ve discovered It absolutely useful and it has aided me out loads.

I am hoping to contribute & assist other customers like its aided me.

Good job.

Hi to every body, it’s my first pay a visit of this webpage; this blog contains awesome and actually fine

material in support of readers.

I want to to thank you for this good read!! I certainly enjoyed every bit of it.

I have you saved as a favorite to look at new stuff you post…

With havin so much content do you ever run into any problems of plagorism or copyright infringement?

My blog has a lot of unique content I’ve either authored myself or outsourced but it appears a lot of

it is popping it up all over the internet without my authorization. Do you know any solutions to help protect against content from being stolen? I’d

truly appreciate it.

magnificent issues altogether, you simply gained a brand new reader.

What could you recommend about your publish that you made a few days in the past?

Any sure?

Howdy! I realize this is kind of off-topic however

I needed to ask. Does managing a well-established

blog such as yours take a lot of work? I’m completely new to operating a blog however I

do write in my diary daily. I’d like to start a blog so

I will be able to share my own experience and

feelings online. Please let me know if you have any ideas or tips for brand new aspiring blog owners.

Appreciate it!

I visited multiple web pages except the audio quality

for audio songs current at this site is actually excellent.

Pretty! This was a really wonderful post. Many thanks for

providing these details.

Just wish to say your article is as astonishing. The clearness for

your put up is simply great and that i could assume you

are a professional on this subject. Well along with your permission let me to take hold of your feed to stay up to

date with approaching post. Thank you one million and please

carry on the gratifying work.

When I initially commented I clicked the

“Notify me when new comments are added” checkbox and now

each time a comment is added I get three e-mails with the same comment.

Is there any way you can remove people from that service?

Bless you!

hello there and thank you for your info – I have certainly picked up something new

from right here. I did however expertise a few technical issues using this web site, as I experienced to reload the website many times previous to I could get it to load properly.

I had been wondering if your web host is OK?

Not that I’m complaining, but slow loading instances

times will very frequently affect your placement in google and

can damage your high-quality score if ads

and marketing with Adwords. Well I’m adding this RSS to my e-mail and could look

out for much more of your respective exciting content.

Ensure that you update this again soon.

It’s really a nice and useful piece of info. I’m glad that you just shared this

useful info with us. Please stay us up to date like this.

Thank you for sharing.

Hello there! I simply want to offer you a huge

thumbs up for your excellent information you’ve got here

on this post. I am coming back to your website for more soon.

all the time i used to read smaller articles which as well clear

their motive, and that is also happening with this post which I am

reading here.

If some one needs to be updated with newest technologies therefore he must be pay a

quick visit this website and be up to date every day.

Paragraph writing is also a excitement, if you be acquainted with then you can write if not it is complicated

to write.

Thank you, I have just been looking for information about this topic for ages and yours

is the greatest I have came upon till now. However, what

in regards to the bottom line? Are you positive in regards to the source?

Hi, Neat post. There’s a problem with your website in web explorer, may check

this? IE nonetheless is the market leader and a

big part of other people will pass over your magnificent writing

due to this problem.

I’ll immediately seize your rss feed as I can’t to find your e-mail

subscription link or newsletter service.

Do you’ve any? Please let me realize in order that I may just subscribe.

Thanks.

Good day! This post could not be written any better!

Reading this post reminds me of my old room mate!

He always kept talking about this. I will forward this article to him.

Pretty sure he will have a good read. Many thanks for sharing!