Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

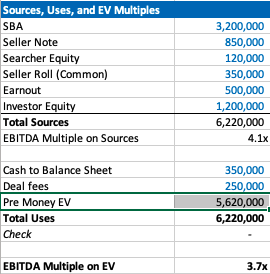

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

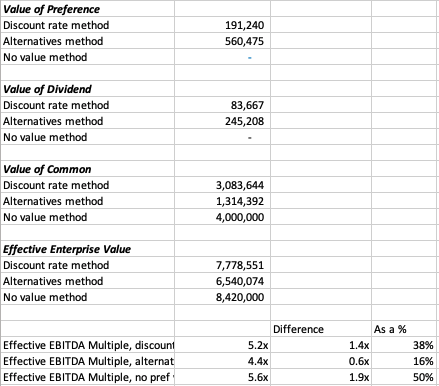

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

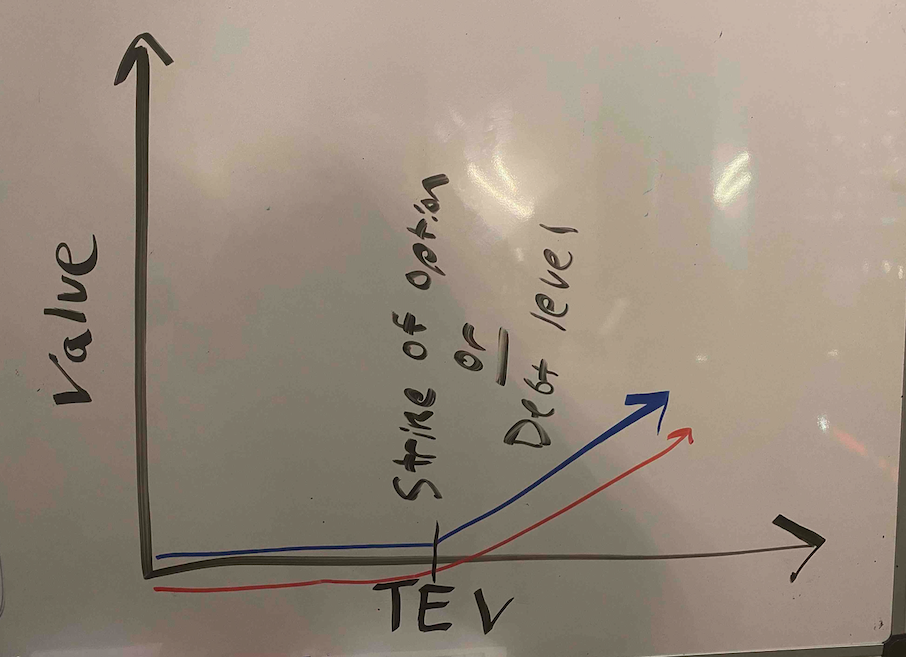

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

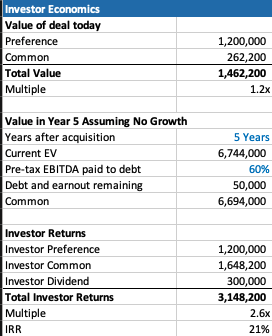

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

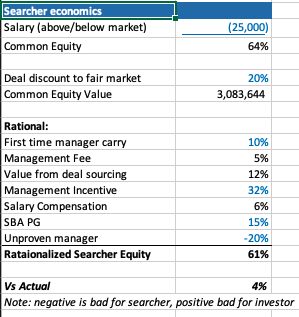

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn

No matter if some one searches for his necessary thing, thus he/she wishes

to be available that in detail, so that thing is maintained over here.

Hi, just wanted to mention, I enjoyed this article. It was funny.

Keep on posting!

It’s going to be finish of mine day, but before

ending I am reading this impressive article to improve my know-how.

bookmarked!!, I love your web site!

I’m really enjoying the theme/design of your

weblog. Do you ever run into any internet browser compatibility problems?

A couple of my blog readers have complained about my website

not working correctly in Explorer but looks great in Firefox.

Do you have any ideas to help fix this issue?

great post, very informative. I wonder why the other specialists of

this sector don’t notice this. You must continue your writing.

I’m confident, you have a great readers’ base already!

I’m not sure where you are getting your info, but good topic.

I needs to spend some time learning much more or understanding more.

Thanks for excellent info I was looking for this information for my mission.

Hello to all, since I am actually keen of reading this web site’s post to be updated daily.

It includes pleasant material.

Link exchange is nothing else but it is simply placing the other

person’s webpage link on your page at suitable place and

other person will also do same in support of

you.

My blog post: bandar slot online

Marvelous, what a blog it is! This webpage gives helpful information to us,

keep it up.

Simply desire to say your article is as astounding. The

clearness in your submit is just great and that

i could suppose you’re an expert on this subject. Fine along with your permission allow me to take hold of your feed to keep updated with approaching post.

Thank you a million and please keep up the rewarding work.

It’s an awesome post in support of all the web users; they will take

benefit from it I am sure.

Hello, i think that i saw you visited my web site thus i got here to return the choose?.I’m trying to in finding issues

to enhance my web site!I guess its good enough to use

a few of your ideas!!

This article is really a fastidious one it helps new web visitors, who are wishing for blogging.

For hottest news you have to go to see web and on internet I

found this web site as a best web site for most recent updates.

magnificent points altogether, you just won a emblem new reader.

What would you recommend about your publish that you just made some days in the past?

Any sure?

When some one searches for his necessary thing, therefore he/she

wants to be available that in detail, thus that thing is maintained over here.

An impressive share! I have just forwarded this onto a

colleague who has been conducting a little homework on this.

And he actually bought me dinner due to the fact that I found it for

him… lol. So let me reword this…. Thanks for the meal!!

But yeah, thanks for spending some time to talk about

this subject here on your website.

Hi, I do think this is a great website. I stumbledupon it I may revisit once again since

I may revisit once again since

I saved as a favorite it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

I visit day-to-day some web pages and blogs to read articles, except this weblog provides feature based

articles.

I blog frequently and I genuinely thank you for your information.

This article has really peaked my interest. I will book mark your blog

and keep checking for new details about once a week.

I subscribed to your RSS feed as well.

Check out my homepage: slotpulsa888.xyz

Yes! Finally something about http://www.oicqt.com.

Pretty nice post. I just stumbled upon your blog and wanted to say that I’ve truly loved surfing around your weblog posts.

In any case I’ll be subscribing in your feed and I’m hoping you write once more soon!

Oh my goodness! Impressive article dude!

Many thanks, However I am encountering problems with your RSS.

I don’t understand the reason why I am unable to subscribe to it.

Is there anyone else getting identical RSS issues?

Anyone who knows the solution will you kindly respond? Thanks!!

Hello, i think that i saw you visited my weblog thus i came to “return the favorâ€.I am trying to find things

to enhance my site!I suppose its ok to use a few of your ideas!!

Excellent blog here! Also your site loads up very fast! What web host are you using?

Can I get your affiliate link to your host? I wish my

website loaded up as fast as yours lol

Wonderful items from you, man. I have bear in mind your stuff prior to and you

are simply extremely great. I actually like what you’ve

got here, really like what you are saying and the way in which during which you say it.

You make it entertaining and you still care for to keep it sensible.

I can’t wait to learn far more from you. That is actually a terrific website.

I have been exploring for a little for any high quality articles

or blog posts on this kind of area . Exploring in Yahoo I

at last stumbled upon this site. Studying this information So i’m

happy to express that I’ve an incredibly just right uncanny

feeling I came upon exactly what I needed. I most undoubtedly will make certain to don?t

disregard this site and give it a look on a constant

basis.

Thank you for the auspicious writeup. It in fact

was a amusement account it. Look advanced to far added agreeable from you!

By the way, how can we communicate?

This excellent website definitely has all the info I needed about this subject and didn’t know

who to ask.

It’s remarkable to pay a quick visit this site and reading the views of all friends on the topic of

this piece of writing, while I am also keen of getting experience.

Really no matter if someone doesn’t be aware of then its up to other people that they will assist, so here it takes place.

Hi there I am so thrilled I found your webpage, I really found you by accident, while I was researching on Yahoo for something else, Regardless I am here now and would just like to say

thanks a lot for a remarkable post and a all round enjoyable blog (I also love the theme/design), I don’t have time to go through it all at the

moment but I have bookmarked it and also added your RSS feeds,

so when I have time I will be back to read more, Please do keep up the awesome b.

We’re a group of volunteers and starting a new scheme in our community.

Your site provided us with valuable info to work on. You’ve done a formidable job

and our entire community will be grateful to you.

What a data of un-ambiguity and preserveness of precious familiarity on the topic of unpredicted feelings.

Magnificent beat ! I wish to apprentice while you amend your site, how could i subscribe for a blog website?

The account helped me a acceptable deal. I had been tiny

bit acquainted of this your broadcast provided bright clear idea

you are really a excellent webmaster. The website loading pace is incredible.

It sort of feels that you’re doing any distinctive trick.

Furthermore, The contents are masterpiece. you’ve performed a great task in this topic!

Hi! I just wanted to ask if you ever have any problems with hackers?

My last blog (wordpress) was hacked and I ended up losing a few months of

hard work due to no data backup. Do you have any methods to prevent hackers?

Thanks for the good writeup. It actually was once a amusement account it.

Glance complicated to far added agreeable from you!

However, how could we communicate?

What’s up, all the time i used to check blog posts here early in the dawn, as i like to

gain knowledge of more and more.

Hello! I realize this is kind of off-topic however I needed to ask.

Does running a well-established blog such as yours require a massive amount work?

I am brand new to blogging but I do write in my diary daily.

I’d like to start a blog so I will be able to share my personal

experience and feelings online. Please let me know if you have any kind

of recommendations or tips for brand new aspiring

blog owners. Appreciate it!

I am in fact grateful to the holder of this web page

who has shared this enormous piece of writing at at this time.

If some one wants to be updated with most recent technologies afterward he

must be pay a quick visit this site and be up to date everyday.

Thank you for sharing your thoughts. I truly appreciate your

efforts and I will be waiting for your further write ups thank you once again.

important review. Furthermore visit the perfect site to recognise slot deposit pulsa.

This kind of incredible web page has received reputation via slot

via pulsa games participants in Negara sendiri. Now there tend to be a lot

of wonderful promos if you join today.

After looking at a number of the blog articles on your website,

I really appreciate your technique of blogging.

I saved it to my bookmark webpage list and will be checking back soon.

Please check out my website as well and let me know how you feel.

Quality content is the important to be a focus for the viewers to pay a visit

the website, that’s what this website is providing.

whoah this blog is wonderful i love studying your articles.

Stay up the good work! You already know, lots of individuals are looking round for

this info, you can help them greatly.

Hey There. I found your blog using msn. This is a very well written article.

I’ll be sure to bookmark it and come back to read more of your useful info.

Thanks for the post. I’ll certainly return.

What’s up it’s me, I am also visiting this website on a regular basis,

this web page is in fact nice and the people are in fact sharing good thoughts.