A few years ago, friends and I took a pit stop in Macau during a trip through Asia after our graduation. While there, I came up with a fairly simple roulette strategy that I thought could work for someone with enough of a bankroll. Since then, my friend Steve and I have argued about 15x about the validity of this strategy. In fact, Steve even wrote a VBA program to prove that I was wrong. Well, Steve, I wrote my own program this past rainy Sunday (to highlight my gambling prowess, this Sunday I also doubled up in Texas Hold ‘EM poker after flopping a full house with 7, 2 off suite – but that’s a story for another day).

The strategy is as follows: put $1 on black. If you win, take your winnings off the table and put a new $1 bet down. If you lose, then put $2 down, if you lose again, double it to $4, if you lose again, double it to $8, and keep doubling down until you win, then take all of your money off the table (your winnings will offest your previous string of losses and leave you with a $1 profit), and start again with a $1 bet. Of course, the problem becomes, what happens when you lose 10 times in a row. Well, I’m glad you asked.

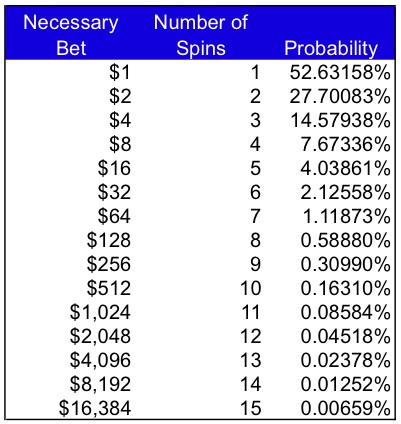

First off, let’s analyze the probability of you losing that many times in a row. There are 38 possibilities in a roulette wheel – numbers 1-36, 0, and 00. So, your chances of not hitting your color are ((38-18)/38, or about 53%. So, you don’t have a great chance of winning if you just play once. But, what are the chances of you losing several times in a row? The below table illustrates how low these odds become (‘Necessary Bet’ is the bet needed to recover losses and make $1. The ‘Probability’ is the cumulative probability of losing n many times in a row. See R1:T17 of the first tab of the excel I link to at the bottom of the post for the calculations):

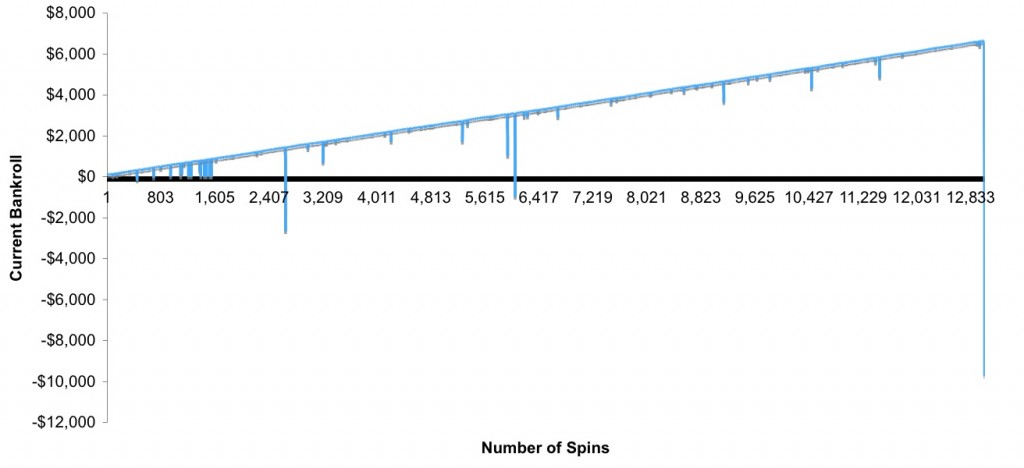

Below is a graph of what your pay offs may look like. Note that you are winning only $1 at a time until you eventually get really unlucky, somewhere around your 13,000th spin in this case, and lose money beyond your bankroll which forces you to quit and walk out of Macau penniless (but hopefully not indebted to some Asian Gangsters). Notice how the blue bar suddenly drops to -$9,000…

This type of payoff structure is analogous to “picking up nickles in front of a steam roller.” If you haven’t already, you should read When Genius Failed, the story of the demise of Long Term Capital Management. LTCM was a hedge fund run by Nobel laureates who made thousands of tiny bets using computer programs in a strategy called statistical arbitrage, among others. The hedge fund blew up as they thought the scenarios that would cause their fund to collapse would only occur once every few centuries (it only took a few years for the fund to meet its very spectacular end in one of the first “too big to fail” situations. Fun fact: all Wall Street banks pitched in to help unwind the fund’s assets, and thus divert a systemic break in the economy, except for Bear Stearns who refused to help…).

Below is a zip file with three Python programs whose outputs are captured in the excel. The programs assume that you start with $100, and can borrow up to $5,000 from your friend (except for the last one that assumes you can borrow $15,000). So, just as LTCM relied on leverage to try to double down on their bets and save their fund, this strategy also relies on loans to stay afloat in bad times when the odds go against you.

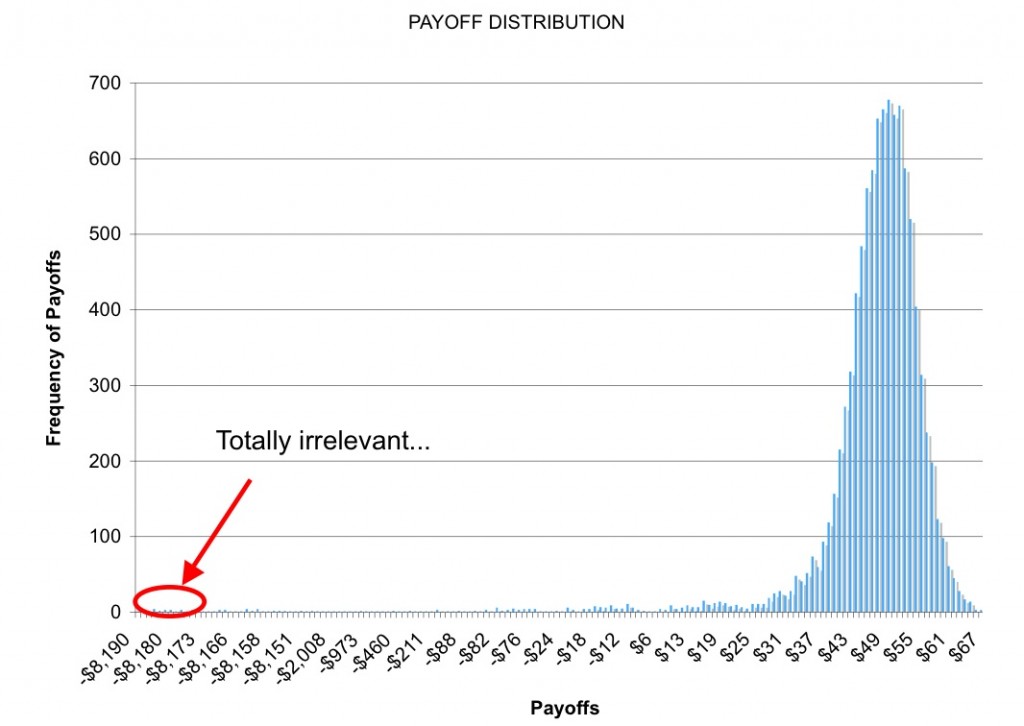

The first program is what would happen if you sat down and played until you went bust. I ran this program once, and you make about $6,000 before hitting some bad luck and going bust (this is shown in the line graph above). The second program basically runs the first program 10,000 times in order to get an average payout. However, this one assumes you are only willing to play 100 games in a row as even 100 games would probably take a very long time in reality. The last program is the same as the second, except that the player can lose up to $15,000 before quitting, and, if they have played 100 games and are at a negative value at the 100th game, they will play until they either recoup their losses, or go bust and lose $15,000. This last scenario actually yields a positive expected value of about $4 (see the third table of the excel file I link to at the end of the post. Expected value is what you would expect to win, on average, if you played this strategy many times). Here is the distribution of returns from spending 10,000 nights in the casino with your friend that has $15,000 he can loan you if need be. Pay no attention to the long tails where you lose $8,000 – that’s like a 10 sigma event and would NEVER happen 🙂

Conclusion: is this an effective strategy? Not really. Even if you found a table that let you start with $1 bets, and you had the patience to sit down and do this, and you had the bankroll, it’s just not going to yield all that much cash over time.

Please feel free to look over my code and let me know if you come up with any other conclusions by modifying it! Also – I’m not a programmer – these scripts were very easy to do and took me only a few hours to write all three and conduct all analysis because Python is super easy! If you want to learn more, MIT has FREE courses on Python that you should check out. Enjoy!

To quote a really great “anti-recruiter” LinkedIn profile describing time spent at a large quant hedge fund: “I earn above-market returns 95% of years by collecting theta, selling volatility in the form of financial derivatives, naked short put options, and in summary, collect nickels and dimes in front of steam rollers, hoping the black swans never appear during my lifetime.”

Attachments:

Python programs: Roulette Programs

Thank you for great content.

schche f50e787ee1 https://wakelet.com/wake/5l_RzheNp0tRv4e0tMNXg

wesydaym f50e787ee1 https://wakelet.com/wake/zG-o-Y7_ui1pKONEJura3

reikar f50e787ee1 https://wakelet.com/wake/DOP32gMcayq_W3btdbyp9

lisssake f50e787ee1 https://wakelet.com/wake/VZ-BFHNT5FVkj13D-yYwN

stederr f50e787ee1 https://wakelet.com/wake/xusvWfzUHZagvVvykkHk2

chrwil f50e787ee1 https://wakelet.com/wake/cXQJJwpcs4WT60Wzkelj9

takycala f50e787ee1 https://wakelet.com/wake/q3lOjqVBBmDeR58BrKxDc

fabydor f50e787ee1 https://wakelet.com/wake/P0Y0hWK2uxwGJwDNnhQR9

En iyi VDS Sanal Sunucu hizmetlerinde .8 uptime garantisi verilmektedir.

darttama f50e787ee1 https://wakelet.com/wake/J4L55WgHitD-NlEc32GTC

harodea f50e787ee1 https://wakelet.com/wake/6bzQNH2vBZiUhdMreoHbk

Thank you for content. Area rugs and online home decor store.

halftam f50e787ee1 https://wakelet.com/wake/t7_50HnKGW_QBdB15BtUB

carmabun f50e787ee1 https://wakelet.com/wake/EqHdvOPoxD4X3fb6v1tlF

wescsle f50e787ee1 https://wakelet.com/wake/MCWoG3oe0mOrw00Bklill

werral f50e787ee1 https://wakelet.com/wake/oBknKa2RAu-jG3p2SX-fT

Great depth -)

free porn

werbern f50e787ee1 https://wakelet.com/wake/fLl4YZQ1oxAmJhlb7rIeG

That is a beautiful picture with very good light 🙂

free porn

criscai f50e787ee1 https://wakelet.com/wake/vgxDB_AXJp1IBmBpqd-We

gisrebe f50e787ee1 https://wakelet.com/wake/6NAvfrUJzPfNw9q3ZYyro

Fantastic images, the shade and depth of the images are breath-taking, they draw

you in as though you are a component of the composition.

free porn

vytohan f50e787ee1 https://wakelet.com/wake/STm873zlAKdDGlIg8Z2c8

enjesail f50e787ee1 https://wakelet.com/wake/2Ck-6-QM1oxxYTRiqNTGE

olikir f50e787ee1 https://wakelet.com/wake/k9WqpBdw9Mn4GNlXcetsg

ulugaba f50e787ee1 https://wakelet.com/wake/qtjdTAk9IaRlpK_QM5NQj

lysarab f50e787ee1 https://wakelet.com/wake/KKQkpRvFyECvEqrb0xKJB

shanursu f50e787ee1 https://wakelet.com/wake/udk24e3fWp_cDlb_B4Ir1