A few years ago, friends and I took a pit stop in Macau during a trip through Asia after our graduation. While there, I came up with a fairly simple roulette strategy that I thought could work for someone with enough of a bankroll. Since then, my friend Steve and I have argued about 15x about the validity of this strategy. In fact, Steve even wrote a VBA program to prove that I was wrong. Well, Steve, I wrote my own program this past rainy Sunday (to highlight my gambling prowess, this Sunday I also doubled up in Texas Hold ‘EM poker after flopping a full house with 7, 2 off suite – but that’s a story for another day).

The strategy is as follows: put $1 on black. If you win, take your winnings off the table and put a new $1 bet down. If you lose, then put $2 down, if you lose again, double it to $4, if you lose again, double it to $8, and keep doubling down until you win, then take all of your money off the table (your winnings will offest your previous string of losses and leave you with a $1 profit), and start again with a $1 bet. Of course, the problem becomes, what happens when you lose 10 times in a row. Well, I’m glad you asked.

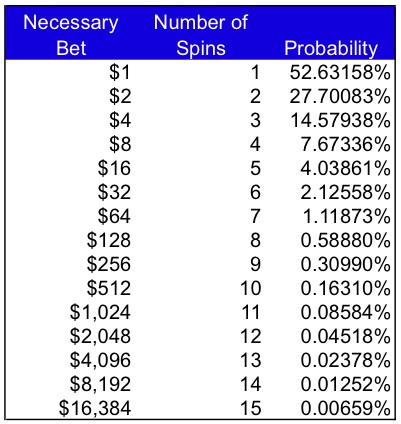

First off, let’s analyze the probability of you losing that many times in a row. There are 38 possibilities in a roulette wheel – numbers 1-36, 0, and 00. So, your chances of not hitting your color are ((38-18)/38, or about 53%. So, you don’t have a great chance of winning if you just play once. But, what are the chances of you losing several times in a row? The below table illustrates how low these odds become (‘Necessary Bet’ is the bet needed to recover losses and make $1. The ‘Probability’ is the cumulative probability of losing n many times in a row. See R1:T17 of the first tab of the excel I link to at the bottom of the post for the calculations):

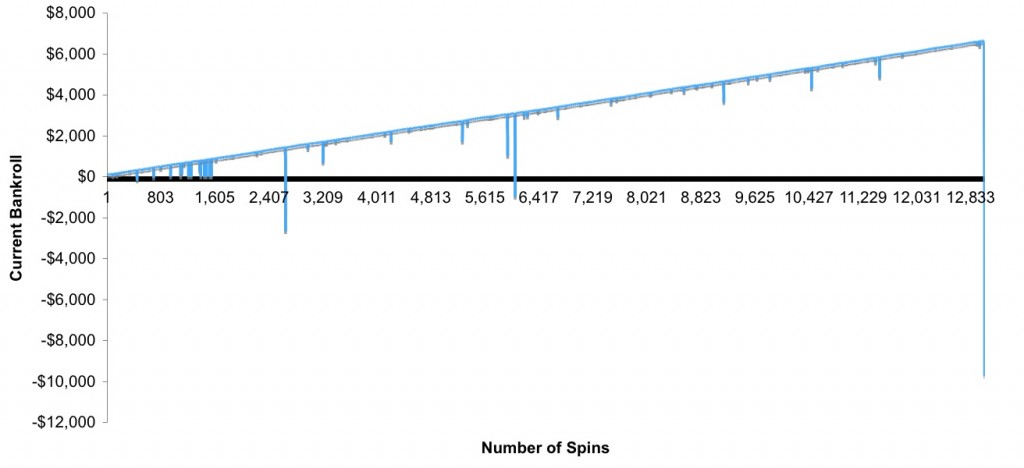

Below is a graph of what your pay offs may look like. Note that you are winning only $1 at a time until you eventually get really unlucky, somewhere around your 13,000th spin in this case, and lose money beyond your bankroll which forces you to quit and walk out of Macau penniless (but hopefully not indebted to some Asian Gangsters). Notice how the blue bar suddenly drops to -$9,000…

This type of payoff structure is analogous to “picking up nickles in front of a steam roller.” If you haven’t already, you should read When Genius Failed, the story of the demise of Long Term Capital Management. LTCM was a hedge fund run by Nobel laureates who made thousands of tiny bets using computer programs in a strategy called statistical arbitrage, among others. The hedge fund blew up as they thought the scenarios that would cause their fund to collapse would only occur once every few centuries (it only took a few years for the fund to meet its very spectacular end in one of the first “too big to fail” situations. Fun fact: all Wall Street banks pitched in to help unwind the fund’s assets, and thus divert a systemic break in the economy, except for Bear Stearns who refused to help…).

Below is a zip file with three Python programs whose outputs are captured in the excel. The programs assume that you start with $100, and can borrow up to $5,000 from your friend (except for the last one that assumes you can borrow $15,000). So, just as LTCM relied on leverage to try to double down on their bets and save their fund, this strategy also relies on loans to stay afloat in bad times when the odds go against you.

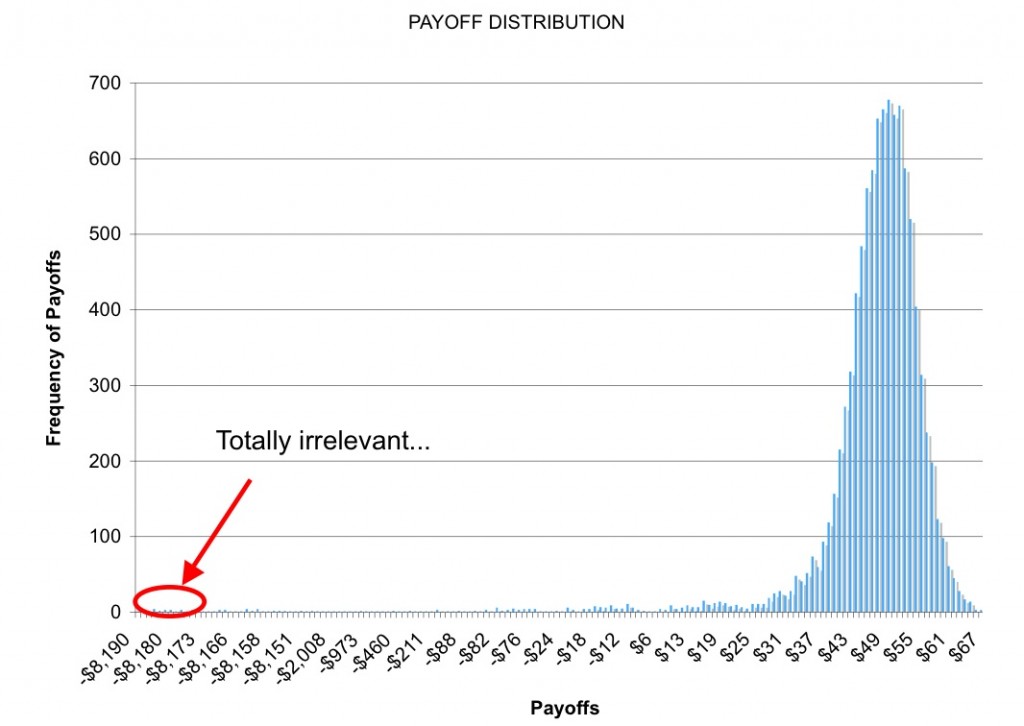

The first program is what would happen if you sat down and played until you went bust. I ran this program once, and you make about $6,000 before hitting some bad luck and going bust (this is shown in the line graph above). The second program basically runs the first program 10,000 times in order to get an average payout. However, this one assumes you are only willing to play 100 games in a row as even 100 games would probably take a very long time in reality. The last program is the same as the second, except that the player can lose up to $15,000 before quitting, and, if they have played 100 games and are at a negative value at the 100th game, they will play until they either recoup their losses, or go bust and lose $15,000. This last scenario actually yields a positive expected value of about $4 (see the third table of the excel file I link to at the end of the post. Expected value is what you would expect to win, on average, if you played this strategy many times). Here is the distribution of returns from spending 10,000 nights in the casino with your friend that has $15,000 he can loan you if need be. Pay no attention to the long tails where you lose $8,000 – that’s like a 10 sigma event and would NEVER happen 🙂

Conclusion: is this an effective strategy? Not really. Even if you found a table that let you start with $1 bets, and you had the patience to sit down and do this, and you had the bankroll, it’s just not going to yield all that much cash over time.

Please feel free to look over my code and let me know if you come up with any other conclusions by modifying it! Also – I’m not a programmer – these scripts were very easy to do and took me only a few hours to write all three and conduct all analysis because Python is super easy! If you want to learn more, MIT has FREE courses on Python that you should check out. Enjoy!

To quote a really great “anti-recruiter” LinkedIn profile describing time spent at a large quant hedge fund: “I earn above-market returns 95% of years by collecting theta, selling volatility in the form of financial derivatives, naked short put options, and in summary, collect nickels and dimes in front of steam rollers, hoping the black swans never appear during my lifetime.”

Attachments:

Python programs: Roulette Programs

philmerc baf94a4655 https://coub.com/stories/4930668-descargar-ul-version-completa

comlys baf94a4655 https://coub.com/stories/4915504-descargar-desperate-times-version-completa-gratuita

chafelt baf94a4655 https://www.guilded.gg/utinlasbes-Trojans/overview/news/9RVge09l

dardars baf94a4655 https://coub.com/stories/4918912-descargar-myths-of-the-world-of-fiends-and-fairies-collector-s-edition-version-completa-gratuita

balforlo baf94a4655 https://www.guilded.gg/madsentladtias-Royals/overview/news/dlv9W1BR

You’ve made some decent points there. I checked on the internet for more info about the issue

and found most individuals will go along

with your views on this website.

free accounts

free accounts

kaialbu baf94a4655 https://coub.com/stories/4902019-descargar-ul-version-completa-2021

friqad baf94a4655 https://trello.com/c/gHxjVeiO/56-descargar-veritex-versi%C3%B3n-pirateada

aldoeir baf94a4655 https://www.guilded.gg/lengwatobacks-Cubs/overview/news/2l3Y5Q8y

saphel baf94a4655 https://www.guilded.gg/sourlirafes-Cobras/overview/news/A6e0JpEl

molmau baf94a4655 https://trello.com/c/t7qwspqC/59-lantern-light-vr-versi%C3%B3n-completa-gratuita

zildory baf94a4655 https://www.guilded.gg/galldanjudes-Cougars/overview/news/KR2Evxjy

ogledes baf94a4655 https://trello.com/c/Y15eXUeh/45-descargar-nanoworld-versi%C3%B3n-completa

This is a great tip particularly to those new to the blogosphere.

Brief but very accurate information… Thank you for sharing this one.

A must read article!

free accounts

free accounts

alisinj baf94a4655 https://trello.com/c/6ob60ApE/56-descargar-maverta-city-gratuita

raghall baf94a4655 https://coub.com/stories/4948320-descargar-gynophobia-version-pirateada-2022

waidar baf94a4655 https://trello.com/c/XX690wUa/53-dark-chronicles-the-soul-reaver-versi%C3%B3n-completa

hartpasq baf94a4655 https://trello.com/c/ZVIbf8zG/46-descargar-there-is-no-stairs-versi%C3%B3n-pirateada

leostef baf94a4655 https://trello.com/c/3Nd04397/58-descargar-isles-of-pangaea-versi%C3%B3n-pirateada-2021

keigfid baf94a4655 https://trello.com/c/Kgkjeewg/99-descargar-ul-gratuita

zalweth baf94a4655 https://trello.com/c/hvfDzZMZ/37-descargar-ul-gratuita

nirpans baf94a4655 https://coub.com/stories/4922787-descargar-prophecy-i-the-viking-child-version-completa-gratuita-2021

persschm baf94a4655 https://marketplace.visualstudio.com/items?itemName=0cumixnibi.Descargar-V-Skin-gratuita

nedvann baf94a4655 https://coub.com/stories/4959306-descargar-love-esquire-rpg-dating-sim-visual-novel-version-completa-2022

egbcor baf94a4655 https://coub.com/stories/4959902-descargar-one-ship-two-ship-redshift-blueshift-version-pirateada-2021

adolwend baf94a4655 https://coub.com/stories/4960442-destiny-s-princess-a-war-story-a-love-story-version-completa

yespree baf94a4655 https://www.guilded.gg/riebestamers-Eagles/overview/news/QlL1ZVx6

Excellent blog here! Also your site loads up fast!

What host are you using? Can I get your affiliate link to your host?

I wish my website loaded up as fast as yours lol

free accounts

free accounts

caleliz baf94a4655 https://www.guilded.gg/tanthumesmas-Storm/overview/news/2lM15aVl

bergon baf94a4655 https://trello.com/c/nf6hs2fs/91-wayfarers-edge-versi%C3%B3n-completa-2022

oguherl baf94a4655 https://coub.com/stories/4931261-descargar-catsby-gratuita-2022

jaiwarr baf94a4655 https://www.guilded.gg/chownosymres-Pioneers/overview/news/Plq3mjPy

lenbetu baf94a4655 https://www.guilded.gg/tanufihis-Outlaws/overview/news/PyJP7JWl

illjael baf94a4655 https://www.guilded.gg/moirehalis-Dodgers/overview/news/16YAx4W6

martdela baf94a4655 https://coub.com/stories/4947322-descargar-chamber-19-version-pirateada-2021

It’s remarkable to pay a visit this web page and reading the views

of all mates regarding this paragraph, while I am also keen of getting experience.

free accounts

free accounts

Heya i am for the first time here. I found this

board and I find It truly useful & it helped me out

a lot. I hope to give something back and aid others

like you aided me.

free accounts

free accounts

karbas baf94a4655 https://coub.com/stories/4949143-descargar-ul-version-pirateada-2022

Thank you great posting about essential oil.

I have read so many articles or reviews concerning the blogger lovers but this article is actually a fastidious article, keep it up.

free accounts

free accounts

patfay baf94a4655 https://coub.com/stories/4907329-the-red-strings-club-version-completa

daryuise baf94a4655 https://trello.com/c/VzrHdTEm/49-descargar-ul-versi%C3%B3n-completa

yedimakf baf94a4655 https://coub.com/stories/4923802-voxelaxy-remastered-version-completa-gratuita-2021

fresah baf94a4655 https://coub.com/stories/4915982-empire-takeover-version-pirateada

ondgold baf94a4655 https://www.guilded.gg/cyafrozleazmoos-Panthers/overview/news/qlDwjakR

fabiuri baf94a4655 https://coub.com/stories/4931461-descargar-momentum-version-completa-gratuita

alealb baf94a4655 https://coub.com/stories/4898317-descargar-companion-version-pirateada

veenkam baf94a4655 https://coub.com/stories/4913921-descargar-legends-of-ellaria-gratuita

lavedare baf94a4655 https://trello.com/c/bx5d5LD4/21-rotation-phonology-break-versi%C3%B3n-completa-gratuita

irejan baf94a4655 https://coub.com/stories/4915597-descargar-loddlenaut-gratuita