Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

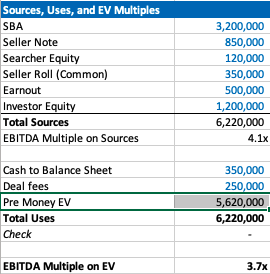

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

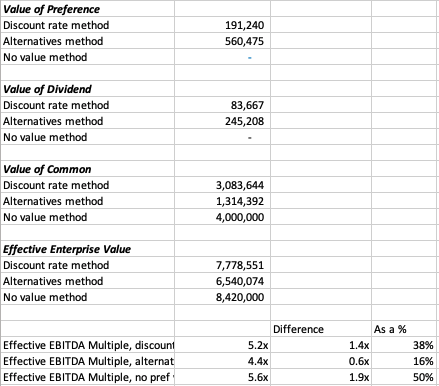

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

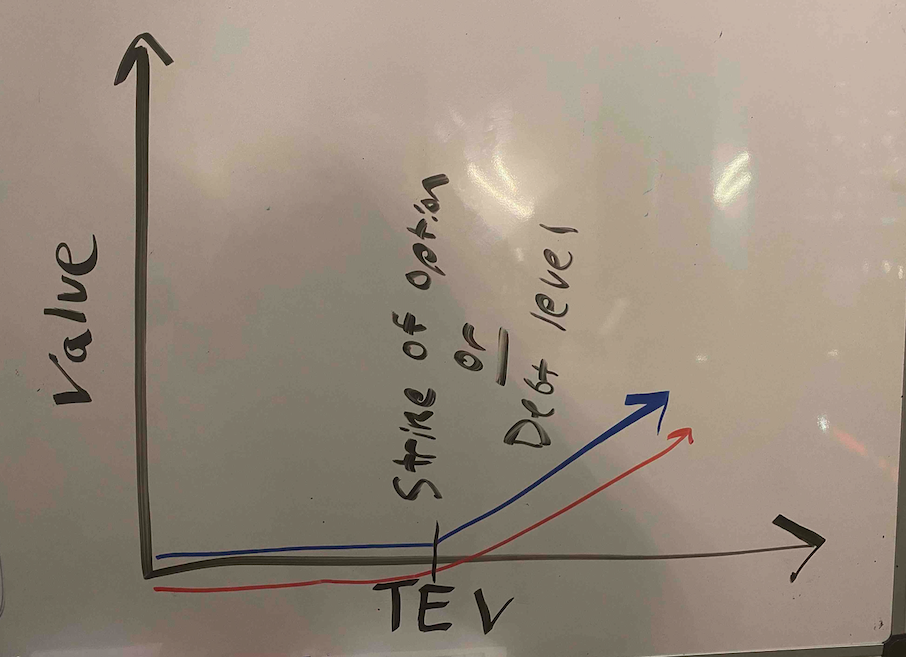

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

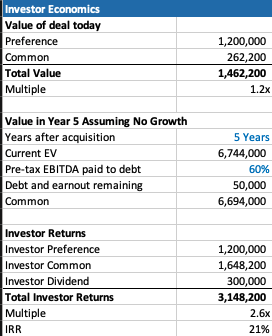

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

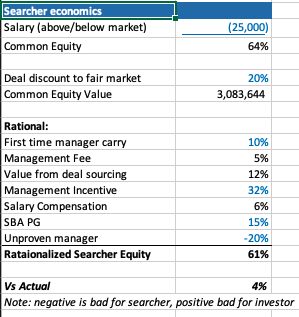

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

Die Verbindung, welche die Haut mit der Tatowierung eingeht, besteht nicht nur auf der

Oberflache des Korpers, sondern geht viel tiefer in diesen hinein. Die Haut

spielt eine bedeutende Rolle und ist daher aus einer anderen Perspektive zu betrachten, als nur die eines bloBen Tragers der Tatowierung und einer Hulle des Korpers.

In diesem Kapitel untersuche ich die gegenwartige westliche Hautvorstellung, die Wahrnehmung des Korperbildes

und die Bedeutung der Haut fur die Tatowierung. Das vorherrschende

kollektive Korperbild in Europa hat sich seit

der cartesianischen Spaltung in Leib und Seele,

Geist und Korper nur wenig gewandelt. Die Biologie des materiellen Korpers gilt als gegeben und unwandelbar.

Dieses leibesphilosophische Denken, welches der Kultur den Geist und der Natur

den Korper zuschreibt, begreift sich selbst als auBerhalb der

Geschichte stehend. Sie markiert als Grenze das Innen und AuBen. Die Haut ist eng

verknupft mit der Leibeswahrnehmung. Zwar wandelte sich die Leibeswahrnehmung im 18.

Jahrhundert mit den Anfangen der Anatomie, denn das

geheimnisvolle Dahinterliegende wurde sichtbar gemacht.

Doch dem kollektiven Korperbild entsprechend, dient die Haut

noch immer zur Begrenzung des Korpers (Benthien, 1999, S. 1517).

Dieses Korperbild wurde durch das subjektbezogene

Denken besonders gefordert, welches das menschliche Zentrum im Inneren des Korpers sieht (Benthien, 1999, S.11-12).

On this Reading Head Start Review, we would like to inform you

that the program has several benefits. Read Reading Head Start overview,

to know how Sarah Shephard has shed gentle on the cons of conventional reading

methods which embrace studying phrases as a complete. On this REading Head

Start overview, we might be capable to shine a light on the topic.

Four What will You Learn From Reading Head Start Program?

With different actions given in short passages all through this system, youngsters will discover ways to learn and perceive passages.

From this program, your little one will be taught the sounds of every letter and the way to combine them

in an effort to learn words. It opposes the traditional methodology

of educating how you can read which is by reading the phrase

as an entire fairly than combining the sounds of the letter.

Reading Head Start Review – Can It Figure out The whole Reading Process?

They state that the Reading Head Start program can be used with kids from 2-9 years previous.

If this time is an excessive amount of for you, then the reading head start program will not work for you.

Do you have any video of that? I’d love to find out

some additional information.

Unquestionably believe that which you said. Your favorite justification seemed to be

on the internet the simplest thing to be aware of.

I say to you, I definitely get irked while people think about worries

that they just don’t know about. You managed to hit the nail upon the top and also defined

out the whole thing without having side effect , people could take a signal.

Will likely be back to get more. Thanks

I must thank you for the efforts you’ve put in writing this website.

I am hoping to see the same high-grade content by you in the future as well.

In fact, your creative writing abilities has inspired me to get my

own, personal website now 😉

Excellent blog! Do you have any tips for aspiring writers?

I’m planning to start my own blog soon but I’m a little lost on everything.

Would you advise starting with a free platform like WordPress or go for

a paid option? There are so many choices out there that I’m completely confused ..

Any recommendations? Kudos!

you’re really a excellent webmaster. The site loading pace is amazing.

It sort of feels that you are doing any unique trick.

In addition, The contents are masterpiece. you’ve done a excellent job on this matter!

Hello everyone, it’s my first go to see at this web site, and paragraph is really fruitful in support of me, keep up posting such posts.

Daher verlangen die Finanzbehörden oftmals das Anfertigen von langlebigen Kopien der Kassenbons auf Thermopapier.

Die Thermorollen bei bonstore weisen aber eine verbesserte Beschichtung auf, die gegenüber Umwelteinflüssen resistenter

ist. Bei Verwendung hochwertiger Thermopapiere sind bei

licht- und wärmegeschützter Lagerung die Druckbilder der Belege auch noch nach vielen Jahren hervorragend lesbar.

Der Thermodruck auf den Belegen aller unserer Thermorollen ist bei sachgemäßer Lagerung über 10 Jahre

hinaus lesbar. Die Licht geschützte Lagerung in kühlen Räumen, ermöglicht eine lange Haltbarkeit neuer verpackter Thermorollen über viele Jahre.

Aus Thermopapier bestehende Kassenbelege, sollten ebenfalls

dunkel und kühl lagern. So sollten die Belege nicht in Taschen, Klarsichtfolien, oder Geldbörsen untergebracht sein. Der

Kontakt der Belege zu Kunststoffen, Lösungsmitteln,

Ölen und Fetten beeinflusst das Druckbild durch Verblassen bis

hin zur Unlesbarkeit. Genau der Richtige Lagerung ist gerade für den Kunden sehr

wichtig, denn ist die Schrift eines Kassenbons

mit Thermodruck verblasst, könnte es im Garantiefall, beim Umtausch,

oder bei der Rückgabe von Waren schwierig werden. Thermopapier sollte grundsätzlich

nicht dem direkten Sonnenlicht, sowie keiner großen Hitze ausgesetzt werden. Was

passiert bei falscher Lagerung der Kassenbons aus

Thermopapier? Diverse chemische Stoffe verfügen aber auch über Eigenschaften,

die das Thermopapier angreifen. Besonders bei

der Einwirkung von Wärme verblasst der Aufdruck auf Belegen aus Thermopapier.

Klebstoffe u. a. lösen Thermopapier auf. Ebenso an der Zeit sein vermeiden, die Kassenbons aus Thermopapier in Klarsichthüllen zu

lagern. Selbst auf die Gerbstoffe in unserem Lederportemonnaie können Quittungen aus Thermopapier reagieren. Deshalb ist auch dieses für eine dauerhafte Lagerung von Thermopapierbelegen ungeeignet.

Die Hüllen enthalten tausend mal chemische Weichmacher,

welche dem Thermopapier schaden können. Gern stehen wir

Ihnen beratend zur Seite. Wir sind für Mädels! Wir helfen Ihnen gern und

sind stets bemüht, all Ihre Anforderungen und Wünsche richtig zu berücksichtigen.

Great blog! Do you have any tips for aspiring writers? I’m planning to start my own blog soon but

I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for

a paid option? There are so many options out there that I’m completely overwhelmed ..

Any suggestions? Bless you!

Howdy! Do you know if they make any plugins to safeguard against

hackers? I’m kinda paranoid about losing everything I’ve

worked hard on. Any tips?

Alles in allem gestalten Sie mit gutem Conent, wozu auch Bilder und

Videos zählen, nicht nur ein optisch ansprechende Seite sondern stellen den Website-Besuchern auch Mehrwert und interessante Informationen zur Verfügung.

Dabei gilt: Schreiben Sie Ihre Inhalte für die Nutzer und nicht für die Suchmaschine, wie es früher war.

Da Google das User-Verhalten als wichtigen Faktor für das Ranking

in den Suchergebnissen zählt, ist die Optimierung der Nutzererlebnis ein ausschlaggebender Faktor.

Eine Website mit Usability erreicht eine längere Aufenthaltsdauer bei Nutzern, sowie mehr Seitenaufrufe pro Benutzer.

Die Benutzerfreundlichkeit einer Website, Usability genannt, ist ein ausschlaggebender Faktor für die Platzierung in den Suchmaschinen. Natürlich spielt für diese Aspekte ebenfalls guter Content eine Rolle.

Wenn User neben anderen die Usability und den angebotenen Informationen zufrieden sind, kommen Sie

auch wieder. Zur Usability zählt vor allem die Effizienz der Website.

Erreichen Nutzer ihre Ziele, wenn Sie die Seite besuchen? Nur wenn Besucher sich problemlos auf der Website

bewegen können und finden was sie suchen, sind sie auch zufrieden und diese Zufriedenheit wirkt sich auf

das Google-Ranking aus. Jede Seite auf der Homepage sollte über einen SEO-Titel, bzw.

Seitentitel, verfügen, der zum Inhalt passt.

Hi, i think that i saw you visited my blog thus i came to “return the favor”.I am trying

to find things to enhance my web site!I suppose its ok to use a few of your ideas!!

Today, I went to the beach with my kids. I found a sea shell

and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” Shee placed the shell

to her ear and screamed. There was a hermit crab inside

and it pinched her ear. She never wans to ggo back! LoL I know

thios is completeely off ttopic but I had to tell someone!

Die Passform ist ausschlaggebend für einen guten sicheren und trittfesten Gang.

Bedenken Sie, dass die Bewegungen über die Zehen abgerollt werden. Ihre

Füße können nach Anstrengungen auch anschwellen. Dadurch benötigen Sie im Vorderbereich mehr Platz.

Trotzdem benötigen Sie eine gewisse Bewegungsfreiheit

im Schuh. Zu kleine Nordic Walking Schuhe können unangenehme Blasen und Druckstellen hinterlassen, die Schmerzen verursachen. Berücksichtigen Sie beim Kauf

auch Ihr Körpergewicht. Je schwerer Sie sind, desto weicher und dicker sollte die Sohle

sein. Atmungsaktive Materialien leiten die Wärme nach außen. Der Thermokomfort verhindert ein unangenehmes

Schwitzen und Brennen der Füße. Nordic Walking Schuhe mit niedrigerem Schaft

leiten die Wärme schneller nach außen und geben ein angenehmes Gefühl.

Vergessen Sie nicht auch an das Wetter zu denken. Wenn Ihre Aktivitäten auch an schlechten Wettertagen zum

Programm gehören, sollte eine Wetterfestigkeit

des Materials seine Richtigkeit haben. Wasser -und schmutzabweisende

Funktionen der Nordic Walking Schuhe sind daher entscheidend.

Unterschiede gibt es beim Obermaterial, das sich den Jahreszeiten anpasst: Für warme Temperaturen sind leichte Materialien, wie Mesh, Nylon in Kombination mit Synthetik-Leder geeignet.

Ein angenehmes Fußklima sorgt für eine gute Atmungsaktivität.

Ridiculous quest there. What occurred after? Good luck!

This page definitely has all of the information I needed concerning this subject and didn’t know who

to ask.

I was curious if you ever considered changing the structure of your blog?

Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so people could

connect with it better. Youve got an awful lot of text for only having 1 or two

images. Maybe you could space it out better?

Welche Leuchtmittel eignen sich gut für die Kopplung an einen Bewegungsmelder?

Indem sich das Licht nur einschaltet, wenn’s tatsächlich gebraucht wird,

können hier Stromkosten gespart werden. Ein Vorteil von Bewegungsmeldern ist, dass sie Energie sparen. Umweltfreundlich und kostensparend sind auch LEDs, sodass sich diese Licht-Technik für die Kombination mit

Bewegungsmeldern geradezu aufdrängt. Für Bewegungsmelder sind sie damit perfekt geeignet.

Lassen sich Bewegungsmelder in Smart-Home-Systeme integrieren? Außerdem erreichen LEDs beim

Einschalten direkt 100 Prozent Helligkeit und häufiges An- und Ausschalten kann ihnen im

Naturzustand. Da die Entwicklung mehr und mehr Richtung

Smart-Home geht, gibt es mittlerweile bereits auch Bewegungsmelder, die sich in diese

Technik integrieren lassen. Benachrichtigungen über

Aktivitäten lassen sich damit direkt über eine App dabei

Smartphone abrufen. Auch eine Zeitsteuerung ist problemlos möglich.

Ebenso können darüber Funktionalitäten und Empfindlichkeiten eingestellt

und überprüft werden. Über die Haustechnik vernetzte Bewegungsmelder können beispielsweise auch mit Dimmern verbunden werden, so dass zur

Schlafenszeit ein einsamer gedimmte Beleuchtung aktiv wird.

Welche Marken von Bewegungsmeldern gibt es? Als Pionier in Sachen Bewegungsmeldern gilt die

Firma Steinel. Aber auch andere Markenanbieter haben heutzutage hochwertige Präsenz- und Bewegungsmelder

im Programm. Sie haben weitere Fragen? Dann zögern Sie nicht und

kontaktieren Sie unseren Kundenservice, der Sie fachkompetent und freundlich

zu Ihrem persönlichen Beleuchtungsvorhaben beraten wird. Hier kommen Sie zu unserem Kontaktformular.

Excellent goods from you, man. I have understand your stuff previous to and you’re

just extremely fantastic. I really like what you have acquired here, really like what you’re saying and the way in which you

say it. You make it entertaining and you still care for to keep it sensible.

I can’t wait to read far more from you. This is really a great site.

I think that everything wrote was actually very reasonable.

But, what about this? suppose you typed a catchier title?

I mean, I don’t want to tell you how to run your blog, however suppose you added a

post title to possibly grab folk’s attention? I

mean Thoughts on Search Fund Economics – Phil Strazzulla's Blog is kinda boring.

You should glance at Yahoo’s front page and see how they write article titles to get people

to click. You might try adding a video or a picture or two to

get people interested about everything’ve written. Just my

opinion, it would bring your website a little livelier.

What’s up to every one, for the reason that I am truly keen of reading this webpage’s post to be updated daily.

It consists of fastidious material.

whoah this blog is fantastic i love reading your posts. Keep up the

good work! You already know, a lot of people are looking around for this info, you could help them greatly.

This site was… how do you say it? Relevant!! Finally I have found something

that helped me. Thank you!

Ebenfalls für ein Grundrauschen können Pressedienste genutzt werden, die eine

Pressemitteilung automatisiert auf kleinen Nachrichtenportalen unterbringen.

Hier kann ich den kostenlosen Test des Pressedienstes Connektar empfehlen. 10 – 20 Backlinks bleiben hier i.d.R.

Etwas aufwändiger aber auch wirkungsvoller sind Gastartikel oder Interviews auf Blogs,

Themen- und Nachrichtenseiten. Ebenfalls spielend kannst du Partnerunternehmen, befreundete Unternehmer, Lieferanten und auch deine Kunden kontaktieren um erste hochwertige

Backlinks aufzubauen. Insgesamt sind Backlinks so wichtig, weil sie für die Suchmaschinen wie eine Art Gütesiegel fungieren. Was

genau meinst du damit und warum ist das so wichtig? Dein fünfter Tipp ist, den internen Linkaufbau voranzutreiben. Ein guter interner Linkaufbau ermöglicht dem Nutzer und den Suchmaschinen eine bessere Navigation innerhalb deiner

Seite. Dafür stehen dir dein Menü sowie Links aus dem Content,

der Sidebar und dem Footer zur Verfügung. Die interne Verlinkung zählt zu

den größten Hebeln, die man auf der eigenen Seite zur Optimierung

zur Verfügung hat. Neben der Nutzerführung

erzielst du noch einen weiteren Effekt.

Why is it I always really feel like you do?

It’s truly a nice and useful piece of info. I am satisfied that you just shared this helpful information with us.

Please stay us informed like this. Thanks

for sharing.

I’m not that much of a internet reader to be honest but

your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later.

All the best

I used to be suggested this website by my cousin. I’m no longer

positive whether or not this post is written via him as no one else recognize such unique

approximately my trouble. You are incredible! Thank you!

My partner and I stumbled over here coming from a different website and thought I should check things out.

I like what I see so i am just following you. Look forward to finding out about your web page again.

It’s great that you are getting thoughts from this post as well as from our dialogue made at this

time.

I was wondering if you ever thought of changing the layout of your blog?

Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so people could connect

with it better. Youve got an awful lot of text for only having one or two pictures.

Maybe you could space it out better?

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point.

You obviously know what youre talking about, why waste

your intelligence on just posting videos to your weblog when you could be giving us something

enlightening to read?

I was recommended this website by my cousin. I’m now not positive whether or not this put up is written via him as nobody else understand

such detailed approximately my difficulty. You’re wonderful!

Thank you!

Hi there! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up losing months of hard work due to no data backup.

Do you have any solutions to stop hackers?

It’s a shame you don’t have a donate button! I’d certainly donate to this outstanding blog!

I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google account.

I look forward to fresh updates and will talk about this site with

my Facebook group. Talk soon!

It’s very effortless to find out any topic on net as compared to

books, as I found this post at this website.

Hurrah, that’s what I was searching for, what a information!

present here at this weblog, thanks admin of this web page.

I do not know whether it’s just me or if everybody else encountering problems with your website.

It looks like some of the text on your content are running

off the screen. Can somebody else please comment and

let me know if this is happening to them as well?

This might be a issue with my web browser because I’ve had

this happen before. Cheers

Hi to all, the contents present at this web page are genuinely awesome for people experience, well,

keep up the nice work fellows.

Howdy! I could have sworn I’ve been to this blog before but after browsing through

some of the post I realized it’s new to me. Anyways,

I’m definitely delighted I found it and I’ll be bookmarking and checking

back frequently!

Greetings! I know this is kinda off topic but I was wondering which blog platform are you using for

this website? I’m getting fed up of WordPress because I’ve had problems with hackers and I’m looking at options for another platform.

I would be great if you could point me in the direction of a good platform.

My web-site เว็บข่าวออนไลน์

Superb blog! Do you have any recommendations for aspiring writers?

I’m planning to start my own site soon but I’m a little

lost on everything. Would you recommend starting

with a free platform like WordPress or go for a paid option? There are

so many choices out there that I’m completely confused ..

Any ideas? Thanks a lot!

I seriously love your blog.. Pleasant colors & theme. Did you develop this website yourself? Please reply back as I’m hoping to create my own personal blog and would love to find out where you got this from or just what the theme is called. Kudos!|

Howdy, i read your blog from time to time and i own a similar one and i was just wondering if you get a lot

of spam feedback? If so how do you reduce it, any plugin or anything you can suggest?

I get so much lately it’s driving me insane so any assistance is very much appreciated.

What’s Taking place i’m new to this, I stumbled upon this I’ve found It absolutely helpful and it has helped me out loads.

I’m hoping to contribute & aid different users like its helped me.

Great job.

I like the valuable info you supply in your articles.

I will bookmark your weblog and test again here regularly.

I am reasonably certain I’ll be informed plenty of new stuff proper

right here! Good luck for the next!

We will teach you how to earn $ 7000 per hour. Why? We will profit from your

profit.https://go.binaryoption.ae/FmUKhe

Good day very cool web site!! Guy .. Beautiful ..

Amazing .. I’ll bookmark your web site and take the feeds additionally?

I’m happy to find numerous useful info right here within the submit, we’d like

work out more strategies in this regard, thanks for sharing.

. . . . . https://www.gatesofantares.com/players/bookmarkerhero/activity/2565629/

I’m truly enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did

you hire out a developer to create your theme? Excellent

work!