Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

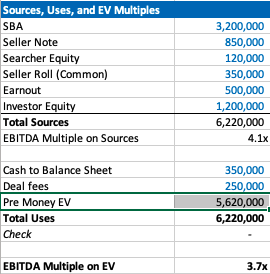

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

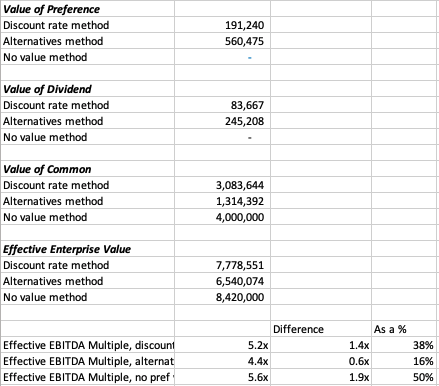

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

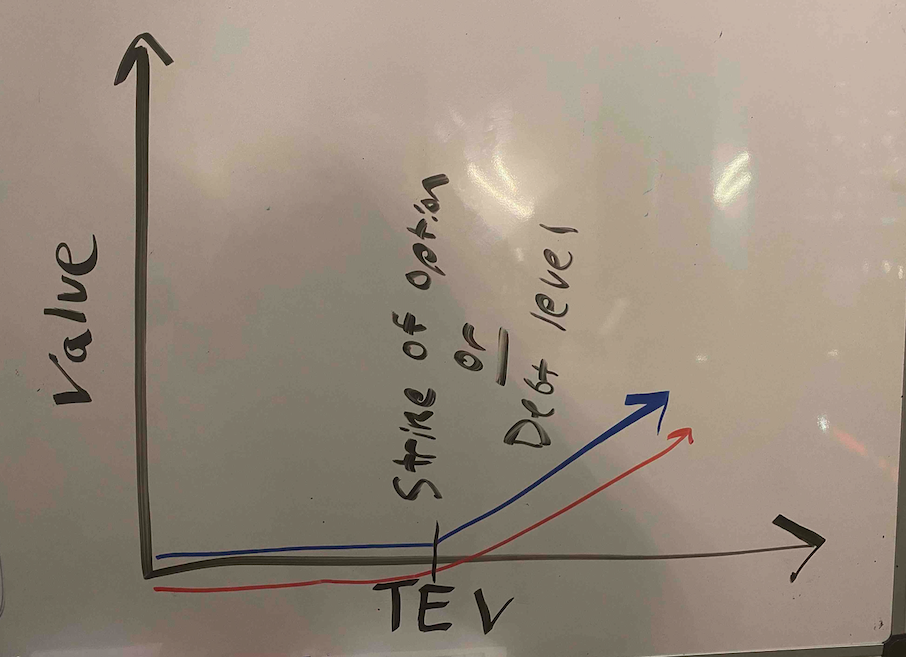

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

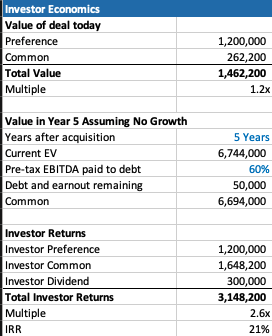

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

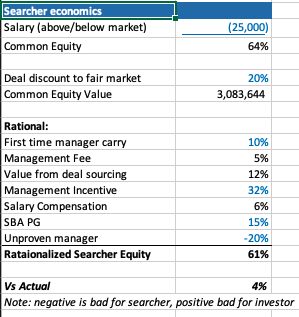

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

Hi, i feel that i noticed you visited my weblog thus i came to go back the favor?.I am trying to find issues to enhance

my site!I suppose its good enough to use some of your concepts!!

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored material stylish. nonetheless, you command get got an shakiness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this increase.

Hola! I’ve been following your blog for

some time now and finally got the courage to go ahead and give

you a shout out from Huffman Texas! Just wanted to tell you keep up the excellent work!

Wonderful beat ! I would like to apprentice while you amend your site, how could i subscribe for a weblog web site?

The account aided me a applicable deal. I have been tiny bit familiar of this your broadcast offered vibrant clear idea

I am continually searching online for posts that can help me. Thank you!

I have been surfing online more than 4 hours today, yet I never found any interesting article like

yours. It’s pretty worth enough for me. In my opinion, if all website owners

and bloggers made good content as you did, the web will be a

lot more useful than ever before.

Greetings from Florida! I’m bored at work so I decided to browse your website on my iphone during lunch break. I love the knowledge you provide here and can’t wait to take a look when I get home. I’m shocked at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyways, very good blog!

An intriguing discussion is worth comment. I do believe that you ought to publish more about this issue, it may not

be a taboo matter but typically folks don’t talk about such issues.

To the next! All the best!!

Avatare, virtuelle Personen, sind reine Kunstprodukte ihrer Erschaffer, in ihrem Aussehen frei gestaltet nach Belieben und Fantasie.

In seinem Science Fiction Roman Idoru2 (japanische Adaption von des Englischen Wortes Idol) erzählt William

Gibson von welcher virtuellen Diva Rei Toei, Sängerin und Frontfrau der erfolgreichsten Band ihrer Zeit, die nur im Cyberspace existiert.

Anno 2004 hat die Suche nach der Schönsten der Schönen eine neue Facette bekommen. Schon heute, im

Zeitalter von Computer und Internet, braucht ein Schönheitswettbewerb nicht einmal an einem realen Ort

stattzufinden, gebunden an den Geschmack des Kulturraumes und für Teilnehmerinnen eingeschränkt durch Landesgrenzen: Avatare reisen in Sekundenschnelle im Netz.

Im vergangenen Jahr hatte der italienische Designer Franz Cerami erstmalig dazu aufgerufen, virtuelle Schönheiten zu entwerfen und in den internationalen Wettbewerb

zu schicken. Der erste digitale Schönheitswettbewerb Miss Digital World

war ein Erfolg, 39 weibliche Avatare gingen an den Start und die

internationale Presse begleitete die neuartige Misswahl mit großem Interesse.

Untern Teilnehmern waren neben privaten 3D-Designern auch die schmetterlingsbeflügelte Elfe

Dawn, ursprünglich von NVidia als Demo für Grafikkarten entwickelt,

die Halb-Vampirin BloodRayne, Heldin aus dem gleichnamigen Computerspiel von Terminal Reality und Majesco, und Webbie, Markenikone der Telecom Brazil.

Does your website have a contact page? I’m having problems locating

it but, I’d like to send you an email. I’ve got some creative

ideas for your blog you might be interested in hearing. Either way, great website

and I look forward to seeing it grow over time.

Ein sleeker Dutt oder ein gerader Mittelscheitel lassen uns optisch leider

älter erscheinen. Besser: der Messy Look. Hier fehlt es nämlich an Bewegung und Lässigkeit!

Ganz egal, bei welcher Frisur – achten Sie darauf, immer

einige Strähnen herauszuziehen. Der Undone-Stil verjüngt uns sofort.

Lockere Zöpfe, die absichtlich annähernd perfekt zusammengenommen werden, sind

wahre Jungbrunnen! Geflochtenes Haar hat nicht nur einen traditionellen Charme, es ist zudem praktisch

und wunderhübsch anzusehen. Ob vollkommen als Bauernzopf,

ein einfacher geflochtener Pferdeschwanz oder eingedrehte Partien an den Schläfen: Die Flechtkunst ist ein Handwerk, welches jede Frau

zumindest minimal beherrschen sollte. Und ist außerdem total unkompliziert zu stylen. Dabei sind himmelwärts natürlich

keine Grenzen gesetzt – mit ausreichend Übung können sagenhafte Haarkunstwerke geschaffen werden. Auch Abwandlungen wie die Fischgräten-Flechttechnik sehen atemberaubend aus.

Das Beste an der ganzen Geschichte: Flechtfrisuren lassen uns jünger wirken! Denn häufig

assoziieren wir sie mit jungen Mädchen. Auch die Farbe kann uns ein optisch jüngeres Erscheinungsbild zaubern. Tatsächlich gilt

hier: Je heller, desto mehr Jahre schummeln wir weg. Geflochtenes Haar hat einen verspielten Charakter

und lässt uns weicher wirken. Haben Sie von Natur aus

dunkles Haar, setzen Sie lieber auf Akzente. Am besten, warme Töne zu wählen. Natürlich sollten Sie vielleicht später planlos Ihre Haare bleichen – es muss schon zum

Typ passen. Honigblond, Karamell- oder Haselnussbraun können in Strähnchen als Highlight oder in Balayagetechnik eingearbeitet

werden. Diese Nuancen wirken weicher und lassen Ihre Gesichtszüge weniger hart wirken.

Helle Akzente wirken prima als optisches Anti-Aging-Mittel!

Good day I am so thrilled I found your site, I really found you by mistake,

while I was searching on Digg for something else, Regardless I am here now and would just like to say kudos

for a tremendous post and a all round exciting blog (I

also love the theme/design), I don’t have time to browse it all at the minute but I have bookmarked it and

also added in your RSS feeds, so when I have time I will

be back to read a great deal more, Please do keep up the excellent

work.

My site kreosite.com

https://community.linksys.com/t5/user/viewprofilepage/user-id/1225188

It is the best time to make a few plans for the future and it is time to be happy. I have read this put up and if I may I want to recommend you some attention-grabbing things or advice. Perhaps you could write subsequent articles referring to this article. I want to read more issues about it!

Hey this is somewhat of off topic but I was wondering if blogs use WYSIWYG editors

or if you have to manually code with HTML.

I’m starting a blog soon but have no coding expertise so I wanted to get advice from someone with

experience. Any help would be enormously appreciated!

Thank you for sharing your info. I truly appreciate your

efforts and I will be waiting for your next write ups thank you once again.

My spouse and I absolutely love your blog and find nearly all of your post’s to be just what I’m looking for.

can you offer guest writers to write content for yourself?

I wouldn’t mind producing a post or elaborating on a lot

of the subjects you write with regards to here. Again, awesome web site!

Oh my goodness! Impressive article dude! Thank you so much, However I am going through problems with your RSS.

I don’t understand the reason why I cannot subscribe to

it. Is there anyone else having identical RSS issues?

Anyone that knows the answer will you kindly respond?

Thanx!!

We absolutely love your blog and find nearly all of your post’s to be just what I’m looking for.

can you offer guest writers to write content for

yourself? I wouldn’t mind creating a post or elaborating on many of

the subjects you write concerning here. Again, awesome weblog!

Take a look at my blog – เว็บบทความ

Undeniably consider that which you said. Your favourite reason appeared to be

at the internet the easiest thing to keep in mind of. I say to you, I definitely get annoyed

even as people think about issues that they plainly do

not understand about. You managed to hit the nail upon the highest and also outlined

out the whole thing without having side-effects , other folks can take

a signal. Will likely be back to get more. Thank you https://www.zupyak.com/p/3085893/t/how-to-play-pubg-mobile

Hi there! Someone in my Myspace group shared this website with us

so I came to take a look. I’m definitely enjoying the information.

I’m bookmarking and will be tweeting this to my followers!

Fantastic blog and brilliant design.

I love it when folks come together and share views.

Great blog, keep it up!

Mit diesem Tool können Ideen für Keywords und Anzeigegruppen generiert werden und es

lässt sich die voraussichtliche Leistung von bestimmten Keywords prüfen. Ferner lassen sich die durchschnittlichen Kosten pro Klick (CPC) und die durchschnittlichen Suchanfragen pro

Monat ermitteln. Um den Umsatz aus Google AdWords zu erhöhen und die Kampagnen-Kosten zu senken, muss eine Kampagne regelmäßig überwacht und

optimiert werden. Profil) sowie eine für jede Suchanfrage ausgerichtete

Zielseite, sind für den Erfolg von AdWords Kampagnen ausschlaggebend.

Kaum ein Mensch öffnet Google und gibt spontan einen Suchbegriff ein,

nur um dann zu schauen, welche Ergebnisse über den Bildschirm flimmern. Gesucht werden Treffer, die Informationen liefern oder zur Problemlösung beitragen. Je näher das Suchergebnis

die gewünschte Fragestellung aufgreift, desto größer ist die Chance,

dass der Treffer angeklickt wird. Jede Suchanfrage hat

einen Grund und bringt eine gewisse Erwartung mit sich.

CTR in %). Die bereits existierenden Ergebnisse sorgen hier für

interessante Einsichten darüber, was in den Snippets gut funktionieren kann.

Welche Titelformulierungen oder Wendungen im Text

verleiten den User eher zum Klicken?

Hey just wanted to give you a brief heads up and let you know a few of

the images aren’t loading properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different browsers and

both show the same results.

If some one wants to be updated with latest technologies afterward he must

be visit this web site and be up to date every day.

Thanks on your marvelous posting! I quite enjoyed reading it, you

could be a great author. I will make certain to bookmark your blog and will often come back down the road.

I want to encourage continue your great work, have a nice evening!

When someone writes an piece of writing he/she maintains the

image of a user in his/her mind that how a user can know it.

So that’s why this post is amazing. Thanks!

My web site; BIOWIN77

Entdeckt menschenleere Buchten oder zerklüftete Küstenabschnitte.

Zum Wandern kann ich euch den gut begehbaren Erdbeerbaumweg empfehlen. Die circa 10 km

lange Strecke führt über Capdepera und verspricht atemberaubende Aussichten. Egal, für welche Aktivität ihr euch entscheidet, ihr werdet es definitiv nicht bereuen und habt eine

gute Alternative zum Strandurlaub. Wer von euch liebt es auf dem Wasser nicht geöffnet

haben? Wir haben eine große Bandbreite an Wassersportaktivitäten, bestimmt ein Highlight

der Reise. Wie ihr sicherlich anhand meiner Cala Ratjada Tipps merkt, bietet

euch der Ort vielfältige, bunte Programme und Langeweile wird garantiert nicht aufkommen. In Cala Ratjada erwartet euch einen große auswahl an Restaurants und

Bars, deswegen darf dieser Punkt definitiv nicht auf meiner

Liste der Cala Ratjada Tipps fehlen. Freut euch auf vielschichtig verschiedensten Gerichten. Schaut doch

mal an der Strandpromenade vorbei und lasst euch von den Speisekarten inspirieren, denn hier gibt

es schier unendliche Möglichkeiten. Im Es Coll d’Os könnt ihr die regionale Küche erleben und ich verspreche euch, ihr werdet

nicht enttäuscht. Im Oleo’s zaubern euch die Köche

köstliche Speisen auf die Teller und wenn ihr eurer Essen bei einem schier

atemberaubenden Ausblick genießen wollt, müsst ihr unbedingt ins Xiringuito gehen.

Hi to every body, it’s my first pay a visit of this web

site; this weblog includes remarkable and really excellent material designed for visitors.

Wonderful article! That is the kind of info that

should be shared across the web. Shame on the search engines for now not positioning this put up upper!

Come on over and talk over with my site .

Thanks =)

Hello my family member! I want to say that this article is awesome, great written and come with approximately all important infos.

I would like to look extra posts like this .

Hey There. I found your weblog the use of msn. That is an extremely neatly written article.

I’ll be sure to bookmark it and come back to read extra of your useful info.

Thanks for the post. I will certainly comeback. https://artcottagetechnologies.com/how-to-play-pubg-mobile/

Hello to all, as I am genuinely keen of reading this webpage’s post

to be updated on a regular basis. It includes nice stuff.

Whats up very nice web site!! Man .. Beautiful ..

Wonderful .. I’ll bookmark your website and take the feeds additionally?

I am happy to find numerous helpful info here within the put up,

we want develop more techniques on this regard, thanks for sharing.

. . . . . https://www.layitlow.com/members/followhat999.744986/

I do trust all the concepts you have offered to your post.

They are very convincing and can certainly work.

Nonetheless, the posts are very short for novices.

May just you please prolong them a little from subsequent time?

Thanks for the post.

https://500px.com/p/1lovelykhan?view=photos

Greetings! Very useful advice in this particular article!

It is the little changes that produce the greatest

changes. Thanks for sharing!

That is a very good tip especially to those fresh to

the blogosphere. Simple but very precise info… Appreciate your sharing this one.

A must read post!

Here is my web site – Sophie

Great post. I was checking constantly this blog and I am impressed!

Very useful information specifically the remaining phase 🙂 I deal with such info much.

I was looking for this particular information for a very long time.

Thanks and best of luck.

Trotz erheblicher Verbesserungen die letzten Jahren erkennt Google immer bislang nicht

alle Arten von Bildern. Zudem gehts bei der Bildoptimierung nicht nur darum, Suchmaschinen bei der Interpretation der Bilder zu helfen. Eine Optimierung kann einen entsprechend großen Einfluss darauf haben, wie schnell Ihre

Website geladen wird und wie hoch Ihr PageSpeed-Insights-Score ist.

In der Tat hört die Bilder-SEO jedoch oft schon beim Hinweis auf, dass Alt-Tags Keywords

enthalten sollten. Schlecht optimierte Bilder sind mit die Hauptursachen für lange Ladezeiten. Dies ist tatsächlich ein Teil des

Prozesses, aber eben nur ein Teil. Alt-Tags und Alt-Texte sind jedoch ein guter Ausgangspunkt, ums Gebiet der Bilder-SEO als Teil der Onpage-Optimierung zu

verstehen. Was ist ein Alt-Attribut? „ALT” heißt „Alternative”.

Es wird bei den Attributen der Bilder auf der Webseite eingegeben. Wird ein Bild nicht angezeigt, wird der Text aus dem entsprechenden ALT-Attribut

angezeigt. SEO-Verantwortliche sprechen häufig über Alt-Tags oder Alt-Texte, Alt-Beschreibungen oder auch Alt-Attribute.

Hey would you mind letting me know which web host you’re

using? I’ve loaded your blog in 3 different web browsers and I must say this blog loads a lot quicker then most.

Can you recommend a good internet hosting provider at

a reasonable price? Thanks a lot, I appreciate it!

Great beat ! I wish to apprentice while you amend your site, how can i subscribe for a blog website?

The account helped me a acceptable deal. I had been a

little bit acquainted of this your broadcast provided bright

clear concept

I think that is among the so much vital info for me.

And i am satisfied studying your article. However want to commentary on few normal things, The

web site style is ideal, the articles is really excellent :

D. Just right process, cheers

This is the perfect blog for everyone who wants to find out about this topic.

You understand a whole lot its almost hard to argue with you (not that I actually will need to…HaHa).

You certainly put a new spin on a topic that’s

been written about for many years. Wonderful stuff, just great!

Thanks for the auspicious writeup. It in reality used to be a

leisure account it. Glance advanced to more introduced agreeable from you!

However, how could we communicate?

Thank you for another informative blog. Where else could I

am getting that type of info written in such a perfect method?

I’ve a undertaking that I am just now working on, and I’ve been at the look

out for such information.

I am not sure where you are getting your information, but good topic.

I needs to spend some time learning more or understanding more.

Thanks for magnificent info I was looking for this information for my mission.

There’s definately a lot to find out about this

subject. I love all of the points you have made.

Hello there! This is kind of off topic but I need some help from an established blog.

Is it very difficult to set up your own blog? I’m not very techincal but I

can figure things out pretty fast. I’m thinking about creating my own but

I’m not sure where to start. Do you have any tips or suggestions?

Thanks