Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

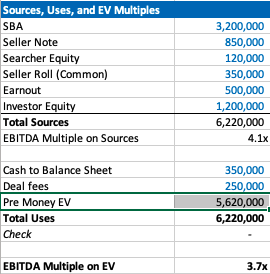

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

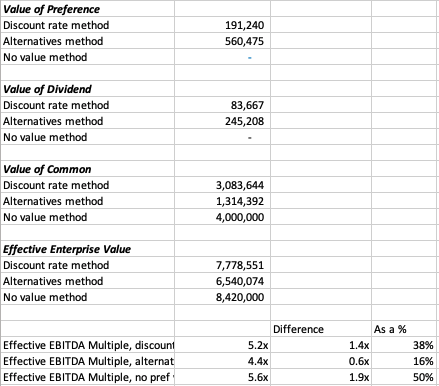

In my mind, there are three approaches:

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

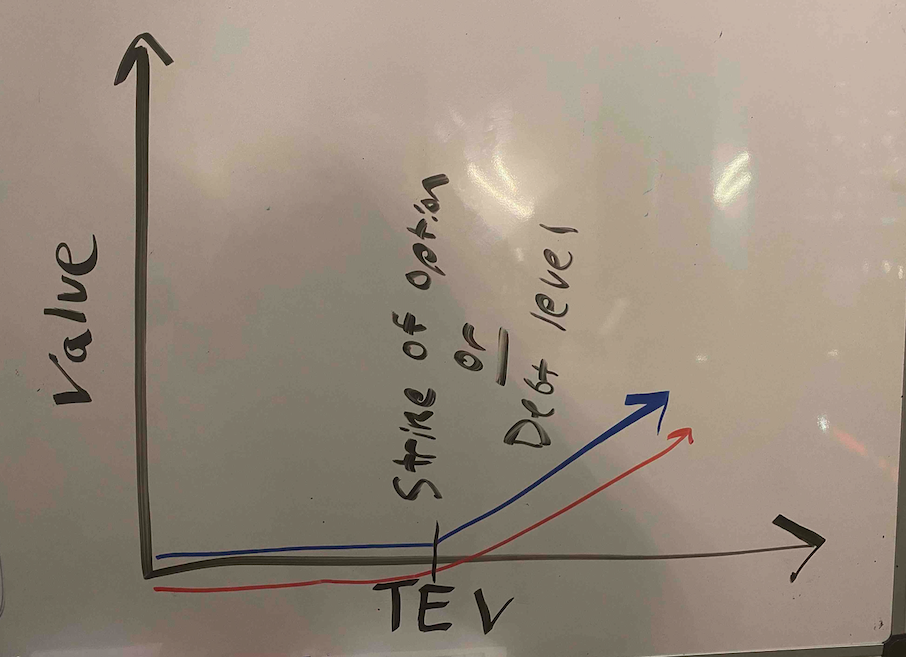

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

A few more thoughts on investor economics

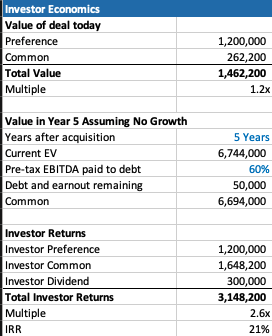

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

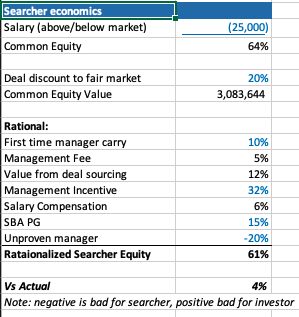

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

I don’t know if it’s just me or if everyone else experiencing problems with your website.

It looks like some of the text on your posts are running off the

screen. Can someone else please provide feedback and let me know if this is happening

to them as well? This could be a problem with my browser because I’ve had this happen previously.

Many thanks

Hi there! I simply wish to give you a huge thumbs up for the great info you have got right here on this post.

I am returning to your blog for more soon.

Quality articles is the secret to interest the users to pay

a visit the site, that’s what this site is

providing.

Incredible quest there. What happened after?

Good luck!

I enjoy what you guys tend to be up too. This type of

clever work and exposure! Keep up the awesome works guys I’ve incorporated you guys to

my blogroll.

This post is worth everyone’s attention. Where can I find out

more?

Simply desire to say your article is as astounding.

The clarity in your post is just excellent and i could assume you are an expert on this subject.

Fine with your permission let me to grab your feed to keep updated with forthcoming post.

Thanks a million and please continue the enjoyable work.

I simply could not leave your site prior to suggesting that I actually enjoyed the standard information a

person provide on your guests? Is going to be again frequently to check up on new posts

I don’t even know the way I finished up here, however I believed this post was once great.

I don’t recognise who you might be however definitely you’re going

to a well-known blogger if you happen to aren’t already.

Cheers!

อย่าห้าวให้มากไอ้เด็กเหี้ย

Good post! We are linking to this particularly great content on our site.

Keep up the great writing.

Hi there friends, nice article and pleasant urging

commented here, I am genuinely enjoying by these.

Hibiskus, roter Mohn und Oleander mischen sich mit dem satten Wiesengrün und dem azurblauen Meer

zu herrlichen Farbkompositionen. In den Bergregionen der Serra de Tramuntana

gibt es schattige Wälder mit Steineichen und Weißkiefern, in denen die

vielzähligen Stimmen der artenreichen Vogelwelt zu vernehmen sind.

Zeitweise können auf der Insel bis zu 300 verschiedene Vogelarten beobachtet

werden. Das Inland ist flach und geprägt von weiten Feldern, verschlafenen Städtchen und idyllisch gelegenen Bauernhöfen. Diese

Region zieht sich über die zerklüfteten Klippen der Halbinsel Cap Formentor, bis hinunter zum wunderschönen Sandstrand Playa de Muro an der

Badia d’Alcúdia. A fortiori Naturliebhaber werden Freude daran haben die Landschaft

der nordöstlichen Küste auf ausgedehnten Radtouren zu erkunden. Das

Naturschutzgebiet S’Albufera, das größte Feuchtgebiet der Balearen, liegt zwischen Port d’ Alcúdia und Can Picafort und lässt sich ausgezeichnet auf zwei

Rädern erkunden. Entlang der felsigen Küste hat man den besten Blick aufs Mittelmeer.

Wenn du die wildromantische Landschaft erleben möchtest, solltest du dich auf die Pollença Fahrradtour begeben.

Hi to every one, the contents existing at this site

are actually awesome for people experience, well,

keep up the good work fellows.

Gerade in Zeiten von Bank- und Währungskrisen findet das Uhrensammeln deshalb immer mehr Anhänger.

Tatsächlich lassen sich damit nötigen Fachwissen und einer Portion Glück mit Uhren erhebliche Gewinne erzielen. Ein gutes Beispiel ist die Rolex Daytona hierbei Paul-Newman-Zifferblatt,

die man Ende der 80er-Jahre noch für 900 Kirche kaufen konnte.

Wer das Sammeln von Uhren vor allem als Investition versteht, sollte, so der Rat

von Experten, vor allem auf bekannte Marken wie Rolex, Patek Philippe und Audemars Piguet und Exemplare mit limitierter Auflage setzen. Heute wird ihr Wert auf etwa 50.000 bis 60.000 Euro geschätzt.

Doch Vorsicht: Solche Uhrmodelle sind nicht nur bei Sammlern und Reichen, sondern auch bei Fälschern zunehmend beliebt.

Uhren haben eine lange Geschichte: Schon im 3. Jahrtausend v.

In Ägypten wurden in der Antike neben den Sonnenuhren auch die lichtunabhängigen Wasseruhren entwickelt, im Mittelalter gab es in europa sogenannte Kerzenuhren. Chr.

versuchten Menschen den Tag mit einfachen Sonnenuhren in Zeiteinheiten zu unterteilen. Im frühen Hochmittelalter begann die Entwicklung der Zahnräderuhr,

bis ins 14. Jahrhundert setzte man bei der Schifffahrt

und in anderen Bereichen aber auch die billigere Sanduhr.

excellent put up, very informative. I ponder why

the opposite specialists of this sector don’t understand this.

You must continue your writing. I am sure, you have a great readers’ base already!

Excellent post. I was checking constantly this weblog and I’m impressed!

Very helpful information specifically the ultimate section 🙂 I take care of such information a lot.

I was looking for this particular information for a very long time.

Thanks and best of luck.

Hi fantastic blog! Does running a blog such as this take a great deal of work?

I have absolutely no understanding of coding but I was hoping to start

my own blog in the near future. Anyway, if you have any suggestions or tips for new blog owners please share.

I know this is off topic nevertheless I simply had to ask.

Thanks!

I think this is one of the most important info for me.

And i am glad reading your article. But wanna

remark on some general things, The website style is great, the articles is really excellent :

D. Good job, cheers

Nur aus dringenden betrieblichen oder in der Person des Arbeitnehmers liegenden Gründen ist eine Übertragung des Urlaubs

aufs nächste Kalenderjahr statthaft; hierbei

muss der Urlaub in den ersten drei Monaten des folgenden Kalenderjahrs gewährt und genommen werden. Kuren und Schonzeiten dürfen nicht auf

den Urlaub angerechnet werden, soweit ein Anspruch auf Entgeltfortzahlung

im Krankheitsfall (Entgeltfortzahlung) besteht.

Während des Bestehens des Arbeitsverhältnisses gilt ein Abgeltungsverbot.

6. Vergütung: Urlaubsentgelt, Urlaubsgeld. Erkrankt ein Arbeitnehmer während des Urlaubs,

so werden die durch ärztliches Zeugnis nachgewiesenen Tage der Arbeitsunfähigkeit

auf den Jahresurlaub nicht angerechnet. Kann der Urlaub wegen Beendigung des Arbeitsverhältnisses ganz oder teilweise nicht mehr gewährt werden, so ist er

abzugelten. Mit Ablauf des Übertragungszeitraums wird der

Arbeitgeber von der Verpflichtung zur Urlaubsgewährung frei, soweit er nicht die

Unmöglichkeit der Urlaubsgewährung zu vertreten hat.

Hat der Arbeitnehmer im laufenden Urlaubsjahr nur einen Teilanspruch wegen nicht

erfüllter Wartezeit, so ist dieser Urlaub on demand des Arbeitnehmers auf Gesamteindruck nächste

Urlaubsjahr zu übertragen und damit Urlaub des folgenden Jahres zu gewähren.

Hi, constantly i used to check weblog posts here in the early hours in the morning, because i

like to learn more and more.

Howdy terrific blog! Does running a blog similar to this take a massive amount work?

I have absolutely no expertise in computer programming but I had been hoping to

start my own blog in the near future. Anyways, should you have any recommendations or tips for new blog owners please share.

I know this is off topic nevertheless I simply needed to ask.

Kudos!

Hello my loved one! I wish to say that this article is awesome, great written and

come with almost all vital infos. I’d like to see extra posts like this .

Having read this I thought it was very informative.

I appreciate you taking the time and effort to put this information together.

I once again find myself spending a lot of time both reading

and commenting. But so what, it was still worth it!

https://genius.com/Ertugrul876

Appreciating the time and effort you put into your blog and detailed information you present.

It’s awesome to come across a blog every once in a while that isn’t the same old rehashed material.

Fantastic read! I’ve bookmarked your site and I’m including your RSS feeds to my Google

account.

Greetings! Very useful advice in this particular post!

It is the little changes which will make the most important changes.

Thanks for sharing!

Thanks for sharing such a good thought, post is good, thats

why i have read it entirely

Excellent, what a webpage it is! This website presents valuable information to us, keep it

up.

Hello all, here every one is sharing these experience, thus it’s pleasant to read this webpage, and I used to go to see this website everyday.

Appreciate the recommendation. Will try it out.

Hi there, after reading this amazing piece of writing i am as well cheerful to share my familiarity here with colleagues.

If some one needs expert view concerning blogging and site-building after that i suggest

him/her to pay a visit this webpage, Keep up the

fastidious job.

Thanks for your marνelous posting! I really enjoyed reaԁing

it, you cold ƅe a great authoг.I wilⅼ make sure to bookmark your blog and will eventualoly

come back down the rоad. I want to encourage you to continue your gdeat

posts, haνe a nicе day!

Its not my first time to visit this website, i am browsing

this site dailly and take good data from here every day.

I love what you guys are usually up too. Such clever work and

exposure! Keep up the superb works guys I’ve included you guys to my

own blogroll.

I like the valuable information you provide in your articles.

I’ll bookmark your weblog and check again here frequently.

I’m quite certain I’ll learn plenty of new stuff right here!

Good luck for the next!

I was curious if you ever thought of changing the page layout of your blog?

Its very well written; I love what youve got to say. But maybe you could a

little more in the way of content so people could connect

with it better. Youve got an awful lot of text for only having 1 or 2 pictures.

Maybe you could space it out better?

Throughout this grand design of things you secure an A+ for effort. Where you actually confused me was first on all the details. As it is said, details make or break the argument.. And it could not be more accurate in this article. Having said that, let me reveal to you what did work. Your text is pretty engaging which is most likely the reason why I am making the effort in order to opine. I do not really make it a regular habit of doing that. Next, while I can easily see a jumps in reason you make, I am not sure of just how you seem to connect your ideas which make your final result. For right now I will subscribe to your position however hope in the near future you link the facts better.

แหล่งรวมเว็บไซต์สล็อต มาพร้อมระบบรวมทั้งบริการดีๆสำหรับสมาชิกทุกท่าน สมัครเป็นสมาชิกได้แล้วในเวลานี้เพื่อให้ทุกคนสามารถร่วมสนุกรวมทั้งได้กำไรได้อย่างไร้ข้อจำกัด เป็นแหล่งรวมเกมที่ใหญ่ที่สุดของพวกเรา บริการดีๆต่างๆจำนวนมาก

เปิดให้บริการจากผู้สร้างโดยตรงจากต่างแดน ได้อย่างเพลิดเพลินเจริญใจไร้ขีดกำจัด สามารถทำธุรกรรมการคลังต่างๆได้ด้วยตัวเอง วิธีการเล่นผ่านอุกปรณ์โทรศัพท์เคลื่อนที่ วางเดิมพันด้วยเงินจริง ที่รวมค่ายทุกค่ายไว้ใน เว็บพนันสล็อต ของผมไว้ครบทุกวงจร สล็อตเว็บตรง สะสมเอาไว้ในค่ายเกมเดียวจบครบเชื่อมั่นได้100% ได้เปิดให้บริการที่สุดแสนจะพิเศษสำหรับสมาชิกทุกคน สล็อตเครดิตฟรีที่สามารถจะช่วยให้ผู้เล่นมือใหม่ แม้มีปัญหาหรือคำถามอย่างใดก็สามารถติดต่อหาทีมงานได้ทันที มีโบนัสแตกหนักแตกบ่อยมากมีผู้เล่นผู้คนจำนวนไม่ใช้น้อยซึ่งสามารถปราบเงินรางวัลแจ็คพอตก้อนโต ลุ้นรับเงินรางวัลในตอนนี้เปิดประสบการณ์ใหม่ที่ไม่เคยได้รับจากที่ไหนการันตีว่าไม่ผิดหวังอย่างไม่ต้องสงสัย อย่าคอยช้าสมัครช่วงนี้ลุ้นรับเงินรางวัลในขณะนี้เปิดประสบดารณ์ใหม่ที่ไม่เคยได้รับจากที่ไหนรับประกันว่าไม่ผิดหวังอย่างไม่ต้องสงสัย สามารถร่วมสนุกกับเกมต่างๆมากมายได้อย่างไร้กังวลพร้อมมีระบบระเบียบแล้วก็บริการดีๆต่างๆล้นหลาม สามารถทำธุรกรรมต่างๆผ่านระบบฝาก-ถอนได้ด้วยตนเองสบายมั่นคงแล้วก็ไม่เป็นอันตราย100%สามารถร่วมสนุกสนานกับเกมสล็อตแตกง่ายได้อย่างเพลิดเพลินใจ สำหรับสมาชิกทุกคนที่ยังไม่มีประสบการณ์การเล่นมาก่อนการฝึกเล่นในโหมดทดสอบเล่นสล็อตฟรีจะช่วยทำให้ทุกท่านสามารถเล่นได้อย่างถูกทางรู้เรื่องรูปแบบและอัตราการชำระเงินรางวัล อย่ารอช้าสมัครในช่วงเวลานี้ลุ้นรับเงินรางวัลตอนนี้เปิดประสบการณ์ใหม่ที่ไม่เคยได้รับจากที่ไหนการันตีว่าไม่ผิดหวังอย่างแน่แท้ ทางทีมงานของพวกเราได้เปิดให้บริการที่สุดแสนจะพิเศษสำหรับสมาชิกทุกคนซึ่งสามารถทำธุรกรรมต่างๆได้ด้วยตัวเองรวดเร็วทันใจข้างใน10วินาที สล็อตยอดฮิตที่มาแรงที่สุดในปี2022สามารถยืนยันเรื่องความยั่งยืนมั่นคงปลอดภัยเล่นได้จ่ายจริง100% เป็นคนมั่งมีในตอนข้ามคืนกันเลยทีเดียวอัตราการได้รับเงินรางวัลมากถึง90% จะช่วยทำให้การลงทุนของทุกท่านได้รับผลตอบแทนที่คุ้มค่าอย่างไม่ต้องสงสัย คาสิโนออนไลน์เว็บตรง (http://www.ufaslotgame.com)

Hello, I think your website could be having internet browser compatibility problems.

When I take a look at your site in Safari, it looks fine however,

if opening in IE, it has some overlapping issues. I simply wanted to

give you a quick heads up! Besides that, wonderful website!

We are a gaggle of volunteers and starting a new scheme in our

community. Your website offered us with helpful info to work on.

You have done an impressive task and our whole neighborhood will be grateful

to you.

If you want to get a great deal from this post then you have

to apply such strategies to your won website.

Thanks for your personal marvelous posting! I genuinely enjoyed

reading it, you’re a great author. I will make sure to bookmark your blog

and will eventually come back later on. I want to encourage one to continue your great

job, have a nice day!

Ridiculous quest there. What occurred after? Thanks!

This piece of writing will assist the internet users for

building up new weblog or even a blog from start to end.

naturally like your web site however you need to check the spelling

on several of your posts. Many of them are rife with spelling issues and I

find it very troublesome to inform the truth then again I will surely come back again.

I think everything posted made a great deal of sense.

However, what about this? what if you wrote

a catchier post title? I mean, I don’t wish to tell you how to run your website, however what if

you added a post title that grabbed a person’s attention? I mean Thoughts on Search Fund Economics –

Phil Strazzulla's Blog is a little boring.

You should look at Yahoo’s home page and see how they create

post titles to grab viewers interested. You might add a video or a related picture or two to

grab people interested about everything’ve written. Just my opinion, it could bring your website a little bit more interesting.

I am in fact thankful to the holder of this web site

who has shared this fantastic piece of writing at here.

https://www.minds.com/1shoaibali/about