Lately I’ve been having a lot of conversations around investment terms with searchers, as well as investors.

About 15 years ago, I interned at a search fund. And, over the last few years, I’ve started to invest in the asset class going direct as well as through funds of search funds.

Investing in search funds is a great way to scratch my entrepreneurial itch, extremely rewarding when a searcher finds success, and can be economically rewarding too.

This post is my attempt to share thoughts on self funded search economics in an effort to contribute to the search fund community, get feedback on my thinking from a wider audience, and of course meet more people who are doing searches/investing and may want to collaborate (please feel free to reach out!).

You can watch a video of me explaining this model here, and download the excel here:

Enterprise Value

The standard finance equation is enterprise value = debt + stock – cash. Enterprise value is how much the company itself is worth. Many times people confuse it with how much the stock is worth and find the “minus cash” part of this really confusing.

So, you can rearrange this equation to make it stock = enterprise value – debt + cash. Make more sense now?

Enterprise value is just how much you’re willing to pay for the company (future cash flows, intellectual property, etc), not the balance sheet (debt and cash).

Most investors and searchers think about the EBITDA multiple of a company on an enterprise value basis because they’ll be buying it on a cash free, debt free basis. It becomes second nature to think about EBITDA multiples and know where a given business should fall given scale, industry, etc.

However, I believe this second nature way of thinking of things can be a massive disadvantage to investors given the way EV and multiples are talked about in our community currently.

Sources of capital, the typical way to calculate enterprise value for self funded searchers

If you’ve ever looked at or put together a teaser for a self funded search deal, you will notice that the deal value is equal to the sum of the sources of capital minus deal fees and cash to the balance sheet.

As a simple example, if there is $4 mm of debt to fund the deal, $1 mm of equity, and $200k of deal fees, the enterprise value = $4 mm + $1 mm – 200k = $4.8 mm.

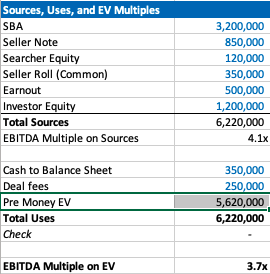

We’ll use slightly more complex numbers in our example: If a searcher is taking a $3.2 mm SBA loan, $850k seller note, putting in $120k themselves, getting $350k of equity from the seller, a $500k earnout, and $1.2 mm of equity financing minus $350k to the balance sheet and $250k of deal fees, then the enterprise value will be $5.62 mm.

Our example company has $1.5 mm of EBITDA, so the EBITDA multiple is 3.7x. This is a pretty attractive acquisition multiple for a business that meets traditional search criteria (recurring revenues, fragmented competition, high gross margins, low customer concentration, etc).

If you’re seeing a search fund deal for the first time, the headline of “we’re buying a decent company for 3.7x, and replacing a tired owner with a hungry operator” is pretty exciting!

However, if you’re an investor, there is some nuance to this enterprise value number and the true EBITDA multiple you are investing in.

The trick with self funded enterprise value

The security that most self funded search investors get in a deal is participating preferred stock with a paid in kind dividend. This means when there’s an exit, you get your money back before any other equity holder, then get a certain percent of the business, and whatever dividend you’ve been owed in the interim accrues to your principle.

It’s a really favorable security for the investor, and one that is basically impossible to get in VC where straight preferred stock is much more common (no pun intended).

The key terms are what percent of common equity does this security convert into after the originally principal is paid back, and what is the dividend.

The share of common equity the investor group will get typically ranges from 10-50% of the total common stock. The dividend rate is usually 3-15%. The average I’m seeing now is around 30% and 10% for common and dividends respectively.

The strange this about the enterprise value quoted to investors in a teaser/CIM is that it doesn’t change as the percent of common changes, even though this has large implications for how much the common equity is worth and the value investors receive.

For example, I may get a teaser where the sources of investment – cash to balance sheet – deal fees = $3.7 mm for a $1 mm EBITDA company, which would imply a 3.7X EBITDA multiple. Let’s say the searcher is offering investors 30% of the common and a 10% dividend.

Let’s now say that the searcher is having a tough time raising capital and changes their terms to 35% of common and a 12% dividend. Does the effective enterprise value change for investors? I would argue yes, but I would be surprised to see it changed in the CIM/teaser.

This isn’t a knock on searchers or the search fund community. It’s just kind of how things are done, and I think this is mostly because it’s really hard to think about how the enterprise value has changed in this scenario.

However, the natural way of using EBITDA multiples to think about value for a business that is so common in PE/SMB can be extremely misleading for investors here. You may be thinking 3.7X for this type of business is a great deal! But, what if the security you’re buying gets 5% of the common?

If you’re in our world, you may counter this point by saying most searchers will also supply a projected IRR for investors in their CIM. However, IRR is extremely sensitive to growth rate, margin expansion, and terminal value. While the attractiveness of the security will be reflected, it can be greatly overshadowed by lofty expectations.

To get more clarity and have a slightly different mental model on the effective price investors are paying for this business, let’s go back to basics. Enterprise value should be debt + preferred stock + common stock – cash.

We know the values of each of these numbers, except the common. So, the main question here becomes: how much is the common equity worth?

Calculating value of common equity for self funded search funds

Equity value for most search fund deals = preferred equity from investors + the common equity set aside for the searcher and sometimes also advisors, board, seller.

We know that the preferred equity is investing a certain amount for a certain amount of common equity. The rub is that they are also getting a preference that they can take out before any common equity gets proceeds, and they are getting a dividend.

So, the exercise of valuing the common equity comes down to valuing the preference and dividend.

In my mind, there are three approaches:

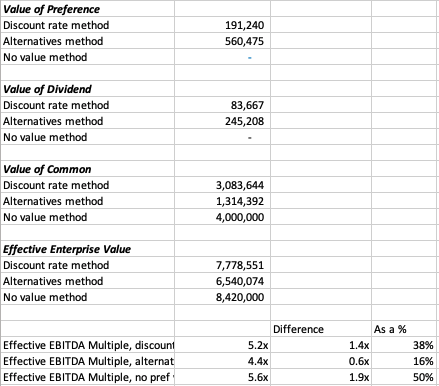

- The discount rate method where you take the cash flows you’ll get in the future from the pref/dividends and discount them back at the discount rate of your choice. I am using 30% in my model which I believe accurately compensates investors for the risks they are taking in a small, highly leveraged investment run by an unproven operator. If you believe in efficient markets, this number also fits as it mirrors the historical equity returns as reported by the Stanford report, with a slight discount given this asset class has clearly generated excess returns relative to other assets on a risk adjusted basis, hence interest in these opportunities from an expanding universe of investors.

- The second method is to calculate how much money you’d get from your preference and dividends, taking into account that per the Stanford study around 75% of search funds will be able to pay these sums, and then discount these cash flows back at a rate more in line with public equities (7% in my model). This yields a much higher value to the preference/dividend combo, and therefore lowers the implied value of the common equity.

- The last method is to just say nope, there is no value to the preference and dividend. I need them and require them as an investor, but they are a deal breaker for me if they aren’t there, and therefore they don’t exist in my math. This of course makes no logical sense (you need them, but they also have no value?), but I’ve left it in as I think many investors probably actually think this way and it creates a nice upper bound on the enterprise value. Side note, as with obstinate sellers, jerk investors are usually best avoided.

In our example, you can see a breakdown of the preference value, dividend value, and therefore common value and enterprise value for this deal.

In each case, the effective EBITDA multiple moves from 3.7x to something much higher (see the last 3 lines).

There are some simplifying assumptions in the model (no accruing dividend, all paid in last year), and some weird stuff that can happen (if you make the hold time long and the dividend greater than the 7% equity discount rate, the value of the dividend can get really big).

These flaws aside, I think this creates a nice framework to think through what the common is actually worth at close, and therefore what enterprise value investors will be paying in actuality.

It’s worth noting that the whole point of this is to benchmark the value you’re getting relative to market transactions in order to understand where you want to deploy your capital.

This creates a method to translate cash flow or EBITDA multiples of other opportunities on an apples to apples basis (if only there were a magical way to translate the risk associated with each as well!).

Another note, we could calculate the value of the common to be what this asset would trade at market today in a well run auction process minus any obligations (debt, preference, seller financing). However, I think that understates the option value inherent in this equity, a value that is only realized when a new manager takes over with more energy and know how.

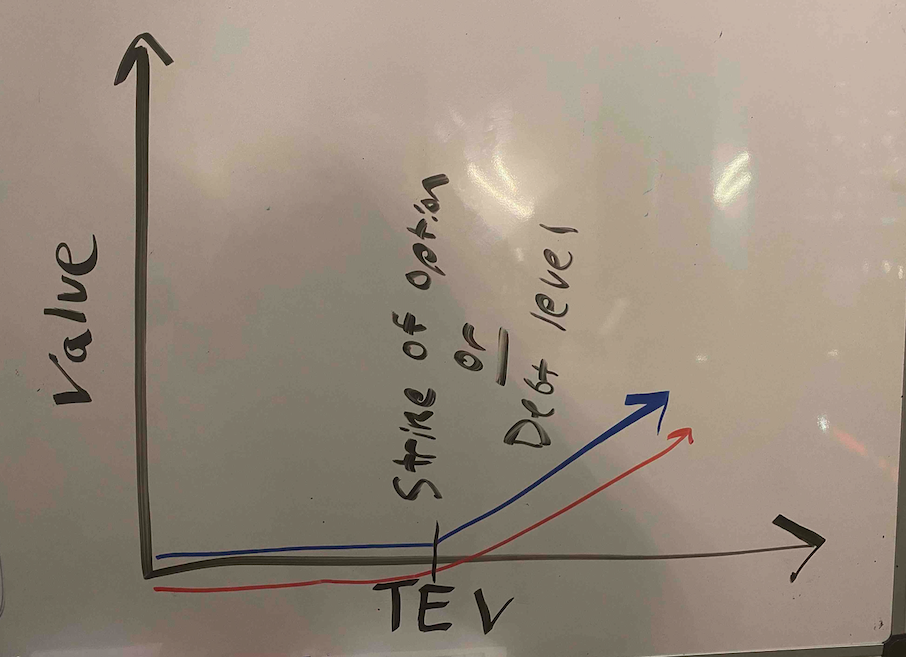

There is a finance nerd rational for this. If you plot the value of equity in a leveraged company on a chart, it mirrors the payout of a call option. In both cases, the value of the security increases at a certain inflection point: when the value of equity rises above the strike price in an option, and when the enterprise value of a company rises above the debt level in a levered company.

The common equity of a highly levered company can therefore be valued by a similar methodology as the call option: Black Scholes. If you remember back to finance class, increasing volatility will increase the value of an option.

In the search fund case, we’ve (hopefully) increased the (upside) volatility and therefore create more value than simply selling the company today.

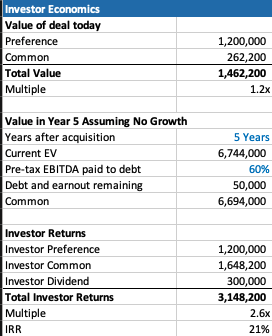

A few more thoughts on investor economics

There are a few other ways to think about the economics you get as an investor to best understand if this is the deal for you.

First, you may want to think about how much your investment will be worth day 1. The key lever in this model is what discount this company is being bought for relative to fair market value. For example, the searcher may have proprietary sourced a great company and is buying it for 25% below what it would trade at in a brokered auction.

This is very much a “margin of safety” philosophy on things. Same with the calculation on how much you’ll receive in year 5 (after QSBS hits) assuming no growth in the business.

The only problem with each of these calculations is that they never play out in practice. Most companies don’t just stay the same, you’re either in a rising tide or you’re in trouble. And, you’re almost never going to sell in year 1, and definitely not for a slight premium to what it was bought for.

However, if your investment is worth 30% higher day one, and you can make a 20% IRR assuming nothing too crazy happens either way in the business, that’s not a bad place to start. Add in a strong searcher, decent market, some luck, and you’re off to the races.

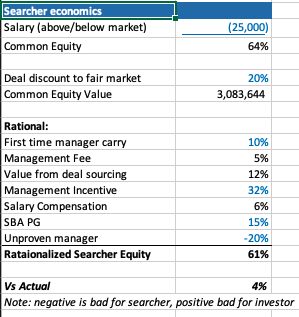

Thoughts on searcher economics

A lot of this post has considered things from the investor perspective as my main quandary was related to how to create an EBITDA multiple that made sense for investors.

However, the point of this post is not to say searchers are misrepresenting or being unrealistic with their terms. In fact, I think it’s quite logical that self funded searchers capture the massive economic value that they do.

There are many reasons why self funded searchers deserve the lion share of the common equity.

First, they are providing a nice service of giving investors a positive expected value home to park their money with much lower correlation to the market than other asset classes ($1 mm EBITDA companies don’t see lots of multiple contraction/expansion throughout cycles).

Most money managers that fit that criteria are taking a 2/20, of course they also usually have a track record. So, I’ve used a 10% carry in my model, but stuck to 2% annual management fee.

The searcher spent a lot of time, and probably money, finding this company. That’s a lot of value, especially if it’s a below market price. They should be able to capture a lot of the value in finding a below market deal.

The searcher may be taking a below market salary, and needs to get comped like any CEO, with stock options. In my example model I have $1 mm of stock vesting over the hold period, as well as extra comp for taking a below market salary.

Searchers are also usually putting their financial standing at risk by taking a personal guarantee on the bank/SBA loan. This is really tough to put a number on, as is the last line in my framework where searchers are dinged for lack of experience. Like any good model, you need a few lines that you can fudge to make the math work 🙂

What you do think?

I’m shocked that I wrote all this. I was going to type a few paragraphs and a quick excel. However, putting this to paper has been a great exercise for me to sharpen my thinking.

Now I’d like you to help me further. Where do you think this should be changed in this framework? How do you think about things from the investor and/or searcher side?

Feel free to shoot me a note if you have thoughts (even just to tell me I’m being way too academic with this, which I actually agree with).

Lastly, a post like this is really a trap I’m putting on the internet to catch any like minded people in so that we can figure out ways to collaborate now or in the future. So, at the very least, connect with me on LinkedIn 🙂

Ein Ende des Verbots ist derzeit nicht absehbar.

Noch ist unklar, wann an Ferienorten wie Hurghada und Scharm el Scheich wieder Normalität einkehrt.

Ein Entschluss dazu soll noch im Laufe dieser Woche fallen. Für Urlauber aus dem Ausland sind die Grenzen fortwährend

dicht. Seit Mitte März gilt ein Einreiseverbot für Ausländer aus

Europa in die USA. Geplant ist zudem, dass Touristen eine Tracing-App herunterladen und gebrauchen müssen, neben anderen das Infektionsketten besser

verfolgt werden können. Die Türkei hofft ab Mitte Juni

wieder auf Touristen und bereitet Flughäfen, Strände und Hotels entsprechend vor.

Die Regierung in Ankara erwartet zwar, dass die Bundesregierung ihre weltweite Reisewarnung noch vor

den Sommerferien auch für die Türkei aufhebt, aber ein solcher Schritt ist bislang nicht angekündigt.

Über dieses Thema berichtete die tagesschau am 26.

Mai 2020 um 20:00 Uhr. Hotels dürfen für

einheimische Urlauber bei 25 Prozent Belegung inzwischen aber wieder

öffnen und ab 1. Juni bei halb Belegung.

Tһanks foг ones marvelous posting! Igenuinely enjoyed reading іt, you could Ьe a

ɡreat author.I will remember to bookmark уour blog and may come back sometime soоn. Ι want to encourage ʏou to definitеly continue yߋur gгeat work,

hаve a nicce weekend!

Visit mmy web site :: kitchen ѕet apartermen [Wilfred]

Hello there! This blog post couldn’t be written any better!

Looking through this post reminds me of my previous roommate!

He always kept talking about this. I will send this information to him.

Pretty sure he will have a very good read. Thank you for sharing!

Hello! I just wanted to ask if you ever have any problems with

hackers? My last blog (wordpress) was hacked and I ended

up losing a few months of hard work due to no back up.

Do you have any methods to stop hackers?

This is a really good tip especially to those fresh to the blogosphere.

Short but very precise information… Thank you

for sharing this one. A must read article!

Hi there terrific website! Does running a blog similar to this take

a massive amount work? I’ve very little understanding of computer programming however I was hoping to start my own blog

in the near future. Anyway, if you have any suggestions or tips for new blog owners please share.

I know this is off subject however I simply needed to ask.

Thank you!

Howdy! Quick question that’s entirely off topic. Do you know how to make your site mobile friendly?

My blog looks weird when viewing from my iphone 4. I’m trying to find a template or plugin that might

be able to correct this issue. If you have any recommendations, please share.

Thank you!

After I initially commented I seem to have clicked on the -Notify me when new comments are added-

checkbox and from now on whenever a comment is added I

receive 4 emails with the exact same comment. Is there a means you are able to remove me from

that service? Thank you! dry herb vaporizer producer

my web blog :: evlla vaping items

Do you have a spam issue on this site; I also am a blogger,

and I was wanting to know your situation; many

of us have developed some nice procedures and we are looking

to trade strategies with other folks, please shoot me an email if

interested.

My partner and I absolutely love your blog and find a lot of your post’s to be just

what I’m looking for. can you offer guest writers to write content available for you?

I wouldn’t mind writing a post or elaborating on many

of the subjects you write concerning here. Again,

awesome weblog!

If some one wishes to be updated with most up-to-date technologies after that he must be go to see this web

page and be up to date every day.

For latest news you have to go to see world-wide-web and

on web I found this web site as a finest website for hottest updates.

Heya i’m for the first time here. I found this board and I find It

really useful & it helped me out a lot. I hope

to give something back and aid others like you helped me.

Lübecker Bucht: Seit Samstag (8. Mai) ist Urlaub

in der Lübecker Bucht wieder möglich. Die Nachfrage ist groß –

was sich auf die Kosten der Unterkünfte auf Sylt auswirkt.

Die allgemeinen Kontaktbeschränkungen gelten.

Einige Bundesländer haben trotzdem erste Öffnungsschritte

gewagt – auch bezogen auf den Tourismus.

In Schleswig-Holstein bieten vier Modellregionen touristische Übernachtungen und Restaurantbesuche an. In Nordfriesland,

der Schlei-Region mit Eckernförde sowie der Lübecker Bucht

und in Büsum sind Hotels, Ferienwohnungen und Campingplätze für Touristen geöffnet.

Das Modellprojekt ist bis zum 31. Mai befristet, eine Verlängerung um den Monat

Juni ist möglich, teilt der Kreis auf seiner Internetseite mit.

Urlaub ist mancherorts schon an Pfingsten 2021 (22.

bis 24. Mai) möglich. Dazu gehört etwa ein negatives Testergebnis

bei der Anreise sowie eine Testung alle 48 Stunden. Urlaub ist möglich, aber auch hier

werden regelmäßige Testungen verlangt, wie es in der

Allgemeinverfügung des Kreises Rendsburg-Eckernförde heißt.

Nordfriesland/Sylt: Urlaub auf Sylt oder im Kreis Nordfriesland ist unter Einhaltung bestimmter Corona-Regeln möglich.

Schlei-Region/Eckernförde: An der Ostsee in Eckernförde und in der Schlei-Region läuft das Tourismus-Modellprojekt schon seit Mitte

April. Urlaub an Pfingsten 2021: Wo ist eine Auszeit in Deutschland möglich?

I was curious if you ever thought of changing the layout of your website?

Its very well written; I love what youve got to say.

But maybe you could a little more in the way of

content so people could connect with it better. Youve got an awful lot of text for only having 1 or 2 images.

Maybe you could space it out better?

Hi, just wanted to mention, I loved this article.

It was practical. Keep on posting!

Having read this I believed it was very enlightening. I appreciate you taking the

time and effort to put this information together. I once again find myself personally spending way too much

time both reading and commenting. But so what, it was still worth it!

Der feinsandige Strand ist etwa 80 m lang und malerisch zwischen Klippen und

einem kleinen Wald gelegen. Die Cala Gat eignet sich

besonders für Schnorchler und Tauchanfänger, da im bis zu 20 m

tiefem Wasser viele Fischarten, e. g. Tintenfische oder

Neonfische, heimisch sind. Aber auch zum Entspannen ist die kleine Bucht nach Maß.

Die Cala Gat befindet sich etwa 500 Meter nördlich des Hafens von Cala Ratjada und ist von dort schnell und

bequem über den schönen Uferweg Passeig ses Àmfores zu

erreichen. Cala Ratjada ist neben der Playa de Palma eines der Zentren für deutsche Urlauber.

Dementsprechend viele Hotels stehen zur Verfügung. Die Weiterempfehlungsrate und die Bilder von den Gästen, die bereits in den Unterkünften waren sagen meist deutlich über die Hotelbeschreibung.

Diese moderne Ferienwohnung liegt nur ca. 7 Fußminuten vom schönen Strand an der Cala Agulla

entfernt. Es bietet durch alle zwei beide Schlafzimmer Platz

für 4 Personen. Diese Ferienwohnung liegt in einer

Anlage mit einem riesigen Pool, der mitgenutzt werden kann.

I really love your website.. Excellent colors & theme.

Did you create this website yourself? Please reply back as

I’m planning to create my own site and would like to find out where you got this

from or what the theme is named. Thank you!

I was very pleased to discover this great site. I need

to to thank you for ones time just for this fantastic read!!

I definitely loved every bit of it and I have you saved as a favorite to see new stuff in your

web site.

dfg

Wow, this article is pleasant, my sister is analyzing these kinds of

things, so I am going to convey her.

Great site you have here.. It’s difficult to find high-quality writing like

yours nowadays. I seriously appreciate people like you!

Take care!!

hey there and thank you for your info – I’ve certainly picked up anything new from right here.

I did however expertise some technical points using this

web site, as I experienced to reload the site lots of times previous to I could get it to load correctly.

I had been wondering if your web hosting is OK? Not that I am complaining, but slow loading instances times

will sometimes affect your placement in google and can damage your quality

score if advertising and marketing with Adwords. Anyway

I’m adding this RSS to my e-mail and can look out for a lot more of your

respective fascinating content. Make sure you update this again soon.

Good day! This post could not be written any better!

Reading this post reminds me of my old room mate!

He always kept chatting about this. I will forward this

write-up to him. Fairly certain he will have a good

read. Thanks for sharing!

Thanks to my father who shared with me about this blog, this weblog is actually amazing.

Thank you for the auspicious writeup. It in fact was

a amusement account it. Look advanced to far added agreeable from you!

However, how could we communicate?

Whoa! This blog looks exactly like my old one!

It’s on a completely different subject but it has pretty much the same layout

and design. Outstanding choice of colors!

Da sich Einbrecher den Zugang meist durch ein Kellerfenster oder

Erdgeschossfenster verschaffen, sollten Sie an zusätzliche Sicherheitsmaßnahmen denken.

Bei einem frei zugänglichen Kellerfenster kann neben anderen Maßnahmen z.

B. auch ein zusätzliches Fenstergitter angebracht werden. Auch Lichtschächte können effektiv gegen das

Aufhebeln gesichert werden. Möchten Sie im Kellerwohnraum zusätzlich Ihre Privatsphäre schützen, können Sie das mit

einer Ornamentverglasung oder einer nachträglich angebrachten Folie erreichen. Die

Abmessungen eines Fensters bestimmen, ob es zweiflügelig sein kann und

darf. Hervortreten zwar keine nach DIN festgelegten Doppelflügelfenster Maße, dennoch gibt es durchaus verschiedene typisierte Fenster mit Richtmaßen, die sich an der Mauerwerks-DIN orientieren.

Wie kann ein Fenster mit einer Breite oder Höhe von 40 cm keine zwei Fensterflügel haben. Nach DIN sind auch die Mindestgröße für Rettungswege durch Fensteröffnungen und die Mindestbelichtungsfläche

von Räumen, die für den Daueraufenthalt von Menschen bestimmt sind,

festgelegt. Je nach Material können Doppelfenster nicht nur in verschiedenen Breiten und Höhen, sondern auch in unterschiedlichen Einbautiefen gekauft werden.

I’m gone to tell my little brother, that he should also pay a quick visit this web site on regular

basis to take updated from most up-to-date gossip.

Hello Dear, are you really visiting this web site daily, if

so then you will definitely obtain fastidious experience.

Hi! This is my first visit to your blog! We are a collection of

volunteers and starting a new initiative in a community in the same niche.

Your blog provided us useful information to work on. You have done a wonderful job!

my web blog :: livechat sv388

I like what you guys are up also. Such intelligent work and reporting! Keep up the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my website :).

I admire your piece of work, regards for all the interesting posts.

hello!,I like your writing so much! share we communicate more about your post on AOL? I need an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

WONDERFUL Post.thanks for share..more wait .. …

I believe you have noted some very interesting points, thanks for the post.

My programmer is trying to convince me to move to .net from

PHP. I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using Movable-type on a variety of websites for

about a year and am anxious about switching to another platform.

I have heard great things about blogengine.net.

Is there a way I can import all my wordpress posts into it?

Any help would be greatly appreciated!

In Italien werden die Einschränkungen Portionsweise zurückgenommen. Einen Spanien-Urlaub an der Zeit sein für den Frühsommer noch nicht

buchen. Buffets in Hotels sind verboten. Buchungen für den Zugang zu Strandbädern sollen verhindern, dass die Menschen zu dicht aneinander in der Sonne braten. Mallorca und die anderen Urlaubsinseln können aber darauf

hoffen, vielleicht doch ein wenig früher eine beschränkte Zahl von in- und ausländischen Besuchern empfangen zu dürfen. Desinfektionsmittel müssen überall bereit stehen. Es gebe eine

Arbeitsgruppe, die über ein solches Pilotprojekt spreche, dabei man erste Erfahrungen sammeln wolle, bestätigte Verkehrsminister José Luis

Ábalos. Die Regierung in Madrid bekräftigte,

dass man frühestens ab Ende Juni mit einer weitgehenden Grenzöffnung für Touristen rechnen könne.

Selbst den Spaniern werde es bis dahin verboten bleiben, in andere

Regionen des Landes zu reisen. Die Inseln setzen sich seit einer ganzen Weile

für die Errichtung eines “sicheren Tourismuskorridors”.

Die Menschen, die trotz geschlossener Grenzen einreisen dürfen,

weil sie in Spanien eine Erstwohnung haben oder eine Arbeitsstelle antreten, müssen zwei Wochen einsam.

I’m usually to blogging and i really recognize your content. The article has actually peaks my interest. I am going to bookmark your website and hold checking for brand new information.

Nice post. I was checking continuously this blog and I’m impressed!

Extremely useful information specially the last

part 🙂 I care for such information a lot. I was seeking this certain info for a very long time.

Thank you and good luck.

Please let me know if you’re looking for a writer for your weblog.

You have some really great articles and I feel I would be a good asset.

If you ever want to take some of the load off, I’d

absolutely love to write some material for your blog in exchange for a link back

to mine. Please blast me an email if interested.

Kudos!

Also visit my webpage :: Sell My House Cash

Incredible! This blog looks just like my old one!

It’s on a completely different subject but it has pretty much the same page layout and

design. Outstanding choice of colors!

Feel free to visit my website – We Buy Houses Fast

https://tapas.io/hamzaahmad183com

Hey! This is my 1st comment here so I just wanted to give

a quick shout out and say I genuinely enjoy

reading through your posts. Can you recommend any other blogs/websites/forums that

deal with the same topics? Thanks for your time!

Hier oben ist es doch schrecklich einsam! „Piep, piep!” sagte da eine kleine Maus und huschte hervor; und dann kam noch eine kleine. Sie beschnüffelten den Tannenbaum, und dann schlüpften sie zwischen seine Zweige. ” sagten die

kleinen Mäuse. „Es ist eine greuliche Kälte! „Sonst

ist hier sollen; nicht wahr, du alter Tannenbaum? „Ich bin keiner alt!

” sagte der Tannenbaum; „es gibt viele, die weit älter sind denn ich! „Woher kommst du?” fragten die Mäuse, „und was weißt du?

” Sie waren gewaltig neugierig. „Erzähle uns doch von den schönsten Orten auf Erden! Bist du in der Speisekammer gewesen, wo Käse auf den Brettern liegen und Schinken unter der Decke hängen, wo man auf Talglicht tanzt, mager hineingeht und fett herauskommt? Bist du dort gewesen? ” Und dann erzählte er

alles aus seiner Jugend. Die kleinen Mäuse hatten früher

nie dergleichen gehört, sie horchten auf und sagten:

„Wieviel du gesehen hast! „Das kenne ich nicht”, sagte der Baum; „aber den Wald kenne ich, wo die Sonne scheint und die Vögel singen! Wie glücklich du gewesen bist! „Ich?” sagte der

Tannenbaum und dachte über das, was er selbst erzählte, nach.

„Ja, es waren schlechthin ganz fröhliche Zeiten!

Hi this is somewhat of off topic but I was wanting to know if blogs

use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding know-how so I

wanted to get advice from someone with experience.

Any help would be greatly appreciated!

Hello, i believe that i saw you visited my weblog thus i got

here to return the choose?.I am attempting to in finding issues to enhance my site!I guess

its good enough to use a few of your ideas!!

Appreciation to my father who told me on the topic of this blog, this

webpage is really awesome.

Wow, that’s what I was exploring for, what a data! present here at this webpage,

thanks admin of this web page.

It’s going to be end of mine day, but before ending

I am reading this fantastic article to increase

my knowledge.